Performance Analysis of Decentralized Finance (DeFi) Tokens: A Focus on Aave (AAVE)

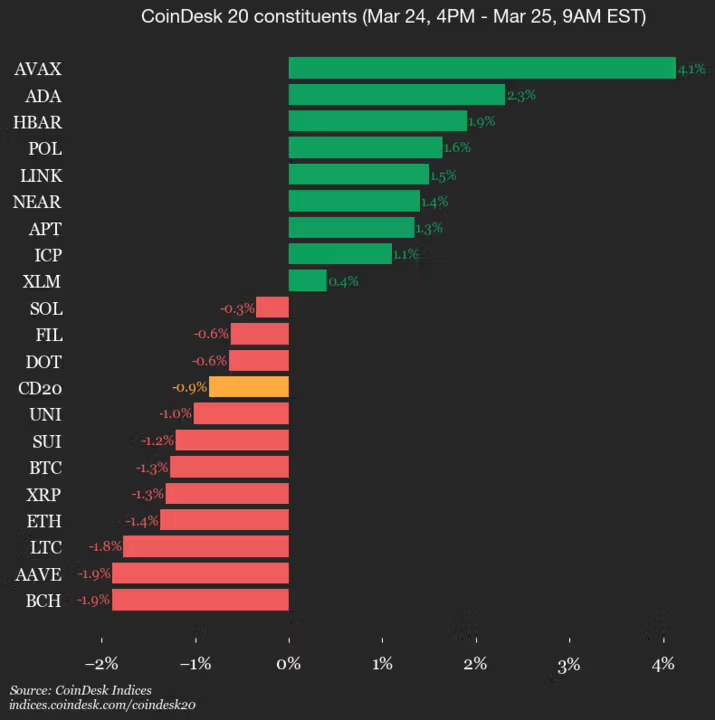

In the ever-evolving world of Decentralized Finance (DeFi), the market performance of various tokens continues to be a topic of keen interest. Among the underperforming tokens in the recent past was Aave (AAVE), which experienced a decline of 1.9%. This blog post aims to provide a detailed analysis of Aave’s recent performance and its potential implications.

Aave (AAVE): An Overview

Aave is an open-source and non-custodial decentralized lending protocol built on the Ethereum blockchain. It enables users to lend and borrow assets with variable and fixed interest rates. The AAVE token is an ERC-20 token that provides governance rights, access to premium services, and a share of the protocol’s fees.

Aave’s Recent Performance

The DeFi market has witnessed significant volatility in recent months, with Aave being no exception. The token’s price has seen a steady decline since its all-time high in May 2021. Several factors have contributed to this trend:

- Competition: The DeFi market is highly competitive, with numerous lending platforms vying for market share. Competitors like Compound (COMP) and Maker (MKR) have gained traction, potentially drawing users away from Aave.

- Regulatory Scrutiny: The increasing regulatory scrutiny of the crypto industry has raised concerns among investors, leading to a sell-off in various tokens, including Aave.

- Market Volatility: The broader crypto market has been volatile, with Bitcoin and Ethereum experiencing significant price swings. This volatility has impacted the prices of DeFi tokens, including AAVE.

Implications for Individuals

For individual investors, the underperformance of Aave may lead to several consequences:

- Reduced Portfolio Value: If you have invested in AAVE, the decline in its price may have resulted in a reduced portfolio value.

- Potential Buying Opportunity: The decline in AAVE’s price may present a buying opportunity for long-term investors, as the token could potentially recover if the broader market conditions improve.

- Diversification: The underperformance of AAVE underscores the importance of diversification in a crypto portfolio. Investing in a range of tokens and assets can help mitigate the impact of market volatility.

Implications for the World

The underperformance of Aave and other DeFi tokens could have broader implications:

- Regulatory Impact: Increased regulatory scrutiny of DeFi platforms could lead to a more stable market, as regulations could provide clarity and reduce uncertainty.

- Innovation and Adoption: Despite the market volatility, the DeFi sector continues to innovate and gain adoption. The underperformance of AAVE and other tokens could motivate developers to improve the overall user experience and address the challenges facing the sector.

- Long-Term Potential: The long-term potential of DeFi remains strong, with the sector offering innovative financial solutions and the potential for financial inclusion on a global scale.

Conclusion

The underperformance of Aave (AAVE) is a reflection of the broader trends in the DeFi market. While the decline in its price may present challenges for individual investors, it also underscores the importance of a well-diversified crypto portfolio. Furthermore, the potential implications for the broader world, including increased regulatory clarity and continued innovation, could lead to a more stable and sustainable DeFi market in the future.

As always, it’s essential to stay informed about market trends and to conduct thorough research before making investment decisions. The crypto market is volatile, and investing always comes with risks. Stay informed, stay cautious, and stay curious.