The Bitcoin Buying Spree of a Tech Giant: A $5.3 Billion Investment

In the ever-evolving world of cryptocurrencies, one tech behemoth has made headlines for its significant investment in Bitcoin. This year, the company has reportedly spent an astounding $5.3 billion on the digital asset, making it one of the largest buyers in the market.

Background of the Company’s Bitcoin Investment

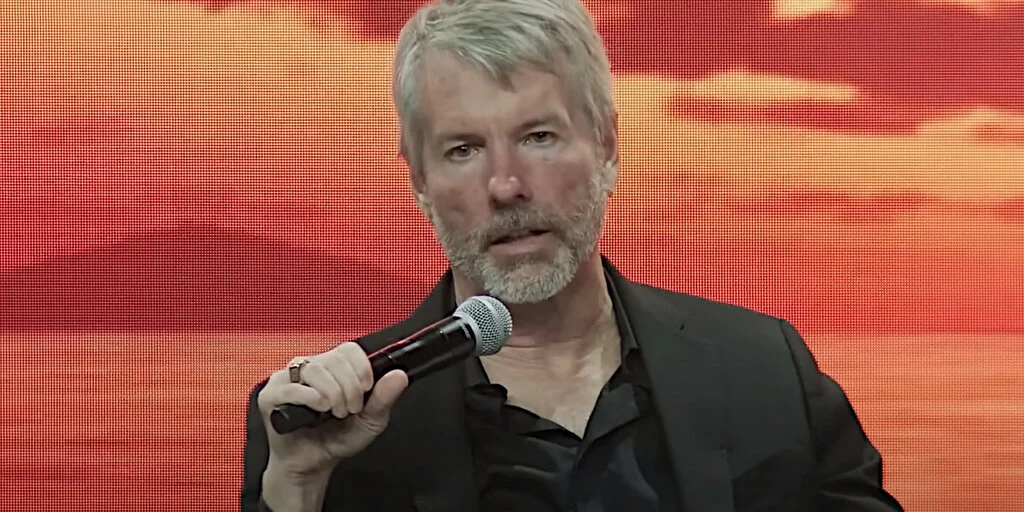

The tech giant in question is none other than Microstrategy, a leading business intelligence firm. The company’s CEO, Michael Saylor, announced the investment strategy back in August 2020, stating that Bitcoin is a superior form of digital property to hold long-term. Since then, Microstrategy has continued to buy Bitcoin in large quantities, using cash on hand and even issuing debt to finance these purchases.

The Significance of Microstrategy’s Bitcoin Buying Spree

Microstrategy’s massive investment in Bitcoin is significant for several reasons. First and foremost, it is a clear sign of growing institutional adoption of cryptocurrencies. As a publicly-traded company, Microstrategy’s investment decisions are closely watched by the financial community. Other companies may follow suit, leading to further institutional investment in Bitcoin and other cryptocurrencies.

Impact on Individual Investors

For individual investors, Microstrategy’s investment strategy could serve as a catalyst for renewed interest in Bitcoin. As more institutional investors enter the market, the price of Bitcoin could potentially increase due to increased demand. However, it is important to note that investing in Bitcoin comes with risks, including market volatility and the potential for loss of investment.

Impact on the World

The impact of Microstrategy’s Bitcoin buying spree on the world extends beyond the financial markets. The company’s investment could lead to increased mainstream acceptance of Bitcoin and other cryptocurrencies. This could result in new business opportunities, such as the development of new financial products and services, as well as the expansion of the broader digital economy.

Conclusion

In conclusion, Microstrategy’s $5.3 billion investment in Bitcoin is a significant development in the world of cryptocurrencies. It represents growing institutional adoption of digital assets and could lead to renewed interest in Bitcoin among individual investors. Additionally, the impact of this investment on the world extends beyond the financial markets, potentially leading to new business opportunities and the expansion of the digital economy.

As always, it is important for investors to carefully consider the risks and potential rewards of investing in Bitcoin or any other cryptocurrency. Consult with a financial advisor or conduct thorough research before making any investment decisions.

- Microstrategy, a business intelligence firm, has spent $5.3 billion on Bitcoin in 2020.

- The investment is a clear sign of growing institutional adoption of cryptocurrencies.

- Individual investors may be inspired to follow Microstrategy’s lead, leading to increased demand and potentially higher Bitcoin prices.

- Impact on the world could include new business opportunities and the expansion of the digital economy.

- Investing in Bitcoin comes with risks, including market volatility and potential loss of investment.