Bitcoin’s Surprising Resurgence: Two Driving Forces

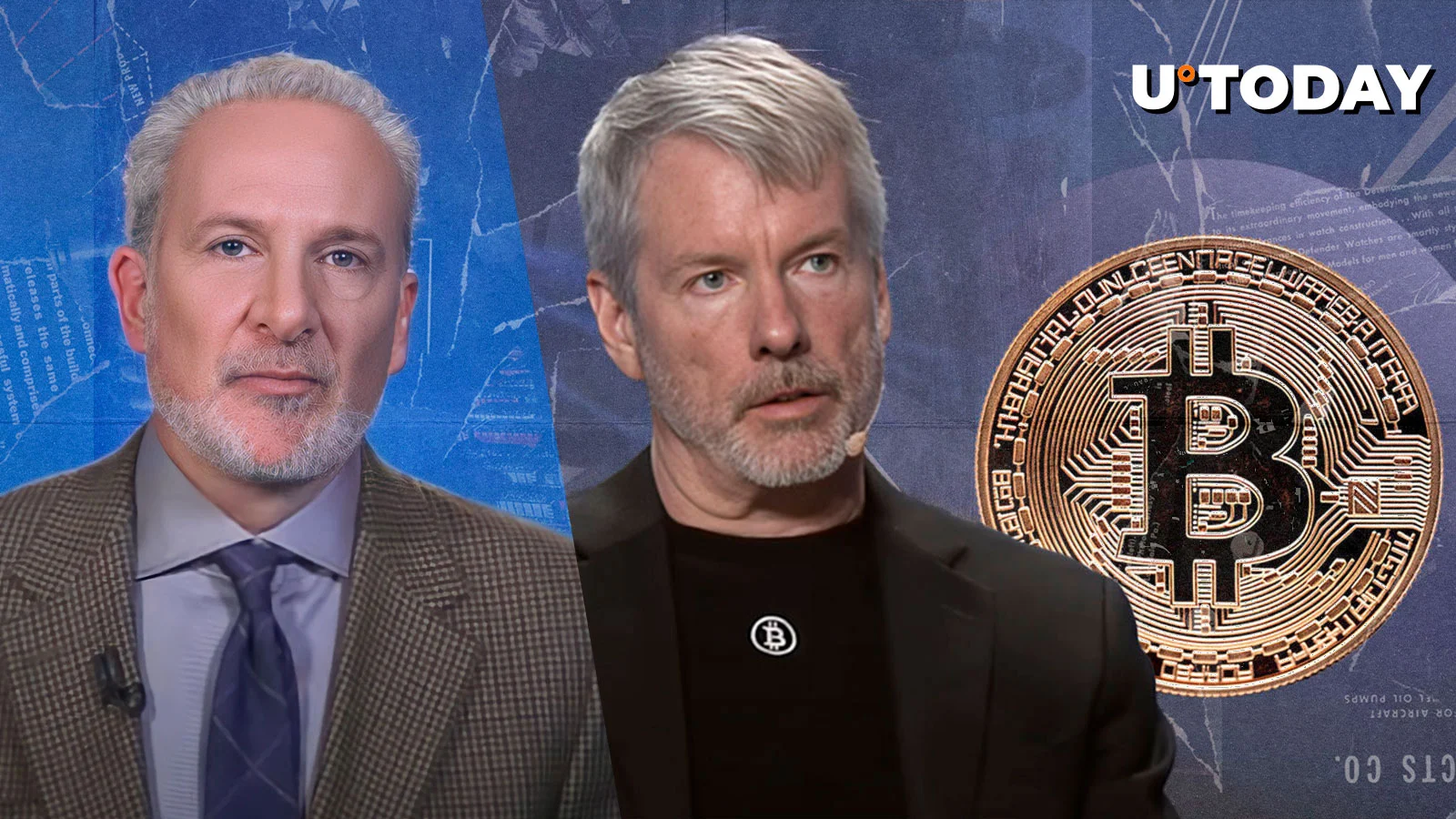

In the ever-evolving world of cryptocurrencies, the latest intrigue revolves around Bitcoin’s (BTC) recent surge past the $87,000 mark. This development comes as a surprise to many, especially given the long-standing criticisms from renowned economist and Bitcoin skeptic, Peter Schiff.

The Critic’s Perspective

Schiff, a well-known critic of Bitcoin, recently took to Twitter to express his thoughts on the current state of Bitcoin demand. He pointed out that the primary drivers of this demand are twofold:

- Michael Saylor-led Strategies: Schiff acknowledged the significant role that Michael Saylor, the CEO of MicroStrategy, has played in Bitcoin’s recent demand. MicroStrategy, under Saylor’s leadership, has been aggressively acquiring Bitcoin as a corporate treasury reserve asset.

- Speculators and U.S. Bitcoin Reserve Anticipation: Schiff also highlighted the growing anticipation among speculators for a potential U.S. Bitcoin reserve. This speculation has fueled demand for Bitcoin, driving its price upward.

Impact on Individuals

For individuals, the recent Bitcoin surge could mean a potential opportunity to invest in this digital asset. Bitcoin’s volatility, however, comes with risks. As with any investment, it is essential to thoroughly research, understand the risks, and consider seeking advice from financial advisors before making any investment decisions.

Global Implications

The impact of Bitcoin’s surge on the world extends beyond individual investors. Here are a few potential implications:

- Central Banks: Central banks and governments worldwide are closely monitoring Bitcoin and other cryptocurrencies. Some are exploring the possibility of creating their digital currencies to compete with Bitcoin. Others are considering regulating or even banning cryptocurrencies.

- Businesses: More businesses are starting to accept Bitcoin as a form of payment, further legitimizing its use and increasing demand.

- Financial Institutions: Financial institutions, including banks and investment firms, are offering Bitcoin-related services and products to cater to growing client interest.

Conclusion

The recent surge in Bitcoin’s price has rekindled the debate around this digital asset’s role in the financial world. With two primary drivers of demand – Michael Saylor-led Strategies and speculators anticipating a potential U.S. Bitcoin reserve – the future of Bitcoin remains uncertain but undeniably intriguing. As individuals, it’s crucial to stay informed, understand the risks, and make informed decisions. Meanwhile, the global implications of this development extend to central banks, businesses, and financial institutions, making this an issue worth keeping an eye on.

Stay tuned for more updates on this developing story!