BlackRock’s Charming Leap into the Solana Blockchain: A New Era for Tokenized Money Market Funds

In an enchanting dance between traditional finance and the crypto realm, BlackRock, the world’s largest asset manager, has announced the expansion of its tokenized money market fund, BUIDL, to the Solana blockchain. With assets under management (AUM) surpassing a captivating $1.7 billion, let’s delve into the whimsical world of this financial milestone.

Why Solana, You Ask?

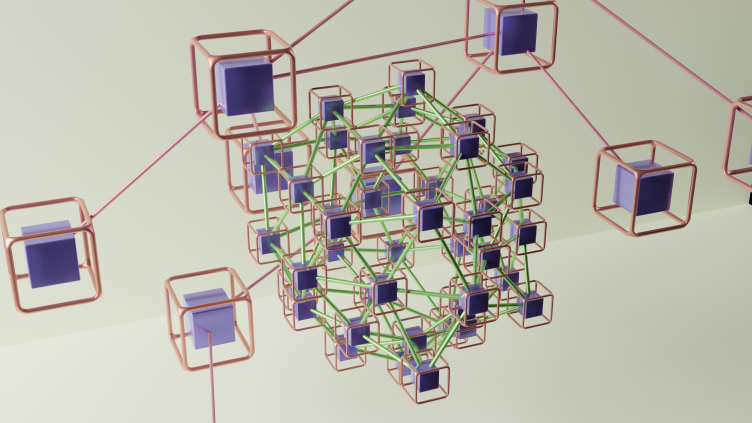

Solana, a blossoming blockchain platform known for its high-performance capabilities and scalability, has caught the eye of BlackRock. The platform’s proof-of-stake consensus mechanism, combined with its ability to process up to 65,000 transactions per second, makes it an alluring choice for a fund of this magnitude.

What Does This Mean for Me?

As a curious and engaged reader, you might be wondering how this development affects you. Well, my dear friend, this is where things get truly fascinating! With BlackRock’s entry into the Solana ecosystem, we could potentially witness a surge in institutional adoption of tokenized assets. This could lead to an increase in liquidity and wider availability of these assets, making it an exciting time for investors looking to explore the crypto space.

- More institutional players entering the Solana ecosystem

- Potential increase in liquidity for tokenized assets

- Wider availability of tokenized assets for investors

And for the World?

The ripple effect of BlackRock’s expansion into the Solana blockchain extends far beyond the realm of individual investors. This move could lead to increased mainstream adoption of blockchain technology and tokenized assets. Here’s how:

- Greater mainstream acceptance of blockchain technology

- Expansion of the tokenized assets market

- Potential for new use cases and applications

A Peek into the Future

As we stand at the precipice of this exciting new chapter, it’s important to remember that the world of finance and technology is ever-evolving. With BlackRock’s leap into the Solana blockchain, we might just be witnessing the beginning of a new era in the tokenized assets market. So, dear reader, let us embrace this enchanting journey together and see where it takes us.

In Conclusion

BlackRock’s expansion of its tokenized money market fund, BUIDL, to the Solana blockchain marks an important milestone in the world of finance and technology. With its AUM surpassing $1.7 billion, this move could lead to increased institutional adoption of tokenized assets and broader availability for investors. The ripple effect of this development extends far beyond the realm of individual investors, potentially leading to greater mainstream acceptance of blockchain technology and new use cases and applications. So, let us embark on this captivating journey together and witness the magic unfold!