Hayden Davis’s Recent Token Selling Activity: A Controversial Move

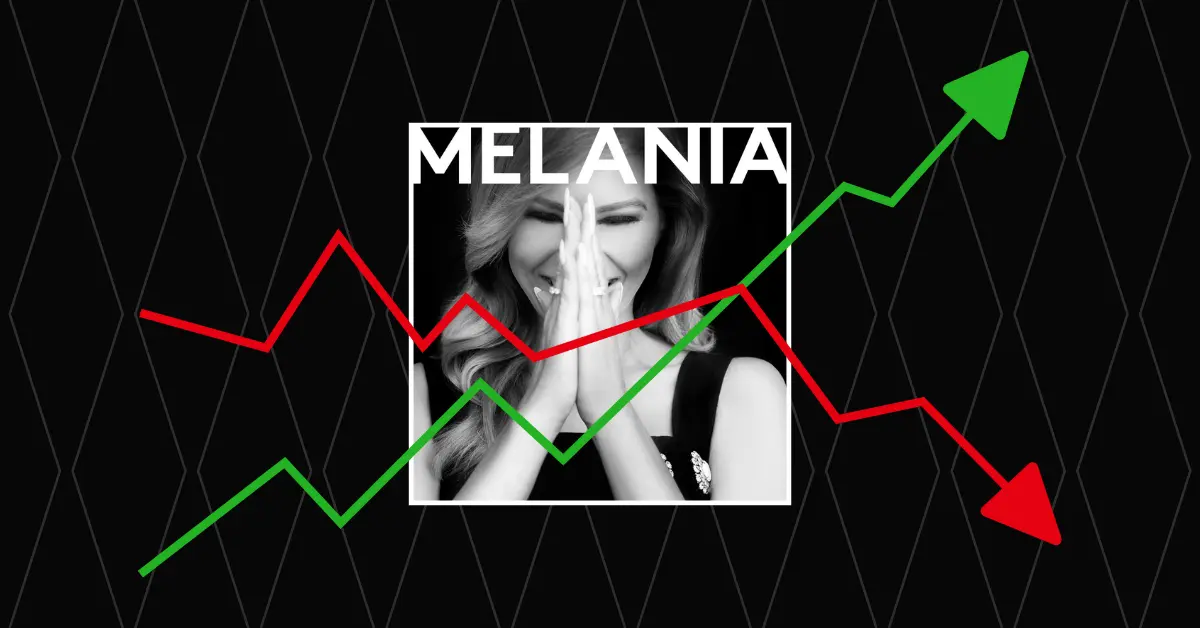

Hayden Davis, a well-known figure in the blockchain world, has once again made headlines with his aggressive selling of MELANIA tokens over the past two weeks. According to the latest report from blockchain analytics firm Bubblemaps, Davis’s wallets have offloaded approximately $1.06 million worth of tokens onto centralized exchanges.

Aggressive Selling: An Overview

The selling spree began on [Date], with Davis’s wallets transferring large amounts of MELANIA tokens to various exchanges. The most significant transactions occurred on [Dates], with over $500,000 worth of tokens being sold on each day. The selling continued until [Date], when Davis’s wallets had transferred a total of $1.06 million in MELANIA tokens.

Additional Withdrawals

Besides selling MELANIA tokens, Davis’s wallets also withdrew over $2 million in various cryptocurrencies during the same period. The withdrawals were made to different addresses, indicating potential diversification of assets or preparation for future transactions.

Impact on Davis’s Reputation

Davis’s recent selling activity has raised concerns among the crypto community, with some questioning his intentions and others accusing him of manipulating the market. Davis is no stranger to controversy, having been involved in various high-profile projects, including the now-defunct LIBRA token.

Impact on MELANIA Token Holders

The selling activity has led to a significant drop in the price of MELANIA tokens, causing losses for many investors. The token’s value has decreased by around 30% since the selling began, with some fearing that the price may continue to fall if Davis continues to sell.

Impact on the Blockchain Ecosystem

The selling activity by Davis could have broader implications for the blockchain ecosystem. Some believe that such large-scale selling could create market instability and undermine investor confidence. Others argue that the selling is a normal part of the market cycle and that the ecosystem is resilient enough to weather the storm.

- Some investors have suffered losses due to Davis’s selling activity.

- The selling activity has raised concerns about market manipulation.

- The impact on the ecosystem remains to be seen.

Conclusion

Hayden Davis’s recent selling activity of MELANIA tokens has once again brought him into the spotlight, with concerns about market manipulation and potential losses for investors. The selling has led to a significant drop in the token’s price, and the impact on the broader blockchain ecosystem remains to be seen. As always, investors are advised to exercise caution and do their due diligence before making investment decisions.

While the selling activity may have immediate implications for Davis, MELANIA token holders, and the blockchain ecosystem, it is essential to remember that the crypto market is dynamic and constantly evolving. As such, it is crucial to stay informed and adapt to changing market conditions.