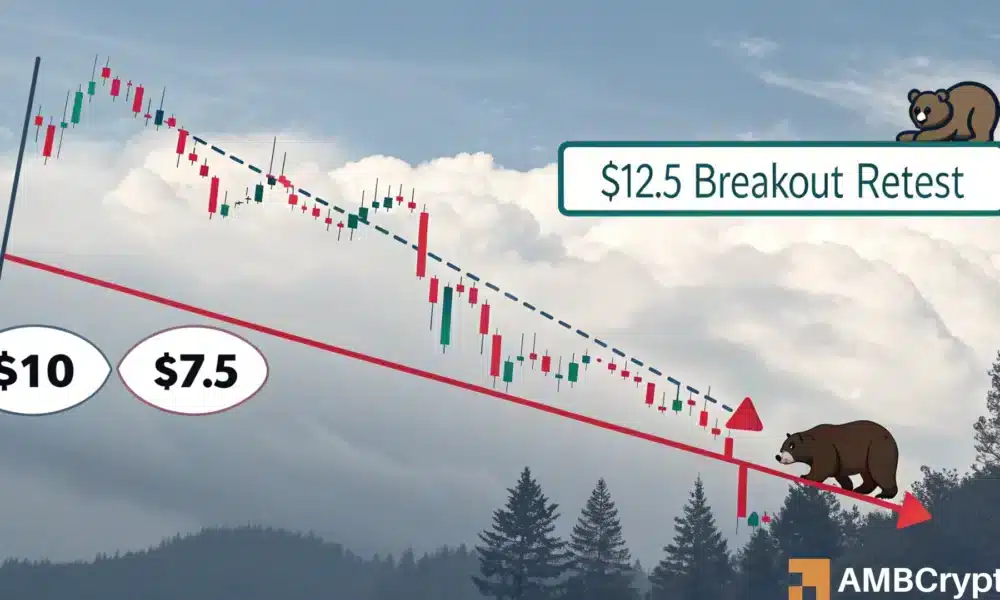

Stock Market Insights: Potential Further Decline of LINK at $12.5

The stock market landscape is constantly evolving, and for those invested in LINK, recent charts indicate a potential retest of a key resistance level at around $12.5. This resistance level has acted as a barrier for LINK’s price movement in the past, and with metrics pointing towards further decline, investors may want to pay close attention.

Technical Analysis

From a technical perspective, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators suggest a bearish trend for LINK. The RSI, which measures the strength of a security’s recent price action, has been trending below 50 for several days, indicating that LINK is in a downtrend. Similarly, the MACD, which shows the relationship between two moving averages, has generated a bearish signal with the short-term moving average crossing below the long-term moving average.

Impact on Individual Investors

For individual investors holding LINK, a further decline in price could result in significant losses. It is essential to review your investment strategy and consider whether holding onto LINK is still aligned with your financial goals. If you are considering selling, it may be wise to wait for a clear downward trend before doing so to maximize potential profits. Conversely, if you believe in the long-term potential of LINK and are in a position to buy more at a lower price, this could be an opportunity to increase your holdings.

Impact on the World

The potential further decline of LINK could have ripple effects on the broader financial market. As a prominent cryptocurrency, LINK’s price movements can impact investor sentiment and market confidence. A significant downturn could lead to increased volatility and uncertainty in the stock market, potentially impacting other sectors and asset classes. However, it is essential to remember that the stock market is complex and influenced by various factors, so the impact on the world may depend on a multitude of other economic and geopolitical developments.

Conclusion

In conclusion, recent charts indicate a potential retest of a key resistance level at around $12.5 for LINK, with technical indicators suggesting a bearish trend. Individual investors holding LINK should review their investment strategy and consider the potential impact on their financial goals. A further decline could have ripple effects on the broader financial market, potentially increasing volatility and uncertainty. As always, it is crucial to stay informed and consider seeking professional advice before making any significant investment decisions.

- LINK may retest a key resistance level at around $12.5

- Technical indicators suggest a bearish trend

- Individual investors should review their investment strategy

- Further decline could impact the broader financial market