Bracing for Change: The Impact of Paul Atkins’ SEC Nomination on Investors and the World

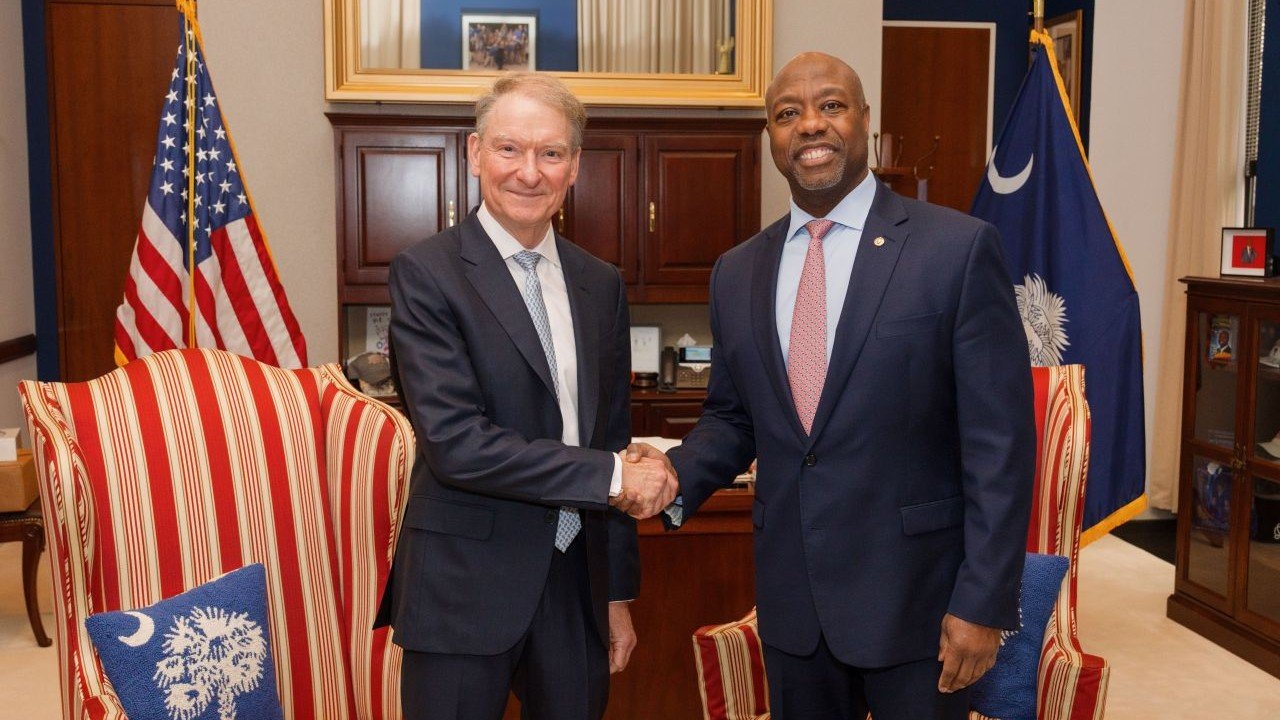

The financial world held its breath as the confirmation of President Donald Trump’s pick for Chairman of the U.S. Securities and Exchanges Commission (SEC), Paul Atkins, loomed on Thursday. Atkins, a former SEC commissioner and current partner at law firm Patton Boggs, is known for his pro-business stance and deregulatory views.

Impact on Individual Investors

For individual investors, the confirmation of Paul Atkins as SEC Chairman could mean a shift in regulatory focus. Atkins has previously advocated for reducing regulatory burdens on businesses, which could lead to less red tape for investors. However, some worry that this deregulatory approach could come at the expense of investor protection. Only time will tell how Atkins’ leadership will balance these competing priorities.

Impact on the Global Financial Market

On a larger scale, the impact of Paul Atkins’ SEC nomination on the global financial market is still uncertain. Some believe that his deregulatory stance could lead to increased foreign investment in the U.S., as businesses see fewer regulatory hurdles. Others argue that this approach could create instability, as regulations provide a level of certainty and predictability that markets thrive on. It’s important to note that the SEC is just one of many regulatory bodies, and the impact of Atkins’ leadership will depend on how it interacts with other regulatory bodies and global economic trends.

A Look at Atkins’ Past

Paul Atkins served as a commissioner at the SEC from 2002 to 2008, where he advocated for deregulation and a more business-friendly approach. After leaving the SEC, he joined law firm Patton Boggs, where he has worked as a partner since 2009. Atkins has also served on the board of the National Association of Securities Dealers (NASD) and the American Bar Association’s Section of Business Law.

What Does This Mean for Me?

As an individual investor, it’s important to stay informed about regulatory changes that could impact your investments. If Paul Atkins’ deregulatory approach leads to fewer regulatory hurdles, it could make it easier for you to invest in certain businesses. However, it’s also important to remember that regulations exist for a reason, and their removal could create risks that are worth considering. Stay tuned for more updates as Atkins’ confirmation hearing approaches.

The World’s Perspective

From a global perspective, the impact of Paul Atkins’ SEC nomination on the world will depend on how his deregulatory approach interacts with other regulatory bodies and economic trends. Some countries may see increased foreign investment as a result of fewer regulatory hurdles in the U.S. Others may view this approach as a threat to their own regulatory frameworks and economic stability. It’s important for investors to keep a global perspective and stay informed about regulatory changes in other countries as well.

- Stay informed about regulatory changes that could impact your investments

- Consider the potential risks and benefits of deregulation

- Keep a global perspective and stay informed about regulatory changes in other countries

Conclusion

The confirmation of Paul Atkins as SEC Chairman could mean a shift in regulatory focus for individual investors and the global financial market. While his deregulatory stance could make it easier for businesses to operate and invest, it could also create risks that are worth considering. Stay informed about regulatory changes and keep a global perspective as we navigate this new regulatory landscape.