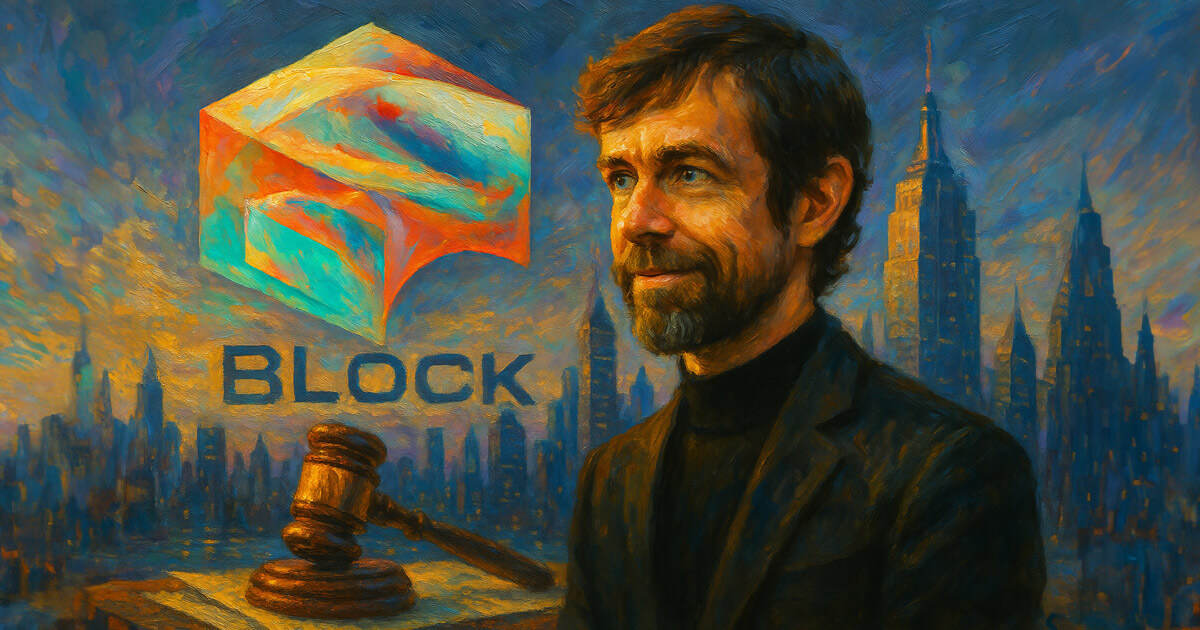

The Hefty Fine Slapped on Block Inc.: A $40 Million Penalty for AML Lapses

In an unexpected turn of events, Block Inc., the revolutionary fintech company helmed by Jack Dorsey, has found itself in hot water with the New York Department of Financial Services (NYDFS). The financial regulatory body announced a staggering $40 million penalty against Block Inc. on April 10, 2023, citing widespread lapses in the company’s anti-money laundering (AML) and compliance systems related to its virtual currency operations.

The Root Cause: AML and Compliance Lapses

According to the NYDFS, Block Inc.’s inadequate AML and compliance controls allowed for the processing of transactions linked to illicit activities, such as money laundering and tax evasion. The regulatory body ascertained these shortcomings through a thorough examination of the company’s business practices.

Impact on Block Inc. and Jack Dorsey

The fine levied against Block Inc. is a significant blow to the company, which has been making strides in the financial technology sector with its popular Cash App. Jack Dorsey, the co-founder and CEO of Block Inc., has been a vocal advocate for decentralized finance (DeFi) and digital currencies. This penalty, however, casts a shadow over his vision and the company’s reputation.

The fine is not an insignificant sum for Block Inc., which reported a revenue of $11.2 billion in 2022. The penalty is expected to impact the company’s bottom line, potentially leading to increased costs and reduced profits.

Implications for Users and the Wider Community

The penalty against Block Inc. has far-reaching implications. For users of Cash App and other virtual currency services provided by the company, this development may instill a sense of unease and uncertainty. Users may question the security and reliability of the platform, potentially leading to a decrease in trust and adoption.

Moreover, this penalty sets a precedent for other regulatory bodies and financial institutions. The NYDFS’s action against Block Inc. demonstrates the increasing scrutiny and focus on virtual currency operations and the need for robust AML and compliance systems.

The Road Ahead: Rectifying the Lapses and Regaining Trust

Block Inc. has acknowledged the penalty and vowed to rectify the identified lapses. The company intends to invest in its AML and compliance infrastructure, hiring additional experts and implementing advanced technologies to strengthen its systems. However, regaining the trust of its users and the wider community will be an uphill battle.

The fine serves as a reminder that even the most innovative and progressive companies are not immune to regulatory scrutiny and the consequences of inadequate compliance measures. As the world continues to embrace digital currencies and decentralized finance, it is crucial that companies prioritize robust AML and compliance systems to ensure the integrity and trustworthiness of the ecosystem.

- Block Inc. fined $40 million by NYDFS for AML and compliance lapses related to virtual currency operations

- Penalty a significant blow to the company, which reported a revenue of $11.2 billion in 2022

- Users may question the security and reliability of the Cash App and other virtual currency services provided by Block Inc.

- Sets a precedent for other regulatory bodies and financial institutions

- Company intends to invest in its AML and compliance infrastructure to rectify the identified lapses

In conclusion, the fine imposed on Block Inc. by the NYDFS serves as a stark reminder of the importance of robust AML and compliance systems in the virtual currency space. As the world continues to embrace digital currencies and decentralized finance, it is crucial that companies prioritize these systems to ensure the integrity and trustworthiness of the ecosystem. Users and the wider community will be closely monitoring Block Inc.’s efforts to rectify the identified lapses and regain trust. Stay tuned for updates on this developing story.