Bitcoin: A Possible Bullish W Turnaround According to John Bollinger

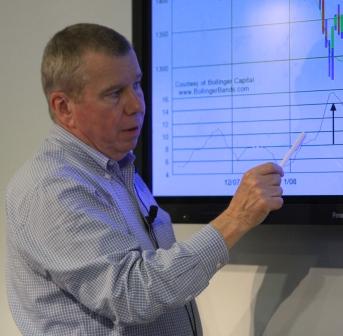

In the ever-volatile world of cryptocurrencies, one name that consistently stands out is Bitcoin. Known as the “digital gold,” Bitcoin continues to intrigue investors and traders alike with its price swings and market trends. Recently, legendary trader John Bollinger, the creator of the popular Bollinger Bands tool, has shared his insights on Bitcoin’s potential bottom.

The W Pattern: A Bullish Indicator

Bollinger, who has been analyzing financial markets for over four decades, believes that Bitcoin might be forming a W-shaped bottoming pattern. This bullish reversal pattern consists of two distinct lows, separated by a brief recovery before plunging again. After the second low, the price then rallies significantly to reach new highs.

Understanding the W Pattern

The W pattern, also known as a double bottom or M-shaped reversal, is a popular technical analysis chart formation. When a stock or asset experiences a significant decline, it can create a first bottom (W left). After a brief recovery, it can then drop again to create a second bottom (W right). Once the second bottom is established, the asset often experiences a strong rebound, leading to new highs.

Bitcoin’s W Pattern: A Closer Look

According to Bollinger, Bitcoin’s first bottom was formed around $3,100 in December 2018. The second bottom, which could be forming now, is around $4,500. Should this pattern hold true, Bitcoin could be on the verge of a substantial rally, possibly reaching new all-time highs.

Personal Implications

As an investor or trader, the potential bullish reversal of Bitcoin could have significant implications for your portfolio. If you’ve been sitting on the sidelines, this could be an opportunity to buy in at a relatively lower price. Conversely, if you’re already invested in Bitcoin, holding on to your position could yield substantial returns.

Global Impact

The potential bullish reversal of Bitcoin could also have far-reaching consequences on the global economy. Bitcoin’s price movements can impact traditional financial markets, particularly stocks, bonds, and commodities. Furthermore, the increased adoption of Bitcoin as a store of value could further legitimize cryptocurrencies as a whole, potentially leading to more mainstream acceptance and integration into the global financial system.

Conclusion

In conclusion, the possibility of a bullish W bottoming pattern in Bitcoin is an intriguing development for traders and investors alike. With the insights of a legendary trader like John Bollinger, we may be on the cusp of a significant price rally. As always, it’s essential to do your own research and consult with financial professionals before making any investment decisions. Stay tuned for more updates on this developing story!

- Bitcoin may be forming a bullish W bottoming pattern according to John Bollinger

- The W pattern consists of two distinct lows, separated by a brief recovery before plunging again

- The potential bullish reversal could have significant implications for individual investors and the global economy

- Stay tuned for more updates on this developing story