Bitcoin Soars Past $78,000 Amid Equities Market Turmoil

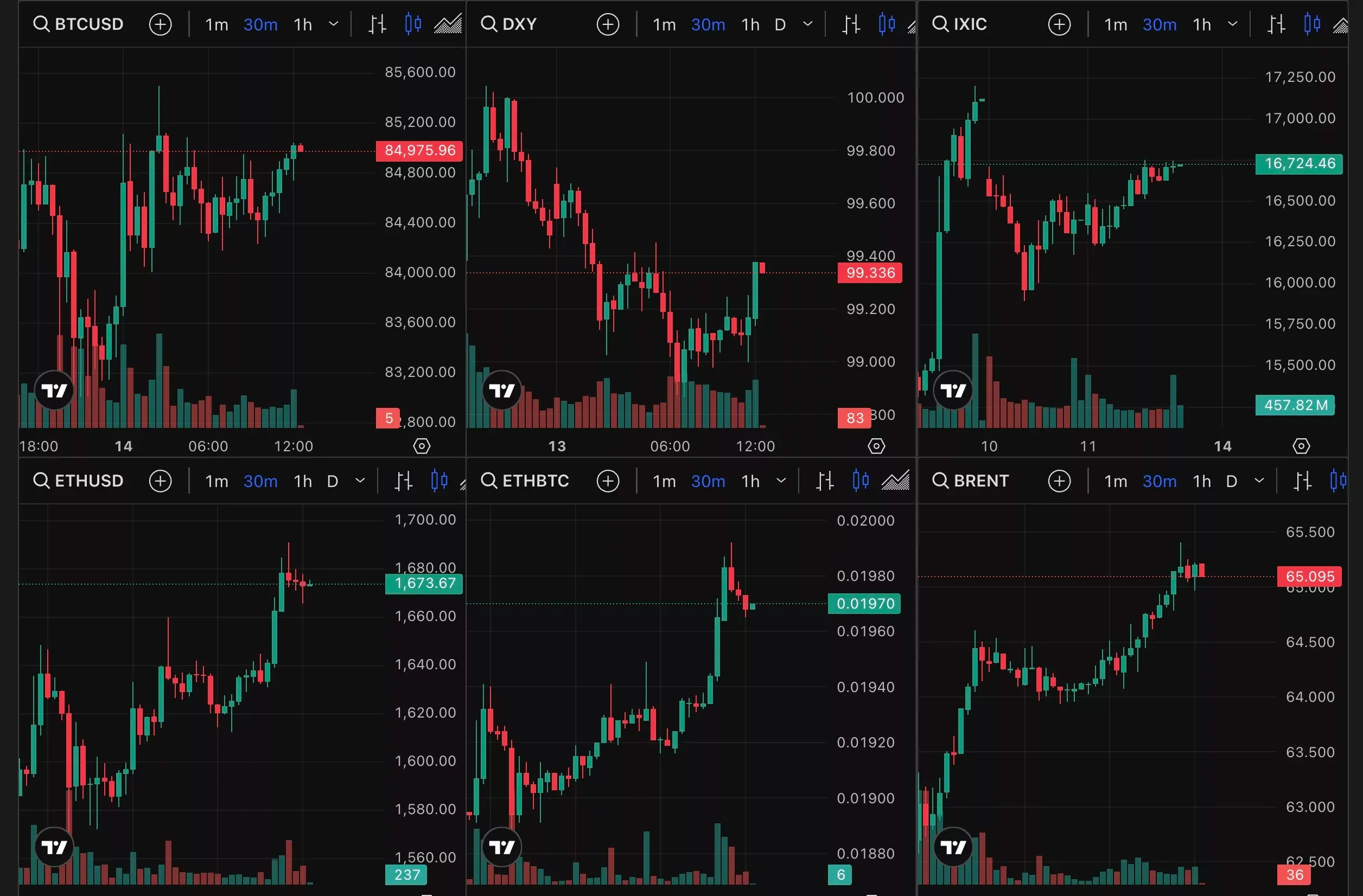

The cryptocurrency market experienced a significant surge on April 9, 2021, as Bitcoin (BTC) price breached the $78,000 mark during the Wall Street open. This sudden price movement came amidst the ongoing “herd-like” behavior in equities markets, which has left many risk-asset traders on edge.

A Swift Move Up: Bitcoin’s Price Action

Bitcoin’s price has been on a rollercoaster ride in recent days, with the digital asset reaching new all-time highs seemingly every other day. On April 9, 2021, this trend continued as Bitcoin opened at $78,300, marking a new milestone for the cryptocurrency.

Equities Markets: The Cause for Concern

The sudden move up in Bitcoin’s price came as equities markets continued to experience significant volatility. The S&P 500 and the Dow Jones Industrial Average both saw sharp declines in the days leading up to April 9, with many investors citing concerns over rising interest rates and inflation as the primary drivers of this market turmoil.

Impact on Individual Investors

For individual investors, the sudden surge in Bitcoin’s price presents a unique opportunity to enter the market at a higher price point than they may have previously considered. However, it also comes with increased risk, as the cryptocurrency’s price can be highly volatile, especially in times of market uncertainty.

- Investors should carefully consider their risk tolerance and investment goals before making any decisions regarding Bitcoin or other cryptocurrencies.

- Diversification remains key, as investing all of one’s funds into a single asset class, no matter how promising, carries significant risk.

- Stay informed about market trends and developments, as these can have a significant impact on the price of Bitcoin and other cryptocurrencies.

Impact on the World

The sudden surge in Bitcoin’s price comes at a time when the digital asset is gaining increasing attention from both individuals and institutions around the world. This trend is expected to continue, with many experts predicting that Bitcoin will eventually become a mainstream asset class.

- Governments and central banks are increasingly recognizing the potential of cryptocurrencies, with some even exploring the possibility of issuing their own digital currencies.

- The integration of cryptocurrencies into mainstream financial systems is expected to bring about significant changes, including increased financial inclusion and improved cross-border transactions.

- However, the volatility of cryptocurrencies, particularly Bitcoin, remains a concern for many, and regulators will need to find a way to balance the potential benefits of these digital assets with the need to protect consumers and maintain financial stability.

Conclusion

The sudden surge in Bitcoin’s price to $78,000 on April 9, 2021, came amidst ongoing market turmoil in the equities markets. For individual investors, this presents both opportunities and risks, and careful consideration is needed before making any investment decisions. For the world at large, the continued rise of Bitcoin and other cryptocurrencies is expected to bring about significant changes, including increased financial inclusion and improved cross-border transactions, but also requires careful regulation to ensure consumer protection and financial stability.

As always, staying informed about market trends and developments is key to making informed investment decisions. Whether you are a seasoned investor or just starting out, it is important to remember that all investments carry risk, and diversification remains a key strategy for managing that risk.