The Bitcoin Price Dip: A Post-Moon Landing Comedown

The Bitcoin market has witnessed a significant rollercoaster ride, with the cryptocurrency reaching “moon landing” level highs towards the end of 2020. These historic prices were largely fueled by the pro-cryptocurrency rhetoric from the Trump administration. However, as we’ve entered 2021, these highs have come back down to Earth, leaving investors and enthusiasts questioning the future of Bitcoin.

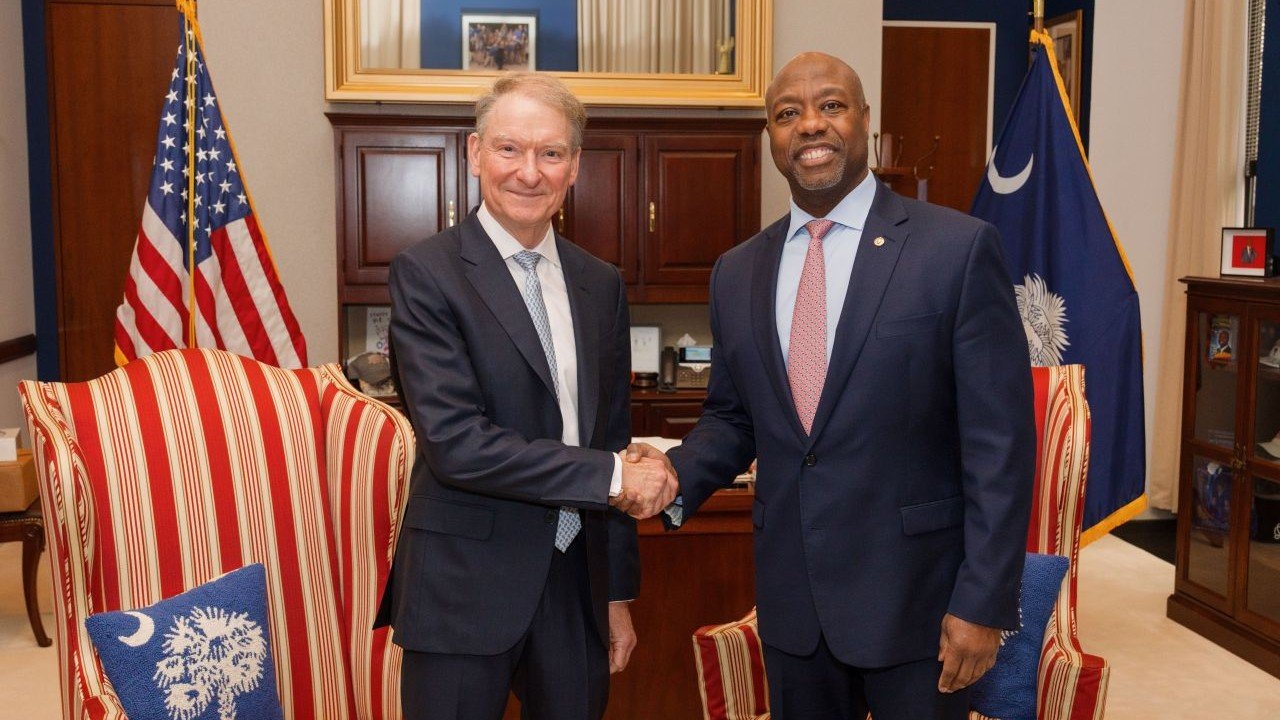

The Trump Effect

The Trump administration’s stance on cryptocurrencies was a game-changer for the market. In May 2020, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) announced that it would no longer require cryptocurrency exchanges to submit reports on transactions involving convertible virtual currencies and their customers if the transactions were below a certain threshold. This move was seen as a major step towards legitimizing Bitcoin and other cryptocurrencies in the eyes of traditional financial institutions.

The pro-crypto sentiment continued when the Office of the Comptroller of the Currency (OCC) issued a letter in July 2020, stating that national banks and federal savings associations could provide cryptocurrency custody services to their customers. These regulatory developments instilled confidence in the market, resulting in a surge in Bitcoin’s price.

The Post-Moon Landing Price Dip

Despite reaching all-time highs in December 2020, Bitcoin’s price has since taken a hit. The cryptocurrency’s value dropped by over 20% in just a few days, causing concern among investors and market watchers.

Several factors have contributed to the price dip. One of the main reasons is the overall volatility of the cryptocurrency market. Bitcoin is known for its price swings, and these fluctuations can be influenced by various factors, including regulatory changes, market sentiment, and large whale transactions.

Another factor is the increasing interest from institutional investors, which has led to an influx of capital into the market. While this has helped drive up the price, it has also resulted in a larger supply of Bitcoin available for sale, which can put downward pressure on the price.

Impact on Individuals

For individual investors, the Bitcoin price dip can be both an opportunity and a cause for concern. Those who bought Bitcoin at its peak and are looking to sell may be feeling the sting of lost profits. However, for those who believe in the long-term potential of Bitcoin and have a long-term investment strategy, the dip could be seen as a chance to buy at a lower price.

Additionally, the price dip may deter new investors from entering the market, which could limit the growth potential of Bitcoin in the short term. However, it could also attract more experienced investors who are looking to take advantage of the price volatility.

Impact on the World

The Bitcoin price dip could have far-reaching implications for the world, particularly in the realm of finance and economics. One potential impact is on the adoption of cryptocurrencies by traditional financial institutions. If the price volatility continues, it could deter some institutions from fully embracing cryptocurrencies, which could slow down the mainstream adoption of Bitcoin and other cryptocurrencies.

Another potential impact is on the broader economy. Bitcoin and other cryptocurrencies are often seen as an alternative to traditional currencies and store-of-value assets like gold. If the price volatility continues, it could erode confidence in Bitcoin as a reliable store of value, which could lead investors to turn to other assets instead.

Conclusion

The Bitcoin price dip is a reminder that the cryptocurrency market is still in its infancy and is subject to significant volatility. While the pro-crypto rhetoric from the Trump administration helped fuel the surge in Bitcoin’s price, it is ultimately the market forces that will determine its long-term value. For individual investors, the dip presents both opportunities and risks, while for the world, it could have far-reaching implications for the adoption of cryptocurrencies and the broader economy.

- Bitcoin reached all-time highs towards the end of 2020, driven in part by pro-crypto rhetoric from the Trump administration.

- The price has since taken a hit, dropping by over 20% in just a few days.

- Several factors have contributed to the price dip, including market volatility and increased institutional investment.

- Individual investors may view the dip as an opportunity or a cause for concern, depending on their investment strategy.

- The price dip could have far-reaching implications for the adoption of cryptocurrencies by financial institutions and the broader economy.