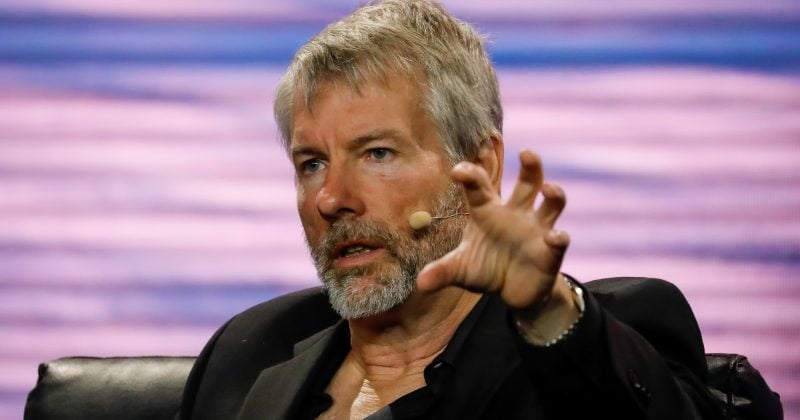

Saylor’s Unwavering Bitcoin Bet:

In a world where traditional finance and technology merge, the cryptocurrency market continues to captivate investors with its high-risk, high-reward nature. Michael Saylor, the CEO of MicroStrategy, has once again made headlines with his unwavering commitment to Bitcoin. Despite reporting a nearly $6 billion unrealized loss in Q1, Saylor is signaling a new Bitcoin buy.

A Risk Worth Taking:

For those unfamiliar with MicroStrategy, the company is a business intelligence firm that made a bold move in 2020 by converting its treasury reserves into Bitcoin. This decision was met with both praise and criticism, as Bitcoin’s value is famously volatile. Saylor’s decision to double down on his investment, despite the significant loss, is a testament to his belief in the potential of cryptocurrency.

Impact on Individual Investors:

The news of Saylor’s continued investment in Bitcoin may inspire individual investors to follow suit. Cryptocurrencies, particularly Bitcoin, have gained popularity in recent years due to their potential for high returns. However, it’s important to remember that investing in cryptocurrencies comes with risks. The value of Bitcoin, and other cryptocurrencies, can fluctuate wildly in a short period. Before making any investment decisions, it’s crucial to do thorough research and consider your financial situation and risk tolerance.

- Consider diversifying your investment portfolio to reduce risk

- Stay informed about market trends and news

- Consult with a financial advisor before making any major investment decisions

Impact on the World:

The impact of Saylor’s continued investment in Bitcoin extends beyond the individual investor. The cryptocurrency market, and Bitcoin in particular, has the potential to disrupt traditional financial systems. As more institutions and individuals invest in cryptocurrencies, we may see a shift in the way we manage and transfer value.

Additionally, the environmental impact of Bitcoin mining is a topic of concern for many. Bitcoin mining requires significant computational power, which in turn requires a large amount of energy. As the value of Bitcoin continues to rise, the demand for mining may also increase, leading to increased energy consumption and potential environmental consequences.

Conclusion:

Michael Saylor’s continued investment in Bitcoin, despite significant losses, is a reminder of the high-risk, high-reward nature of cryptocurrency strategies. While the potential for high returns can be enticing, it’s important to remember that investing in cryptocurrencies comes with risks. Before making any investment decisions, it’s crucial to do thorough research, consider your financial situation and risk tolerance, and stay informed about market trends and news.

Furthermore, the impact of Saylor’s investment extends beyond the individual investor. The cryptocurrency market, and Bitcoin in particular, has the potential to disrupt traditional financial systems. However, it’s important to consider the potential environmental consequences of increased Bitcoin mining. As we continue to navigate the world of cryptocurrencies, it’s crucial to approach investments with a thoughtful and informed perspective.