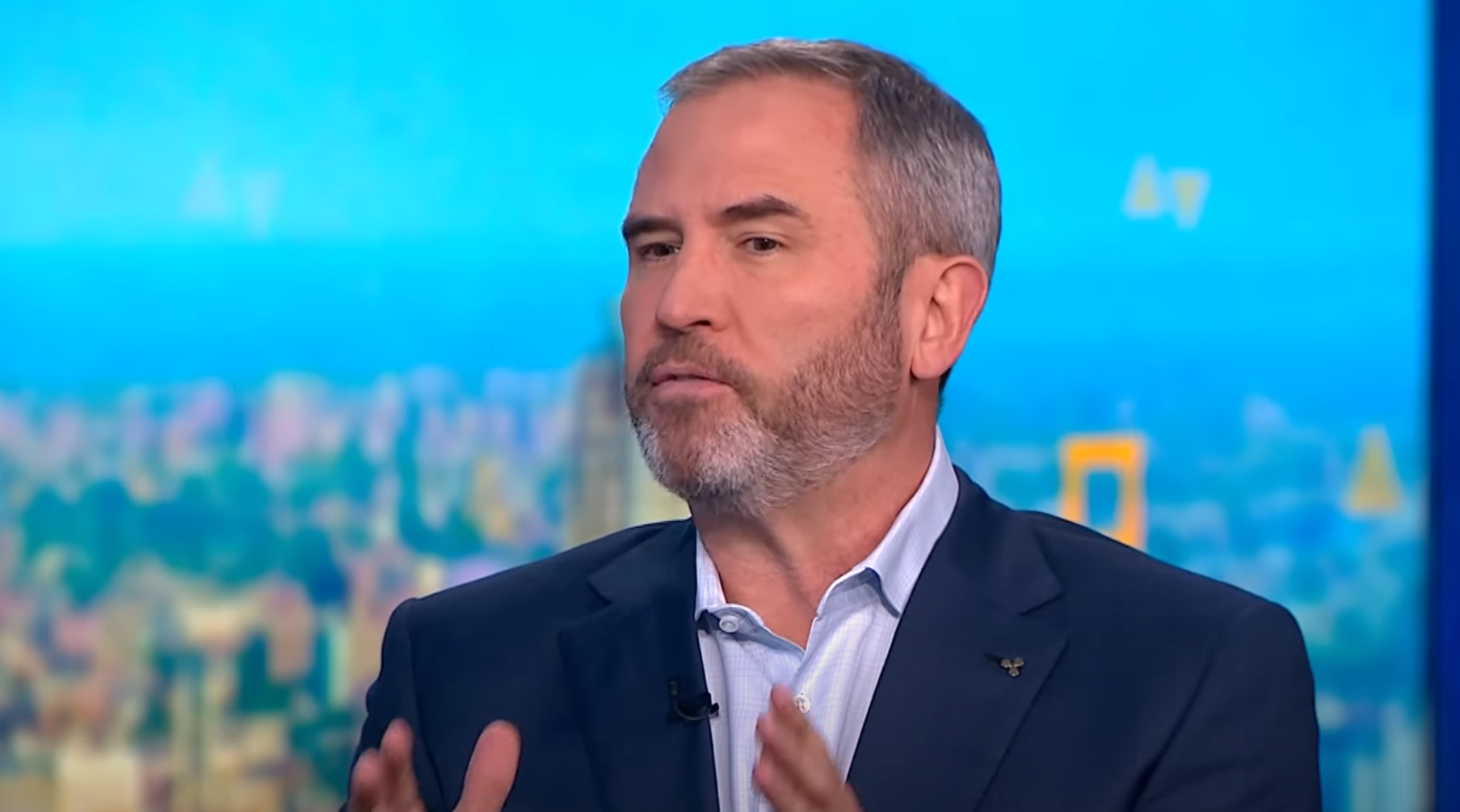

Ripple CEO Brad Garlinghouse Discusses Post-Lawsuit Plans and Future Prospects

In a recent interview with Bloomberg, Ripple CEO Brad Garlinghouse shared insights into the aftermath of the company’s legal battle with the US Securities and Exchange Commission (SEC) and discussed potential future plans.

The Lawsuit and Its Conclusion

Garlinghouse acknowledged the challenges the lawsuit posed for Ripple, stating, “It’s been a long and arduous process,” but expressed optimism about the outcome. He maintained that Ripple and XRP are not securities, stating, “XRP is a decentralized, open-source digital asset that is not controlled by Ripple.”

Strategic Outlook: IPO and Partnerships

When asked about a potential Initial Public Offering (IPO), Garlinghouse expressed his belief that Ripple is “in a great position to go public,” but did not provide a definitive timeline. He also mentioned the importance of partnerships, citing collaborations with major financial institutions like MoneyGram and Santander, which have significantly boosted Ripple’s reach and credibility.

XRP’s Role in the US Crypto Stockpile

Garlinghouse also addressed the possibility of XRP being included in the new US Crypto Stockpile, a digital asset investment product managed by the US government’s Treasury Department. Although he did not reveal any specifics, he expressed his support for the initiative, stating, “We believe that the US government will continue to be a leader in digital asset innovation.”

Impact on Individual Investors

The lawsuit and its outcome could have significant implications for individual XRP investors. If the SEC determines that XRP is a security, it could potentially lead to a halt in trading or other regulatory actions. However, if Ripple’s argument that XRP is a decentralized digital asset prevails, it could bolster investor confidence and potentially lead to increased adoption and value growth.

Impact on the World

The outcome of the Ripple lawsuit could set a precedent for how regulatory bodies approach other digital assets, potentially impacting the entire crypto market. If Ripple is successful in its argument, it could pave the way for greater regulatory clarity and acceptance of digital assets. Conversely, if the SEC determines that XRP is a security, it could create uncertainty and potentially stifle innovation in the crypto space.

Conclusion

The conclusion of Ripple’s lawsuit with the SEC marks an important juncture for the company and the crypto industry as a whole. The outcome could significantly impact individual investors, the crypto market, and regulatory frameworks. As Garlinghouse noted, “This is a pivotal moment for the digital asset industry, and we’re confident that the facts and the law will prevail.”

- Ripple CEO Brad Garlinghouse discussed the conclusion of the company’s lawsuit with the US Securities and Exchange Commission (SEC)

- Garlinghouse touched on potential IPO plans, partnerships, and XRP’s potential role in the US Crypto Stockpile

- The lawsuit could set a precedent for how regulatory bodies approach other digital assets

- The outcome could significantly impact individual investors and the crypto market