The Impact of President Trump’s Global Tariff Regime on Crypto and Beyond

President Donald Trump’s recent announcement of a global tariff regime has sent shockwaves through financial markets, causing sharp corrections across various risk assets, including crypto. Although digital currencies initially showed some resilience, market analysts caution that they remain exposed to broader macroeconomic shocks.

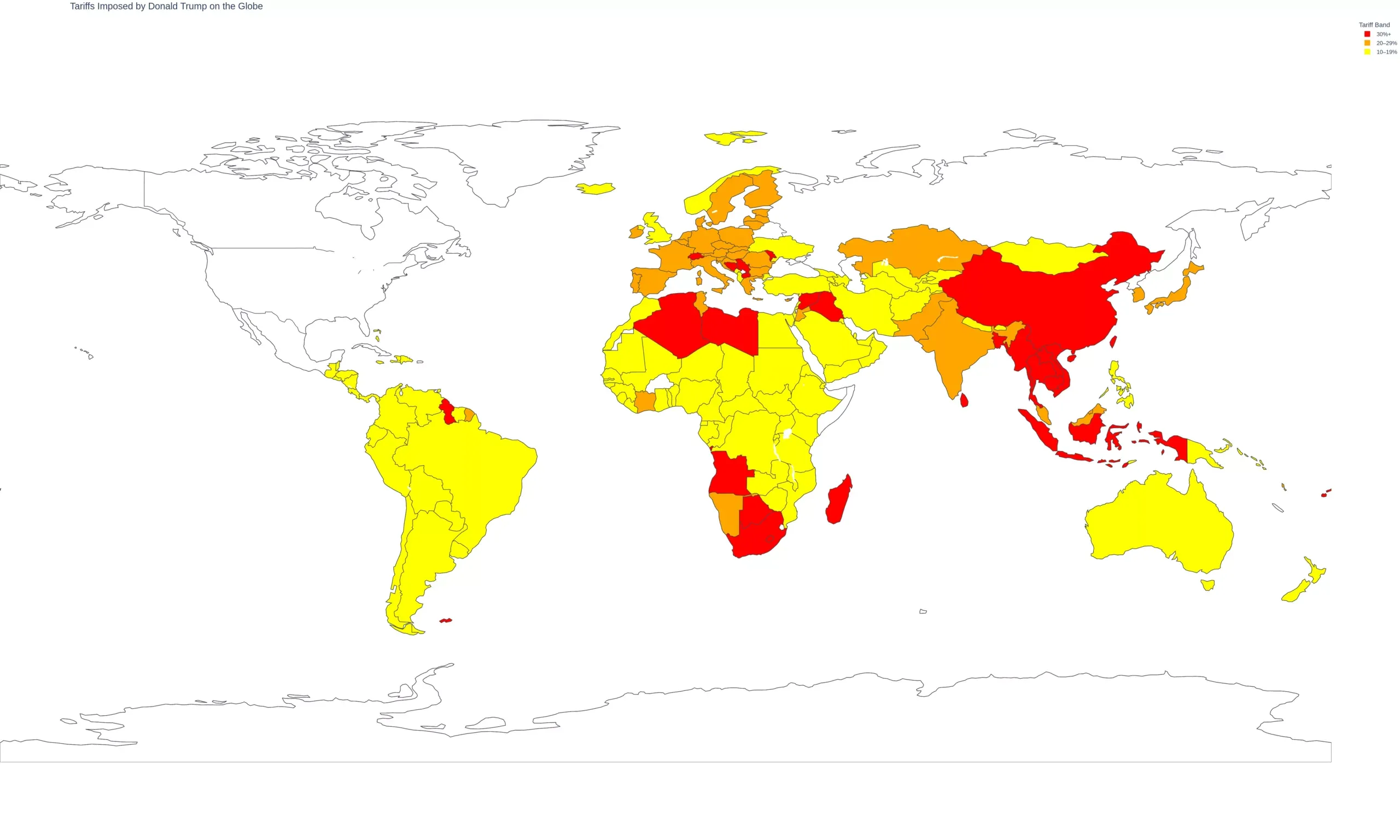

Understanding the Tariff Regime

The global tariff regime refers to the U.S. government’s decision to impose tariffs on imported goods from various countries in response to perceived trade imbalances. The tariffs aim to protect domestic industries and create jobs, but they also increase the cost of imported goods for American consumers and businesses.

The Impact on Crypto

The crypto market, which had been experiencing a bull run in the first quarter of 2018, was initially unaffected by the tariff announcement. However, as the implications of the tariffs became clearer, digital currencies began to feel the pressure. The total crypto market capitalization dropped from over $400 billion to around $300 billion in a matter of days.

One reason for the sell-off is the increased uncertainty and volatility in financial markets, which can make it more difficult for investors to allocate capital. Crypto, which is already a highly volatile asset class, becomes even riskier in such an environment.

The Broader Impact

The tariff regime’s impact on crypto is just one piece of a larger puzzle. The tariffs could lead to a global trade war, which would have far-reaching consequences for the global economy. Some potential impacts include:

- Higher inflation: Tariffs increase the cost of imported goods, which can lead to higher inflation.

- Slowing economic growth: A global trade war could lead to slower economic growth, as businesses face higher costs and reduced access to global markets.

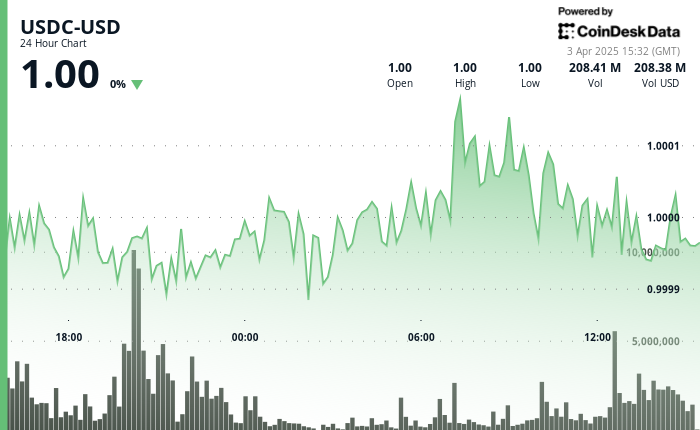

- Currency volatility: The uncertainty caused by a trade war could lead to increased currency volatility, which can impact the value of crypto and other assets.

- Geopolitical tensions: A trade war could lead to increased geopolitical tensions, which can impact investor sentiment and market stability.

Personal and Global Implications

As an individual investor, the tariff regime could impact your portfolio in several ways. Depending on your asset allocation, you may see losses in stocks, bonds, and crypto. It’s important to stay informed about global economic developments and adjust your investment strategy accordingly.

From a global perspective, the tariff regime could lead to a more protectionist world economy, with countries focusing on their own interests rather than global cooperation. This could lead to reduced trade flows, slower economic growth, and increased geopolitical tensions.

Conclusion

The global tariff regime announced by President Trump is reshaping investor sentiment and triggering sharp corrections across various asset classes, including crypto. The uncertainty and volatility created by the tariffs can make it more difficult for investors to allocate capital, particularly in a highly volatile asset class like crypto. It’s important for investors to stay informed about global economic developments and adjust their investment strategies accordingly.

From a broader perspective, the tariff regime could lead to a more protectionist world economy, with potentially far-reaching consequences for economic growth, trade flows, and geopolitical stability. As individuals, we can only do so much to influence these developments, but staying informed and taking a long-term, strategic approach to investing can help mitigate the impact on our portfolios.

Invest wisely, and stay informed.