The Curious Case of Michael Saylor’s Strategy Outperforming Bitcoin: Insights from Tobam

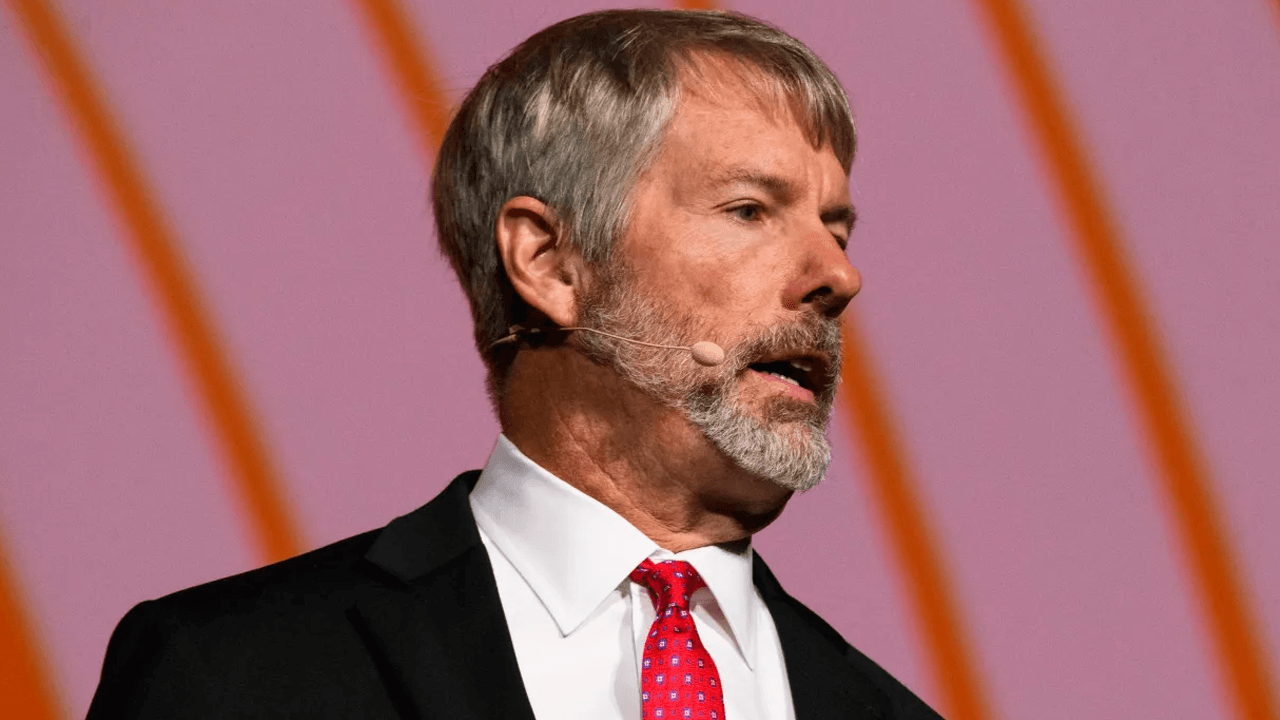

Paris-based asset manager Tobam, known for its research-heavy approach, has recently published a quantitative paper shedding light on an intriguing phenomenon: the continued outperformance of Michael Saylor’s Strategy (MSTR) compared to bitcoin (BTC).

Reason 1: Diversification

According to Tobam’s research, one of the primary reasons for Strategy’s superior performance lies in its diversification benefits. The asset manager argues that while bitcoin is a single asset class, Strategy offers exposure to various sectors, industries, and companies. This diversification helps mitigate the risk associated with investing in a single asset class like Bitcoin.

Reason 2: Income Generation

Another factor that sets Strategy apart from Bitcoin is its income generation capacity. While Bitcoin is a purely digital asset, MSTR pays dividends to its shareholders. These dividends provide a steady stream of income, which can help investors weather market volatility and maintain a stable financial position.

Reason 3: Institutional Investment

The third reason for Strategy’s outperformance is the increasing institutional investment in the technology sector, particularly in companies like Microstrategy. With large institutional investors showing a growing interest in tech stocks, the demand for MSTR has been on the rise, leading to its continued price appreciation.

Implications for Individual Investors

For individual investors, Tobam’s research suggests that a diversified portfolio, including both Bitcoin and stocks like MSTR, could potentially offer better risk-adjusted returns than investing solely in Bitcoin. By balancing the volatility of digital assets with the stability of stocks, investors can enjoy the best of both worlds.

Global Impact

On a larger scale, Tobam’s findings could have significant implications for the investment community as a whole. As more institutional investors enter the crypto market and explore the benefits of diversifying their portfolios, the demand for digital assets like Bitcoin and stocks like MSTR is expected to grow.

- Increased institutional interest in Bitcoin and other digital assets

- Growing recognition of the importance of diversification in investing

- Expansion of investment opportunities beyond traditional asset classes

Conclusion

In conclusion, Tobam’s research offers valuable insights into the reasons behind Michael Saylor’s Strategy’s continuous outperformance of Bitcoin. By highlighting the benefits of diversification, income generation, and institutional investment, the asset manager sheds light on the evolving investment landscape and the growing importance of balancing risk and reward in a volatile market.