The Impact of Trump’s Tariff War on Ethereum: A Rollercoaster Ride

The crypto market has been on a wild ride lately, with prices soaring and plummeting in response to various economic and political developments. One of the most significant factors influencing the market’s volatility has been the ongoing tariff war between the United States and China. This trade dispute has created uncertainty and instability, leading to fluctuations in the value of various cryptocurrencies.

Ethereum’s Price Swings

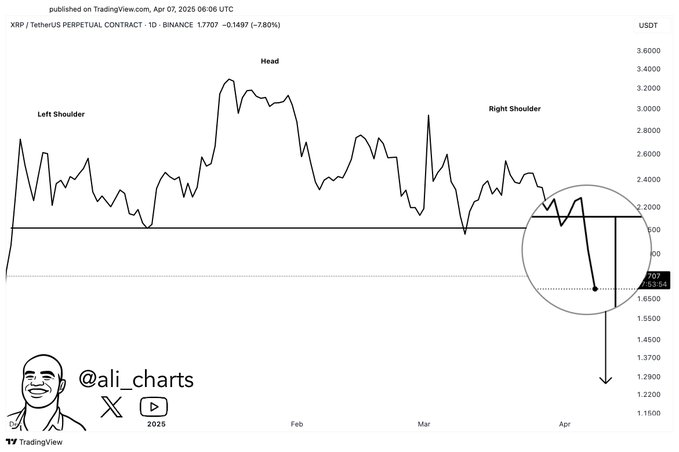

One asset that has been particularly affected by this market sentiment is Ethereum. In recent weeks, the price of Ethereum made a strong push past the $1,550 mark, even reaching a high of $1,687. This rally was fueled by optimism over the potential for increased institutional adoption of Ethereum and other cryptocurrencies.

A Short-Lived Rally

However, the rally was short-lived, and Ethereum quickly lost steam. The asset slipped below key resistance levels and is currently trading under $1,580. This decline can be attributed to a number of factors, including profit-taking by investors and renewed concerns over the economic impact of the tariff war.

The Effects on Individuals

For individual investors, the volatility of the crypto market can be both exciting and frustrating. Those who bought Ethereum at its peak and sold at its recent low may be feeling the pain of missed opportunities. However, others may see this as a buying opportunity and be optimistic about the long-term potential of Ethereum and other cryptocurrencies.

- Individual investors should always do their own research and consider their risk tolerance before making investment decisions.

- Diversification is key to mitigating risk in any investment portfolio.

The Effects on the World

On a larger scale, the impact of the tariff war on Ethereum and the crypto market as a whole is just one piece of a much larger puzzle. The trade dispute between the United States and China has far-reaching implications for the global economy, and its resolution will depend on a number of complex factors.

- The tariff war could lead to decreased economic growth and increased inflation, which could negatively impact the value of traditional currencies.

- Cryptocurrencies, including Ethereum, could potentially serve as a hedge against inflation and economic instability.

Conclusion

The relationship between the tariff war and the crypto market, particularly Ethereum, is complex and multifaceted. While the short-term price swings can be frustrating for individual investors, the long-term potential of cryptocurrencies as a hedge against economic instability remains an intriguing possibility. As always, it is important for investors to do their own research and consider their risk tolerance before making any investment decisions.