The Exciting Revival of Dogecoin: A Reflection of Bitcoin’s Momentum

The digital asset market has been a rollercoaster ride for investors in recent times. Among the coins that have experienced a significant surge in value, Dogecoin (DOGE) has been making headlines. This popular meme coin, known for its Shiba Inu mascot, has mirrored the recovery moves of Bitcoin (BTC), leaving many market observers intrigued.

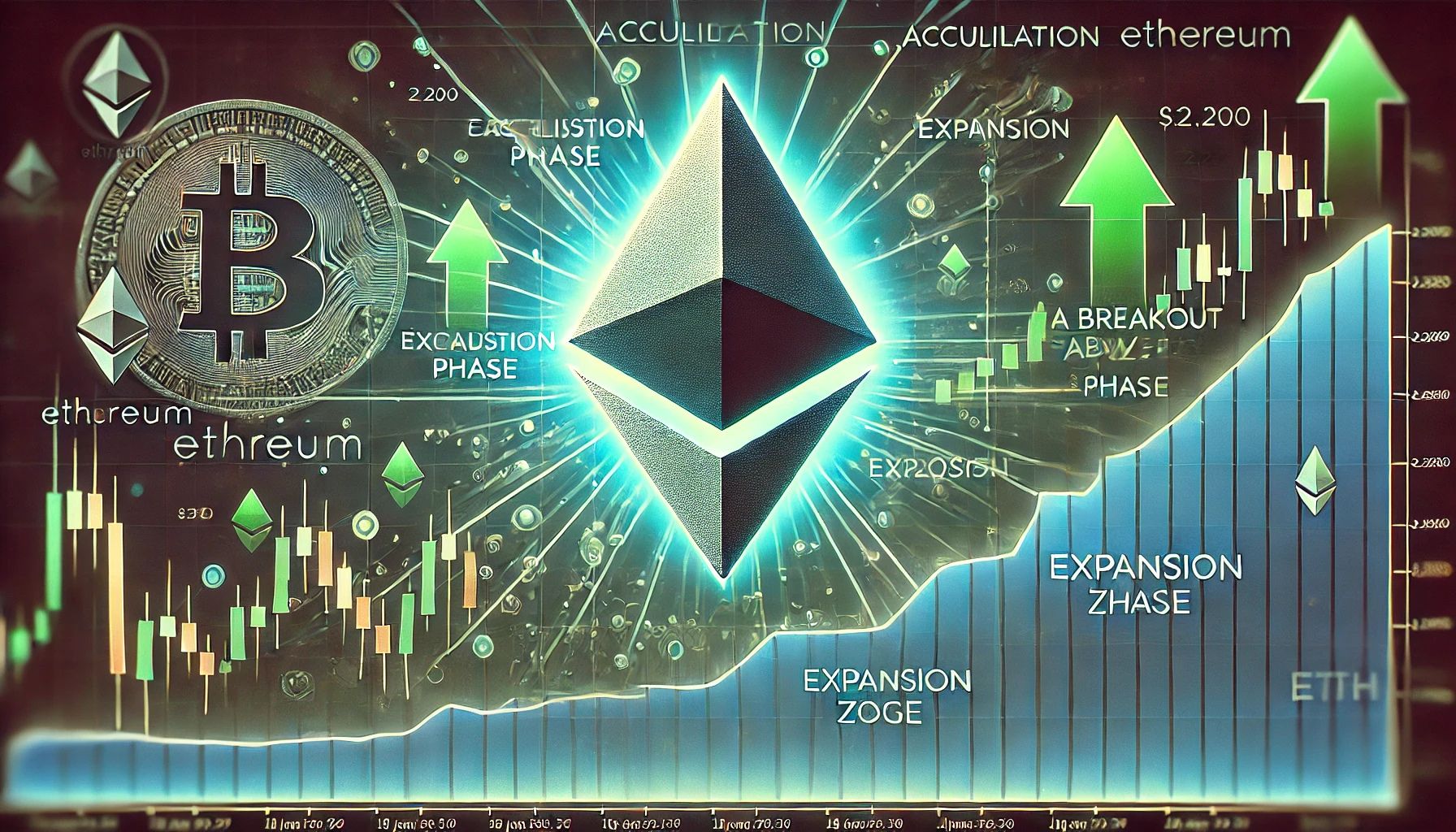

Price Rebound and Open Interest

In the past 24 hours, the price of Dogecoin has seen a notable increase, with a jump of over 25%. This price rebound is not an isolated event, as open interest – a measure of outstanding contracts – has also surged, indicating a heightened level of trading activity.

Understanding Dogecoin’s Connection to Bitcoin

The correlation between Dogecoin and Bitcoin is not a new phenomenon. Historically, the price movements of these two coins have shown similar trends, with Dogecoin often following Bitcoin’s lead. This relationship can be attributed to several factors:

- Market sentiment: The broader market sentiment can influence the price action of both Bitcoin and Dogecoin. When investors are bullish on the market, they may also be more inclined to buy Dogecoin.

- Trading patterns: Large whale investors and market makers can manipulate the price of both Bitcoin and Dogecoin, causing price movements in one coin to influence the other.

- Memes and social media: Dogecoin’s association with memes and social media can create buzz and hype, leading to price swings.

Impact on Individual Investors

As an individual investor, this Dogecoin rally could present both opportunities and risks. On the positive side, you could potentially make substantial profits if you buy Dogecoin at the right time and sell it when the price peaks. However, it’s essential to remember that investing in cryptocurrencies carries inherent risks, including market volatility and the possibility of total loss.

Global Implications

The Dogecoin rally and its connection to Bitcoin have broader implications for the global economy. This price movement could:

- Increase the overall market capitalization of the cryptocurrency sector, potentially leading to more mainstream acceptance and adoption.

- Attract more attention to the digital asset market, potentially bringing new investors into the space.

- Impact traditional financial markets, as investors may allocate more funds to cryptocurrencies and away from stocks, bonds, or other assets.

Conclusion

The Dogecoin rally and its correlation to Bitcoin’s recovery have left many investors intrigued. While price movements in Dogecoin can present opportunities for profits, they also carry inherent risks. Moreover, the broader implications of this price action extend beyond the cryptocurrency market and could impact global financial markets and the broader economy. As always, it’s essential to conduct thorough research and consider seeking advice from financial professionals before making investment decisions.

Stay informed and stay curious!