Decoding the Volatility: An In-depth Analysis of Ethereum Price Prediction

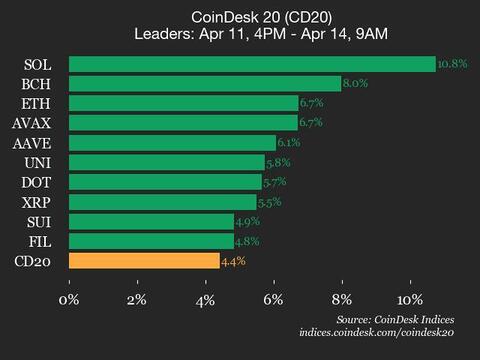

The cryptocurrency market has been a rollercoaster ride for traders and investors over the past 24 hours. The overall market capitalization has seen significant fluctuations, leaving many wondering where the next big move will be. Among the top cryptocurrencies, Ethereum (ETH) has been a subject of intense interest due to its volatility and potential price movements.

Understanding Ethereum’s Volatility

Ethereum, the second-largest cryptocurrency by market capitalization, has been experiencing wild price swings. These fluctuations can be attributed to various factors, including but not limited to:

- Market sentiment: The overall market sentiment plays a crucial role in Ethereum’s price movements. Fear and greed can significantly impact the demand and supply dynamics of Ethereum.

- Regulatory news: Any news regarding cryptocurrency regulations can cause Ethereum’s price to react. Positive news can lead to a bullish trend, while negative news can result in a bearish trend.

- Technical indicators: Technical analysis is another important factor influencing Ethereum’s price. Key resistance and support levels, moving averages, and other technical indicators can provide valuable insights into Ethereum’s price movements.

ETH Price Prediction: Where is Ethereum Headed Next?

Predicting the exact price of Ethereum is a complex task due to the numerous factors at play. However, we can look at some key technical and fundamental indicators to gain a better understanding of Ethereum’s price trend:

Technical Analysis

From a technical standpoint, Ethereum’s price has been trading within a range of $3,000 to $3,600 over the past few days. The 50-day moving average (MA) and 200-day MA are currently acting as support and resistance levels, respectively. A break above the 200-day MA could signal a bullish trend, while a breakdown below the 50-day MA could indicate a bearish trend.

Fundamental Analysis

From a fundamental perspective, Ethereum’s price is driven by its underlying use case and adoption. Ethereum is the go-to platform for decentralized applications (dApps) and non-fungible tokens (NFTs), making it an essential component of the decentralized finance (DeFi) ecosystem. The ongoing Ethereum London Hard Fork upgrade, scheduled for August 2021, is expected to improve the network’s scalability and reduce transaction fees, which could lead to increased adoption and, consequently, a higher price.

The Impact of Ethereum Price Fluctuations on Individuals

For individual investors, Ethereum’s price fluctuations can have both opportunities and risks. On the one hand, a bullish trend could result in significant profits. On the other hand, a bearish trend could lead to losses. It is essential to conduct thorough research and consider factors such as investment goals, risk tolerance, and market conditions before making any investment decisions.

The Impact of Ethereum Price Fluctuations on the World

Ethereum’s price fluctuations can have far-reaching implications for the global economy. For instance, a bullish trend could lead to increased adoption of decentralized technologies and the emergence of new business models. Conversely, a bearish trend could result in decreased investor confidence and a slowdown in the growth of the decentralized finance ecosystem. It is important to note that the cryptocurrency market is still in its infancy, and its impact on the global economy is still evolving.

Conclusion

In conclusion, Ethereum’s price predictions are an essential topic of discussion for traders and investors in the cryptocurrency market. Understanding the underlying factors influencing Ethereum’s price movements can help individuals make informed investment decisions and navigate the market’s volatility. While the short-term price fluctuations can be unpredictable, the long-term potential of Ethereum and the decentralized finance ecosystem remains promising.