Ripple’s XRP: Banks’ Favorite Crypto Asset Post-SEC Decision

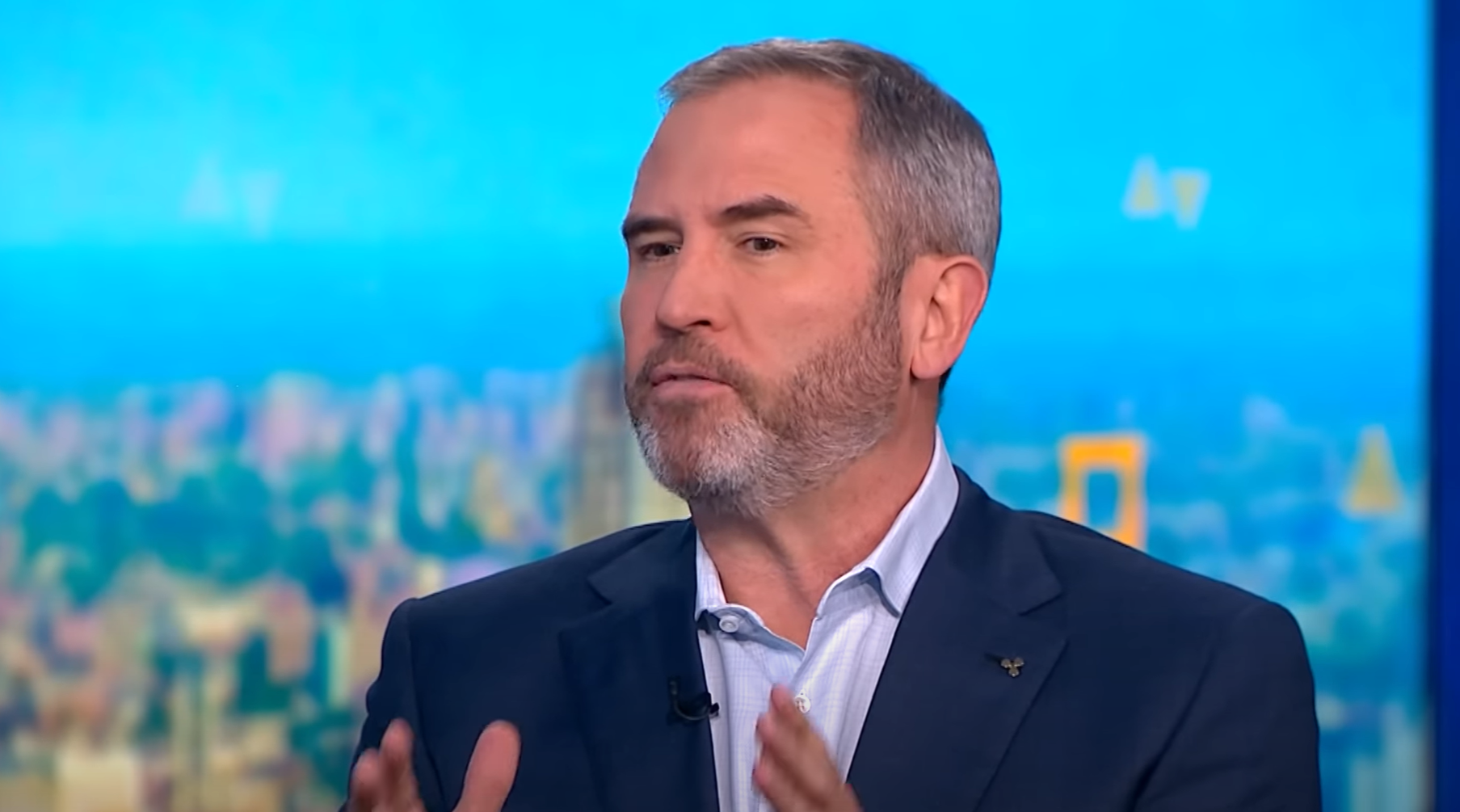

In a recent interview with FOX Business, Ripple CEO Brad Garlinghouse shared some exciting news about the company’s growing engagement with financial institutions, specifically banks, following the US Securities and Exchange Commission’s (SEC) decision to end its investigation into Ripple. Let’s delve deeper into this intriguing development.

Banks Embrace Ripple and XRP

According to Garlinghouse, banks have been increasingly interested in Ripple and its native cryptocurrency, XRP. He stated, “Banks want to use digital assets, and they want to use blockchain, but they don’t want to deal with the volatility and the uncertainty of Bitcoin and Ethereum.” XRP, being a stable and centralized digital asset, offers banks the benefits of blockchain technology without the volatility associated with other cryptocurrencies.

The SEC’s Decision: A Turning Point for Ripple

The SEC’s decision to end its investigation into Ripple came as a relief to many in the crypto community. This development signifies a significant milestone for Ripple, as it removes an overhanging uncertainty that had been affecting the company’s growth. Garlinghouse shared his thoughts on the matter, “The SEC’s decision is a clear signal that Ripple is not a security.” He added, “It’s a clear signal that XRP is a digital asset, and it’s going to be treated as a digital asset.”

Impact on You: A New Era for Cross-Border Payments

For individuals, the end of the SEC investigation could potentially lead to more accessible and affordable cross-border payments using Ripple and XRP. Banks adopting Ripple’s technology could mean faster, cheaper, and more secure international transactions. This could be a game-changer for people who frequently send money across borders, such as immigrants sending money back to their home countries or businesses dealing with international transactions.

Impact on the World: A Step Towards Mainstream Adoption

The growing adoption of Ripple and XRP by banks is a significant step towards mainstream adoption of cryptocurrencies. It demonstrates that digital assets have a place in the traditional financial system, and they offer tangible benefits over traditional methods of cross-border transactions. This could lead to further research and development in the crypto space, which could result in even more innovative applications and use cases for digital assets.

Conclusion: A Bright Future for Ripple and XRP

The end of the SEC investigation into Ripple and XRP is a clear indication of the growing acceptance and adoption of digital assets in the financial industry. With banks showing increasing interest in Ripple and its native cryptocurrency, we can expect to see more innovative applications and use cases for digital assets in the future. This development is not only a win for Ripple and its investors but also for the crypto community as a whole. As Garlinghouse put it, “This is a turning point for the entire industry.”

- Banks are increasingly engaging with Ripple and XRP, following the SEC’s decision to end its investigation into the company.

- XRP offers banks the benefits of blockchain technology without the volatility associated with other cryptocurrencies.

- This development could lead to more accessible and affordable cross-border payments for individuals.

- It’s a significant step towards mainstream adoption of digital assets in the financial industry.