XRP Holders Establish a Wide Demand Zone as Dominance Against Bitcoin Grows

The cryptocurrency market has experienced significant shifts in the past few months, with XRP (Ripple) gaining ground against Bitcoin (BTC). XRP holders have established a wide demand zone for the altcoin, signaling a potential trend reversal. In this article, we will delve deeper into the reasons behind this growing dominance and what it means for XRP holders and the broader cryptocurrency market.

Growing Adoption and Partnerships

One of the primary reasons for XRP’s growing dominance is its increasing adoption and partnerships. Ripple, the company behind XRP, has been making strategic partnerships with various financial institutions, making XRP a preferred choice for cross-border payments. For instance, in January 2021, Ripple announced a partnership with MoneyGram, a leading global money transfer company, to use XRP for cross-border payments.

Improved Liquidity and Trading Volume

Another factor contributing to XRP’s growing dominance is improved liquidity and trading volume. According to CoinMarketCap, XRP has a daily trading volume of over $3 billion, making it the second-largest cryptocurrency by trading volume. This improved liquidity makes it easier for investors to buy and sell XRP, creating a stable demand zone for the altcoin.

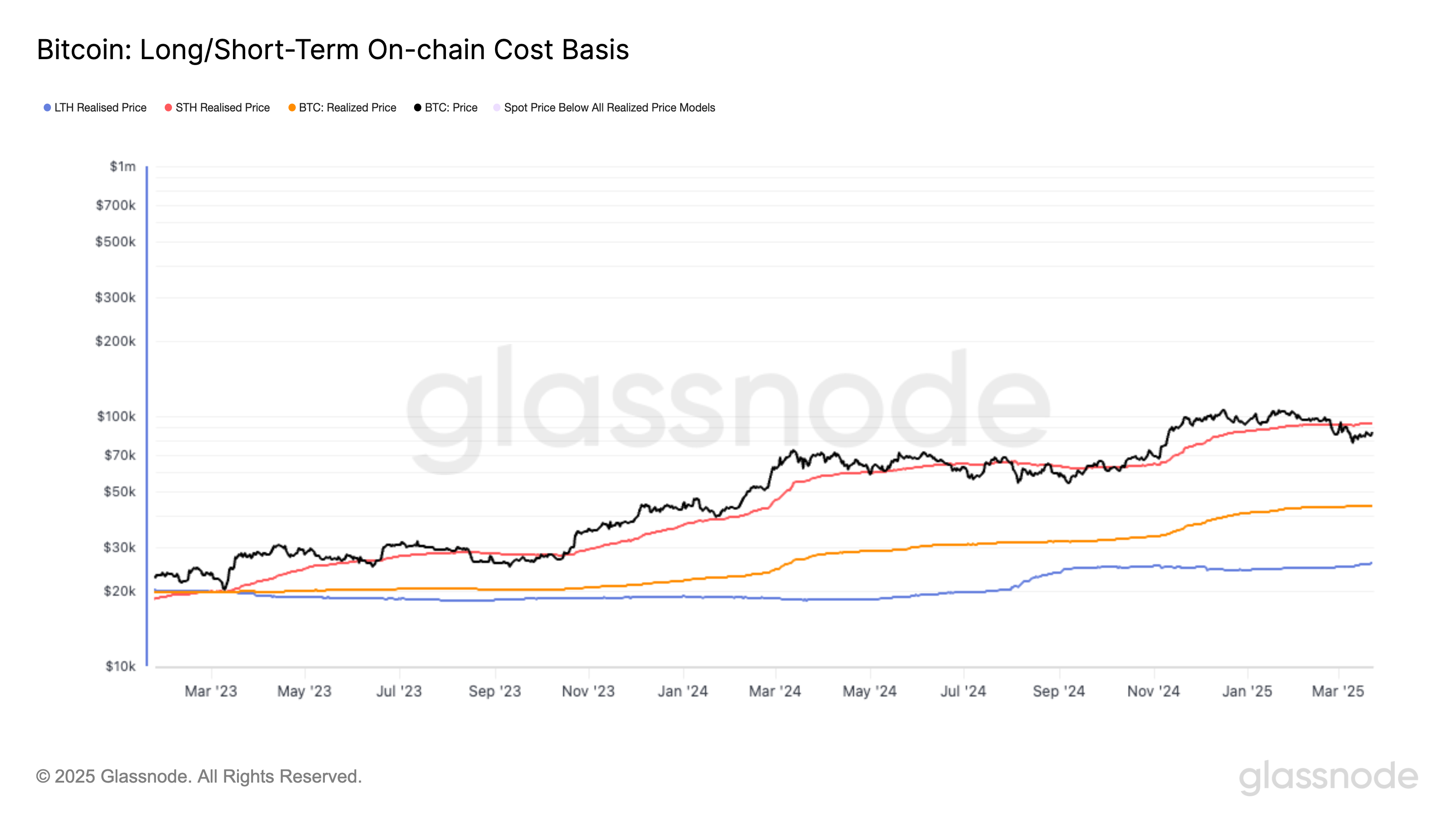

BTC Dominance Slipping

The decline in Bitcoin’s dominance has also played a role in XRP’s growing dominance. Bitcoin’s dominance has been on a downtrend since its all-time high in late 2017, dropping from over 70% to around 45% in 2021. This trend has opened up opportunities for other cryptocurrencies, including XRP, to gain market share.

Impact on XRP Holders

For XRP holders, the growing dominance of XRP against Bitcoin could mean significant gains. As more financial institutions adopt XRP for cross-border payments, the demand for the altcoin is expected to increase, leading to potential price appreciation. However, it is essential to remember that investing in cryptocurrencies carries inherent risks, and past performance is not indicative of future results.

Impact on the World

The growing dominance of XRP against Bitcoin could have far-reaching implications for the world. The use of XRP for cross-border payments could make transactions faster, cheaper, and more efficient, potentially disrupting traditional financial institutions and remittance services. Moreover, the adoption of XRP could lead to greater financial inclusion, especially in developing countries where access to traditional financial services is limited.

Conclusion

In conclusion, XRP holders have established a wide demand zone for the altcoin as its dominance against Bitcoin grows. The reasons behind this trend include increasing adoption and partnerships, improved liquidity and trading volume, and the decline in Bitcoin’s dominance. For XRP holders, this trend could mean significant gains, but it is essential to remember the inherent risks of investing in cryptocurrencies. For the world, the adoption of XRP could lead to faster, cheaper, and more efficient cross-border payments, potentially disrupting traditional financial institutions and leading to greater financial inclusion.

- XRP holders have established a wide demand zone for the altcoin

- Growing adoption and partnerships, improved liquidity, and declining Bitcoin dominance are contributing factors

- Impact on XRP holders could mean significant gains, but investing in cryptocurrencies carries inherent risks

- Impact on the world could lead to faster, cheaper, and more efficient cross-border payments, greater financial inclusion, and disruption of traditional financial institutions