The Brave Pioneers of Bitcoin: Navigating Legal and Financial Risks

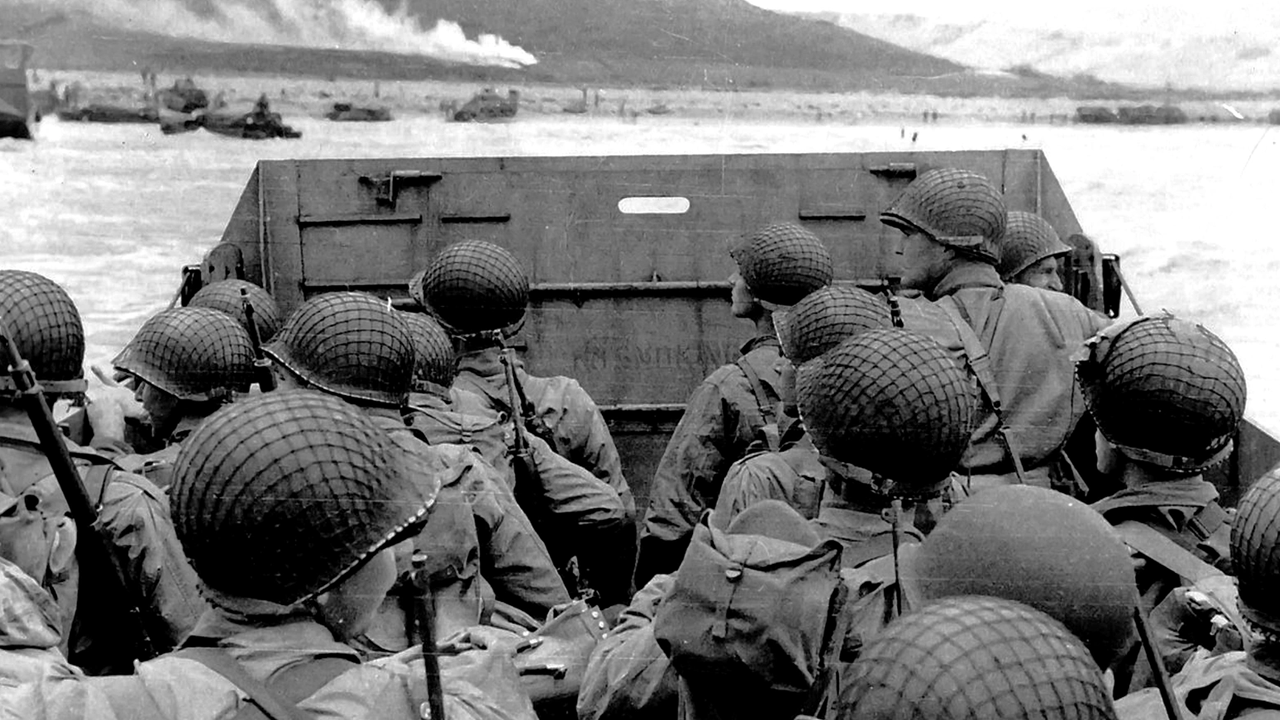

The world of cryptocurrency has seen its fair share of ups and downs since the inception of Bitcoin in 2009. Early adopters and pioneers of this digital currency bravely ventured into uncharted territory, facing legal and financial risks that could be compared to soldiers “running into machine gunfire,” as investor Trace Mayer described in a recent interview. In this blog post, we’ll delve into the high-stakes environment that shaped the rise of cryptocurrency, focusing on the experiences of early Bitcoin pioneers like Roger Ver.

Roger Ver: A Bitcoin Evangelist

Roger Ver, also known as “Bitcoin Jesus,” was one of the earliest investors in Bitcoin. He first learned about the digital currency in 2011 and was immediately intrigued by its potential. Ver invested a significant amount of his savings into Bitcoin, seeing it as a game-changer for the financial world.

Legal Risks

At the time, the legal landscape surrounding Bitcoin was uncertain. Governments and regulatory bodies were unsure of how to classify and regulate digital currencies. Ver and other early adopters faced the risk of being charged with money laundering or other financial crimes. The lack of clear regulations made it difficult for businesses to accept Bitcoin as a form of payment and for individuals to invest in it without fear of legal repercussions.

Financial Risks

The financial risks were equally daunting. Bitcoin’s value was highly volatile, making it a risky investment. Prices could fluctuate wildly in a short period, leaving investors with significant losses. Ver and other early Bitcoin investors had to constantly monitor the market and make quick decisions based on price movements.

Impact on Individuals

For individuals, the rise of Bitcoin and other cryptocurrencies means greater financial freedom and access to a global economy. Transactions can be made without the need for intermediaries like banks, making it easier and cheaper to send money across borders. However, this also means that individuals must take on the responsibility of securing their digital assets, as there is no central authority to protect them.

Impact on the World

On a larger scale, the impact of Bitcoin and other cryptocurrencies on the world is still unfolding. Some experts predict that digital currencies will disrupt traditional financial systems, leading to a more decentralized and equitable economy. Others warn of the risks associated with cryptocurrencies, including their use in illegal activities and their potential to fuel economic instability.

Conclusion

The early Bitcoin pioneers, including Roger Ver, navigated legal and financial risks that were unprecedented in the financial world. Their bravery and vision paved the way for the rise of cryptocurrencies and the potential for a more decentralized and equitable global economy. As individuals and businesses continue to adopt digital currencies, it is important to stay informed of the latest developments and to take the necessary steps to secure your digital assets.