Peter Schiff’s Criticism: Ethereum’s Slump and Trump’s Economy

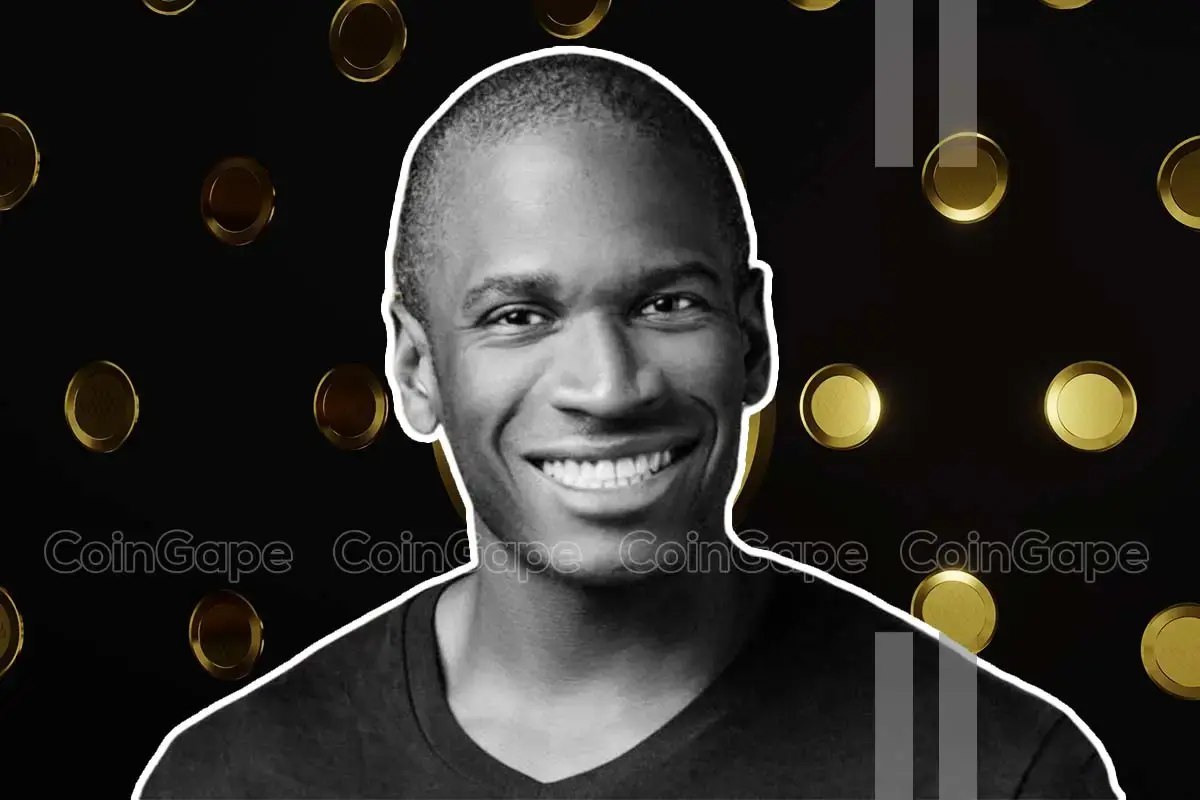

Peter Schiff, a well-known Bitcoin critic and the CEO of Euro Pacific Capital, has once again made headlines with his harsh criticism towards the crypto market and Donald Trump’s economic policies. In a recent post on social media platform Steemit, Schiff took aim at Ethereum (CRYPTO: ETH) and the broader market, which has been experiencing a steep sell-off.

Ethereum’s Slump

Schiff pointed out that Ethereum had dropped below $1,500 for the first time in over two years. The cryptocurrency briefly touched the $1,400 range, representing a significant loss for investors. Schiff took this opportunity to express his skepticism towards Ethereum and the entire crypto market.

“It’s amazing to see how quickly Ethereum has gone from a high of $4,350 to a low of $1,400,” Schiff wrote. “But it’s not just Ethereum that’s getting crushed. Bitcoin is down 60% from its all-time high, and most altcoins are down 90% or more. This is what happens when you invest in things based on hype and emotions rather than fundamentals and value.”

Trump’s Economic Policies

Schiff also criticized Donald Trump’s economic policies, which he believes have contributed to the market volatility. He argued that the Federal Reserve’s easy money policies and the administration’s pro-inflation stance have led to an unsustainable economic boom.

“The stock market is up because of the Fed’s money printing and Trump’s tax cuts,” Schiff stated. “But this is a recipe for disaster. The economy can’t sustain this level of growth, and when it eventually crashes, investors are going to be in for a rude awakening.”

Effects on Individuals

For individual investors, Schiff’s criticism serves as a reminder of the risks associated with investing in cryptocurrencies and the stock market. The volatility of these assets can lead to significant losses, especially for those who invest based on hype and emotions rather than fundamental analysis and long-term value.

- Investors should be cautious and diversify their portfolios to minimize risk.

- Thorough research and analysis are essential before making any investment decisions.

- A long-term perspective and a focus on fundamentals can help mitigate the impact of market volatility.

Effects on the World

On a larger scale, Schiff’s criticism of Ethereum and Trump’s economic policies could have significant implications for the global economy. A prolonged bear market in cryptocurrencies and the stock market could lead to decreased consumer confidence and reduced economic growth.

- Governments and central banks may be forced to take action to stabilize markets and protect their economies.

- Investors may shift their focus to more stable assets, such as gold and bonds.

- The crypto market’s volatility could lead to increased regulation and scrutiny from governments and financial institutions.

Conclusion

Peter Schiff’s criticism of Ethereum and Donald Trump’s economic policies serves as a reminder of the risks and uncertainties inherent in the crypto market and the global economy. For individual investors, it is essential to approach investing with caution, thorough research, and a long-term perspective. On a larger scale, the implications of these developments could have significant implications for the global economy, leading to increased regulation, shifts in investor sentiment, and potential market stabilization efforts.

“The crypto market and the stock market are notoriously volatile, and investors need to be prepared for the risks,” Schiff concluded. “But with the right approach, it’s possible to navigate these markets and come out on top.”