Crypto Market Surges: A New Lease of Life Amidst Tariff Uncertainty

The cryptocurrency market has experienced a significant surge over the last 24 hours, with many popular assets recording impressive gains. This unexpected upturn can be attributed to the recent announcement made by President Trump regarding the pause on country-based tariffs.

Impact on the Crypto Market

The crypto market has been on a rollercoaster ride in recent months, with various factors influencing its volatility. However, the latest news regarding tariffs has brought about a wave of optimism, leading to a flurry of buying activity.

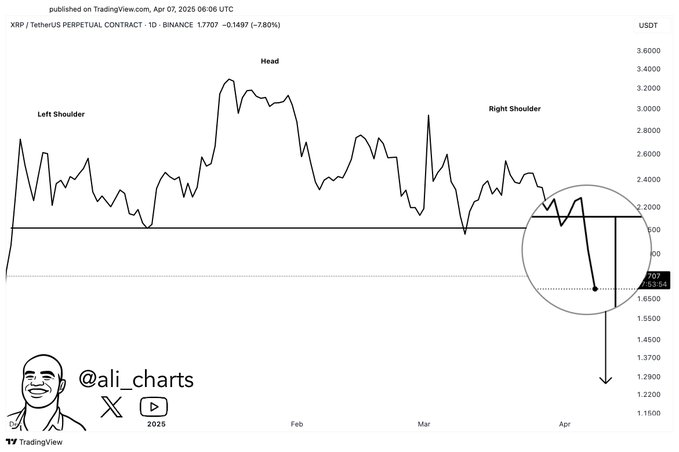

According to data from CoinMarketCap, Bitcoin, the largest cryptocurrency by market capitalization, has gained over 8% in the last 24 hours. Other major cryptocurrencies such as Ethereum, Ripple, and Litecoin have also seen similar gains.

Weekly Outflows Flipped

The recent surge in the crypto market has come as a relief for investors, especially after weeks of outflows. Data from CoinShares shows that outflows totaled $104 million in the week ending September 11th. However, the tide seems to have turned, with inflows of $53 million recorded in the week ending September 18th.

Effects on Individuals

For individual investors, the recent surge in the crypto market could mean potential profits, especially if they have been holding onto their assets during the bearish period. However, it is essential to remember that investing in cryptocurrencies carries risks, and investors should only invest what they can afford to lose.

Effects on the World

The impact of the recent surge in the crypto market extends beyond individual investors. The global economy has been facing numerous challenges, including trade tensions and economic uncertainty. The crypto market’s resilience in the face of these challenges could be a sign of its growing maturity as an asset class.

Moreover, the crypto market’s surge could have a ripple effect on other markets, potentially leading to increased investor confidence and risk appetite. However, it is essential to note that the crypto market’s volatility remains a significant concern, and its impact on the broader economy is still uncertain.

Conclusion

The recent surge in the crypto market is a welcome development for investors, especially after weeks of outflows. The news regarding the pause on tariffs has brought about a wave of optimism, leading to increased buying activity. However, it is essential to remember that investing in cryptocurrencies carries risks, and investors should only invest what they can afford to lose.

The impact of this surge extends beyond individual investors, potentially leading to increased investor confidence and risk appetite in the global economy. However, the crypto market’s volatility remains a significant concern, and its impact on the broader economy is still uncertain.

As the crypto market continues to evolve, it is essential to stay informed and make informed investment decisions. The pause on tariffs is just one of many factors influencing the crypto market, and investors should consider all relevant information before making any investment decisions.

- Crypto market experiences significant surge

- President Trump’s announcement regarding tariffs is the catalyst

- Outflows have been flipped, with inflows of $53 million recorded in the last week

- Individual investors could potentially profit from the surge

- Impact on the global economy is still uncertain