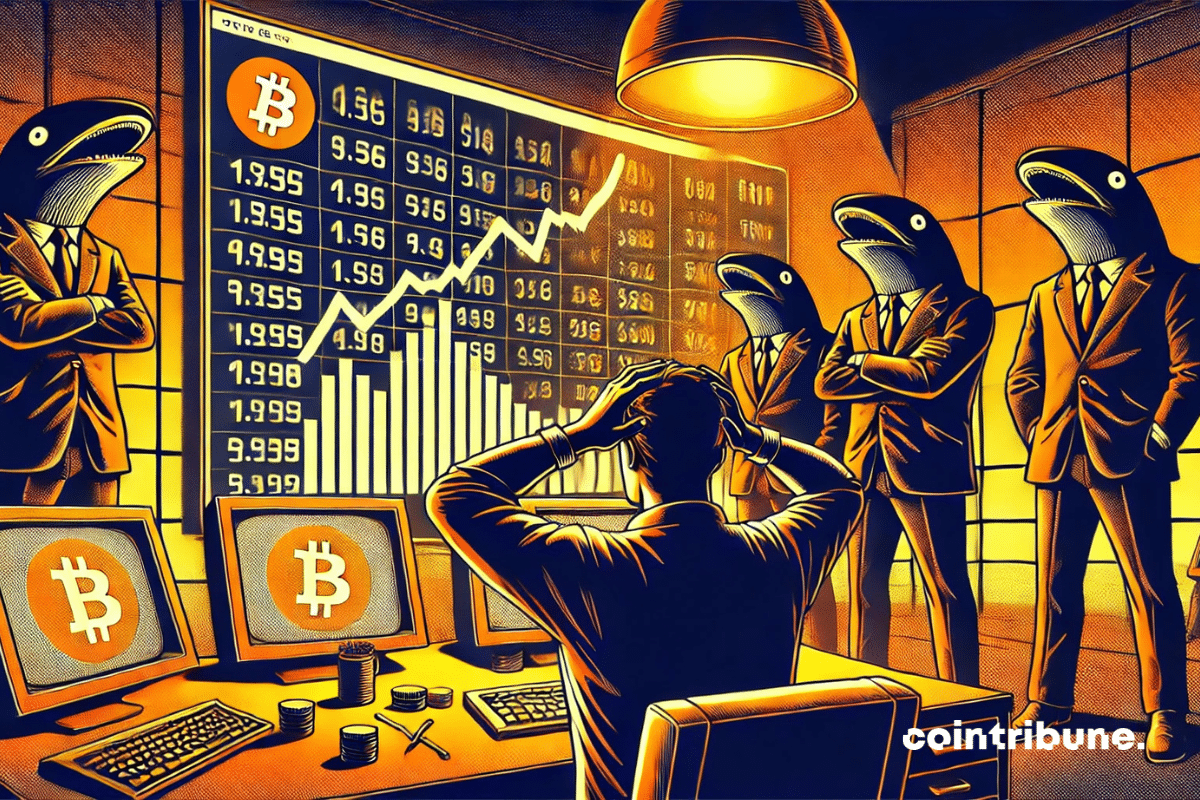

Bitcoin’s Downturn: Small Investors Panic, “Whales” Buy

The cryptocurrency market has been experiencing turbulence over the past few days, with Bitcoin leading the charge. For the fourth consecutive day, Bitcoin’s value has continued to decline, reaching a new low of $83,387 on March 28. This downward trend has left small investors feeling anxious and uncertain.

Small Investors’ Reactions

The panic among small investors is palpable. Social media platforms are filled with concerns and fears about the future of Bitcoin and other cryptocurrencies. Many are questioning whether they should hold on to their investments or sell to minimize their losses. Some have even resorted to selling their Bitcoin at a loss to limit their losses.

Whales’ Actions

Despite the fear and uncertainty among small investors, “whales” – large investors with significant holdings of Bitcoin – are taking advantage of the downturn to increase their positions. According to several market analysts, these large investors are buying up Bitcoin at lower prices, preparing for a potential rebound.

Impact on Individuals

For individuals who have invested in Bitcoin or other cryptocurrencies, the downturn can be a source of anxiety and financial stress. Those who have recently entered the market may be considering selling their holdings to minimize their losses. However, it is essential to remember that the cryptocurrency market is known for its volatility, and prices can fluctuate significantly.

- Consider setting a stop-loss order to limit potential losses.

- Do not make impulsive decisions based on short-term market trends.

- Consider diversifying your portfolio to minimize risk.

Impact on the World

The downturn in Bitcoin’s value can have broader implications for the global economy. Bitcoin’s volatility can impact financial markets and economies that are heavily invested in the cryptocurrency. Additionally, Bitcoin’s use as a store of value and medium of exchange can be affected by its value fluctuations.

- Countries that have adopted Bitcoin as legal tender, such as El Salvador, may be impacted.

- Institutions and businesses that hold large Bitcoin positions may be affected.

- The broader impact on the economy will depend on the duration and severity of the downturn.

Conclusion

The downturn in Bitcoin’s value can be a source of anxiety for individuals and the global economy. While small investors may be panicking and considering selling their holdings, “whales” are taking advantage of the situation to increase their positions. It is essential to remember that the cryptocurrency market is known for its volatility and that prices can fluctuate significantly. Individuals should consider setting stop-loss orders, diversifying their portfolios, and avoiding impulsive decisions based on short-term market trends.

For the global economy, the impact of the downturn will depend on its duration and severity. Countries and institutions that are heavily invested in Bitcoin may be impacted, and the broader implications for the economy will be monitored closely.