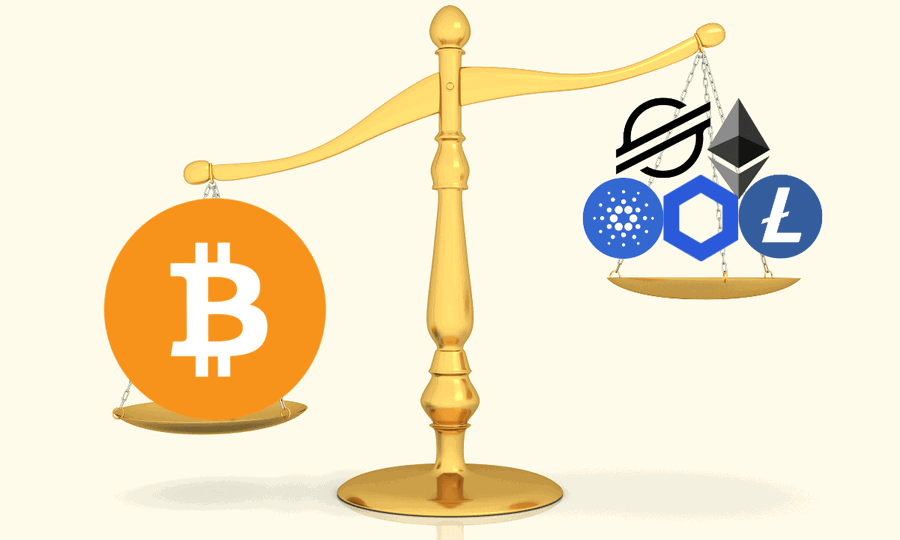

Bitcoin Dominance: A New Trend in Crypto Market Consolidation

In the ever-evolving world of cryptocurrencies, the ongoing consolidation has been a topic of intense interest and debate. Amidst this market turbulence, an astute analyst using the pseudonym “cryptododo7” has drawn attention to some intriguing developments concerning Bitcoin dominance.

What is Bitcoin Dominance?

Bitcoin dominance refers to the percentage of the total cryptocurrency market capitalization that Bitcoin holds. It is a significant indicator of the relative strength and popularity of the first cryptocurrency compared to other digital assets.

Recent Developments in Bitcoin Dominance

According to cryptododo7’s analysis, Bitcoin’s dominance has been on an upward trend, having recently breached the 50% mark. This rise in dominance could be indicative of several factors, including:

- Increased Adoption: As more investors and businesses adopt Bitcoin, its market capitalization grows, leading to an increase in dominance.

- Altcoin Market Downturn: When the altcoin market experiences a downturn, investors often shift their funds to Bitcoin, increasing its dominance.

- Regulatory Clarity: Clearer regulatory guidelines for Bitcoin can lead to increased institutional investment, boosting its dominance.

Implications for Individual Investors

For individual investors, this trend could mean:

- Focus on Bitcoin: With Bitcoin dominance on the rise, investors might consider allocating a larger portion of their portfolio to Bitcoin.

- Altcoin Underperformance: If Bitcoin continues to outperform altcoins, investors may experience smaller gains or even losses on their altcoin investments.

- Diversification: As always, it is essential to maintain a diversified portfolio to mitigate risk.

Global Implications

On a larger scale, the rise in Bitcoin dominance could:

- Increase Institutional Adoption: Greater Bitcoin dominance could attract more institutional investors, leading to increased market stability and legitimacy.

- Shift Focus from Altcoins: A Bitcoin-dominated market could result in reduced focus on altcoins and potential underperformance.

- Regulatory Scrutiny: As Bitcoin’s dominance grows, regulatory bodies may pay closer attention to the cryptocurrency, potentially leading to clearer guidelines and increased adoption.

Conclusion

The ongoing consolidation in the crypto market and the rise in Bitcoin dominance are essential developments for investors to monitor. While the trend could lead to increased focus on Bitcoin and potential underperformance of altcoins, it also presents opportunities for institutional adoption and regulatory clarity. As always, it is crucial to stay informed and maintain a diversified investment strategy.

As cryptododo7’s analysis suggests, the crypto market is constantly evolving, and staying up-to-date on the latest trends and developments is vital for making informed investment decisions.