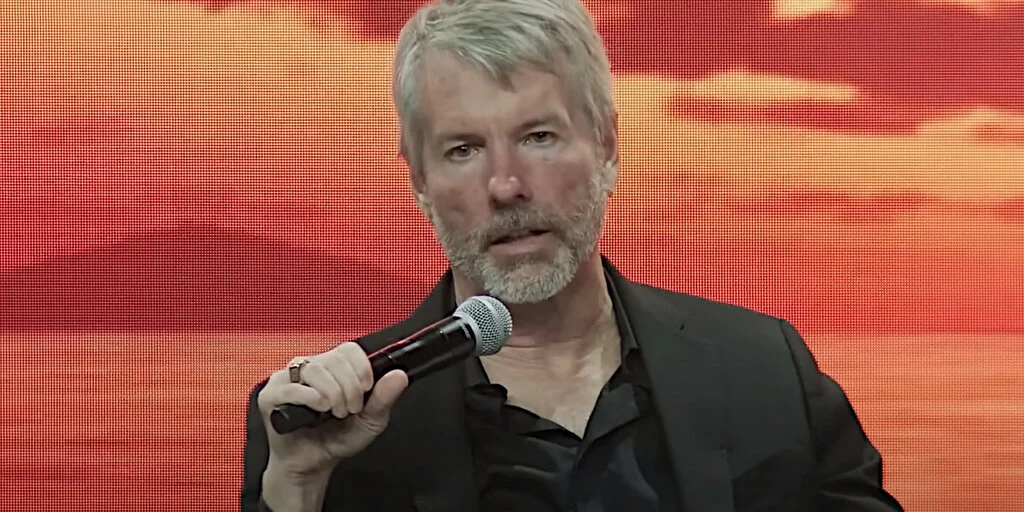

Michael Saylor’s Bitcoin Buying Spree: A Game-Changer for BTC Investors and the World

In a recent move that has sent ripples through the cryptocurrency community, business intelligence company MicroStrategy, led by outspoken Bitcoin bull Michael Saylor, announced its latest acquisition of 6,911 Bitcoin coins. This purchase comes just a week after the company’s earlier announcement of having bought 16,796 Bitcoin in August.

Impact on Individual Investors

The news of MicroStrategy’s continuous Bitcoin buying spree is a clear indication of the growing institutional adoption of Bitcoin. This trend is likely to inspire confidence in individual investors, who may see this as a signal that Bitcoin is no longer just a risky investment but a viable asset class. Moreover, MicroStrategy’s significant Bitcoin holdings make it an attractive target for other companies to follow suit, potentially leading to a surge in demand for Bitcoin.

- Increased investor confidence: MicroStrategy’s large-scale Bitcoin purchases show that institutional investors are becoming increasingly bullish on Bitcoin, making it an attractive investment option for individual investors.

- Potential price increase: The increased demand for Bitcoin from institutional investors, inspired by MicroStrategy’s moves, could lead to a price increase for the cryptocurrency.

Impact on the World

MicroStrategy’s Bitcoin purchases not only have implications for individual investors but also for the world at large. Bitcoin’s decentralized nature and limited supply make it an attractive alternative to traditional fiat currencies, particularly in economies plagued by hyperinflation or political instability.

- Shift in financial power: As more institutions and individuals invest in Bitcoin, the decentralized cryptocurrency could challenge the dominance of traditional financial institutions and currencies.

- Global adoption: The growing adoption of Bitcoin by institutional investors, such as MicroStrategy, could lead to increased mainstream acceptance and usage of the cryptocurrency.

Conclusion

MicroStrategy’s announcement of purchasing an additional 6,911 Bitcoin coins is a significant development in the world of cryptocurrency. This move not only demonstrates the growing institutional adoption of Bitcoin but also has the potential to inspire confidence in individual investors and lead to increased demand for the cryptocurrency. Moreover, the implications of this trend extend beyond the investment community, potentially challenging the dominance of traditional financial institutions and currencies and contributing to the global adoption of Bitcoin as a viable asset class and alternative currency.

As we continue to witness these developments in the cryptocurrency landscape, it’s essential for investors and observers alike to stay informed and adapt to the ever-evolving world of Bitcoin and other digital currencies.