Bitcoin Mining Profitability Takes a Hit: A Detailed Analysis

The cryptocurrency market has been experiencing significant fluctuations in recent times, with Bitcoin (BTC) leading the charge. One of the most intriguing aspects of Bitcoin’s ecosystem is its mining process. Mining is the backbone of the Bitcoin network, ensuring the security and integrity of transactions. However, the profitability of Bitcoin mining has been under the microscope lately, with investment bank Jefferies reporting a 7.4% decline in March.

Understanding Bitcoin Mining Profitability

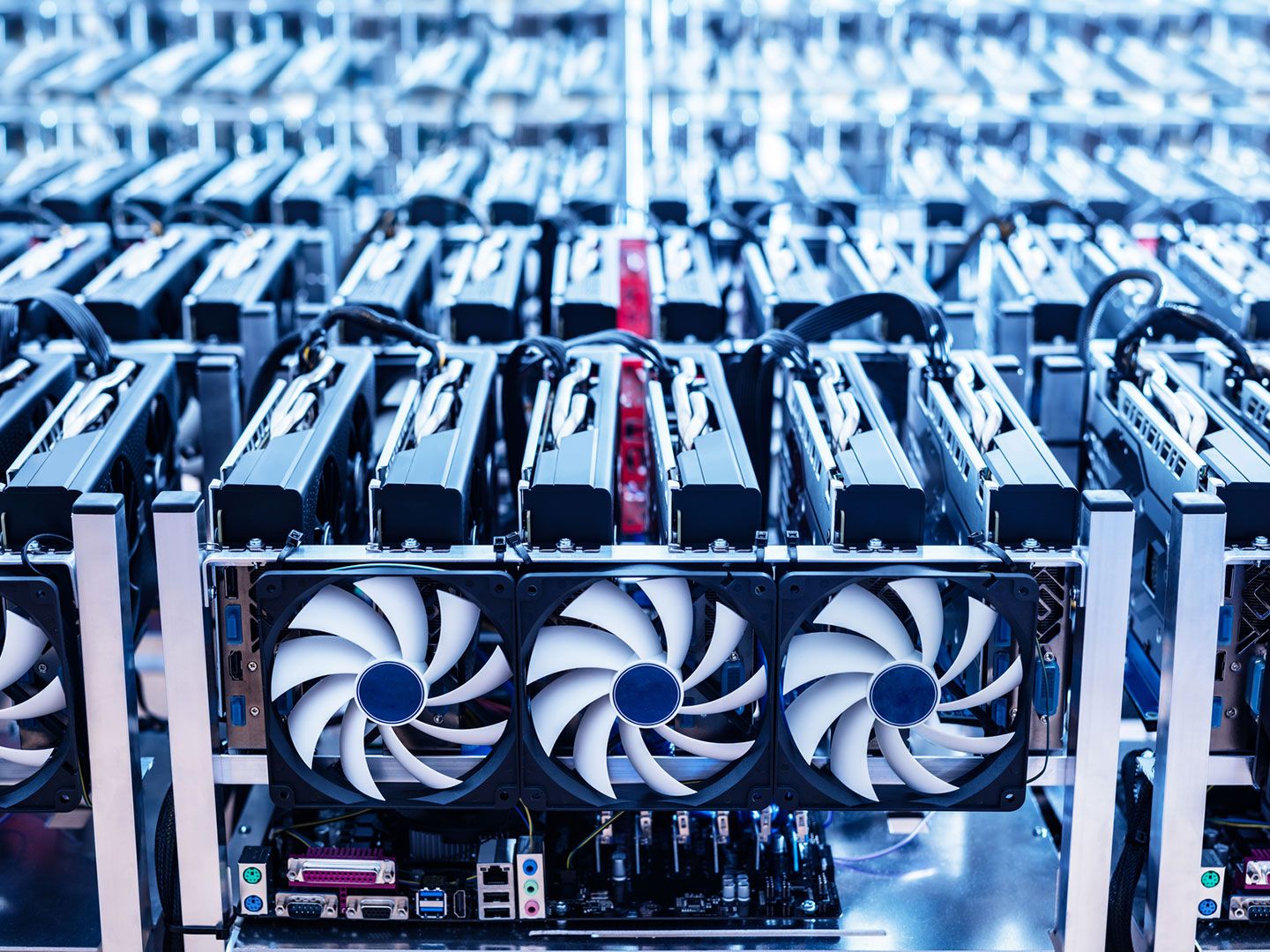

Before delving into the specifics of the recent decline, it’s essential to understand the concept of Bitcoin mining profitability. Mining profitability is a measure of how financially viable it is for miners to mine new Bitcoins. This viability is determined by the cost of electricity, hardware, and other operational expenses, compared to the revenue generated from mining new coins and transaction fees.

Factors Affecting Bitcoin Mining Profitability

Several factors contribute to the decline in Bitcoin mining profitability. One of the primary factors is the increasing difficulty of mining new Bitcoins. This difficulty level adjusts every 2,016 blocks, or approximately every two weeks, to maintain the average time between new blocks at ten minutes. As more miners join the network, the competition intensifies, requiring more computational power to mine new blocks.

The Role of Electricity Costs

Another significant factor is the cost of electricity. Bitcoin mining is an energy-intensive process, with miners requiring vast amounts of electricity to power their computers. Countries with lower electricity costs, such as China and Russia, have seen a surge in mining operations due to their cost advantages. Conversely, countries with higher electricity costs, like the United States, may find it less profitable to mine Bitcoin.

Impact on Individual Miners

For individual miners, the decline in mining profitability may lead to decreased incentives to mine new Bitcoins. This could result in fewer new coins entering the market, potentially leading to a supply crunch. However, it’s essential to note that larger mining operations with economies of scale may still find mining profitable, despite the decline.

Global Implications

On a larger scale, the decline in Bitcoin mining profitability could have global implications. China, which currently dominates the Bitcoin mining landscape, could see a shift in the industry’s center of gravity as other countries with lower electricity costs become more attractive. This could lead to a redistribution of mining operations and potentially impact the geopolitical dynamics of the Bitcoin network.

Conclusion

The decline in Bitcoin mining profitability, as reported by Jefferies, is a significant development in the world of cryptocurrency. While individual miners may be impacted, the global implications could be far-reaching, potentially leading to a redistribution of mining operations and geopolitical shifts. As the cryptocurrency market continues to evolve, it’s essential to stay informed about these developments and their potential implications.

- Bitcoin mining profitability declined by 7.4% in March, according to Jefferies

- Factors contributing to the decline include increasing mining difficulty and electricity costs

- Individual miners may be less incentivized to mine new Bitcoins, potentially leading to a supply crunch

- Global implications could include a redistribution of mining operations and geopolitical shifts