The Crypto Market Amid Global Economic Uncertainties: A Severe Drawdown for Ethereum

As the global economic landscape undergoes significant shifts with Trump’s new “Liberation Day” tariffs and a sudden liquidity crunch, traditional markets are experiencing turbulence. This instability is causing ripple effects throughout the crypto market, leading to one of its most severe drawdowns since 2020.

Bitcoin Holds Ground Amidst Volatility

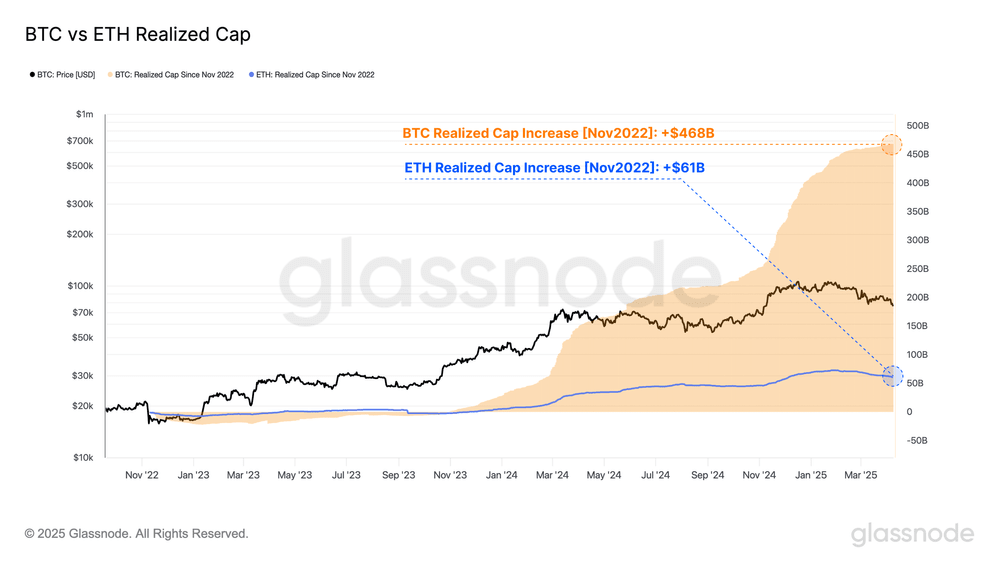

Bitcoin, the flagship cryptocurrency, has shown some resilience amidst the market turmoil. Although it has experienced volatility, dipping below the $40,000 mark, it has managed to recover somewhat. Bitcoin’s decentralized and scarce nature continues to attract investors seeking a hedge against inflation and economic instability.

Ethereum Faces Sharper Losses

Ethereum, the world’s second-largest cryptocurrency by market capitalization, is not faring as well. The asset has seen sharper losses, with its value dropping below the $2,500 mark. This decline can be attributed to the crypto’s close ties to the traditional finance sector and its role as a platform for decentralized applications.

Impact on Individual Investors

For individual investors, this market volatility can be a source of anxiety. Those who have recently entered the crypto space may be questioning their investment decisions, while seasoned investors are reassessing their portfolios. It is essential to remember that short-term market fluctuations do not necessarily indicate long-term trends. Diversification and a long-term investment strategy can help mitigate potential losses.

- Consider diversifying your portfolio across various cryptocurrencies and sectors.

- Do not make hasty decisions based on short-term market fluctuations.

- Stay informed about global economic trends and their impact on the crypto market.

Global Implications

The crypto market’s volatility is not an isolated phenomenon. It is interconnected with global economic trends, particularly those related to trade policies and liquidity. The ongoing trade tensions between major economies and the sudden liquidity crunch can lead to continued instability in the crypto market and beyond.

Central banks and governments may respond to these economic challenges by implementing monetary and fiscal policies. These actions can impact the value of various currencies and assets, including cryptocurrencies.

Conclusion

The crypto market is undergoing a severe drawdown as global economic uncertainties mount. While Bitcoin has shown some resilience, Ethereum is facing sharper losses. Individual investors should consider diversifying their portfolios and staying informed about global economic trends. The ongoing market volatility is not an isolated phenomenon and is interconnected with global economic trends, particularly those related to trade policies and liquidity.

As always, it is essential to remember that investing in cryptocurrencies carries risks, and it is important to do thorough research and consider seeking professional advice before making investment decisions. Stay calm and focus on your long-term investment strategy during these turbulent times.