The Shifting Tides of Ethereum: From Deflationary to Inflationary

Ethereum, the second-largest cryptocurrency by market capitalization, has seen a significant shift in its monetary policy over the past year. Once considered a deflationary digital asset, Ethereum’s supply dynamics have started to resemble those of Bitcoin, its older and more well-known counterpart. Let’s delve deeper into this transformation.

Ethereum’s Deflationary Past

For those unfamiliar, deflationary cryptocurrencies are digital assets whose total supply decreases over time. Ethereum achieved this deflationary status through its Ethereum Improvement Proposal (EIP) 1559, which introduced a base fee that is burned and destroyed with every transaction. This mechanic not only helped reduce the overall supply of Ether but also made the network more efficient by incentivizing users to include fewer transactions per block.

The Turning Point

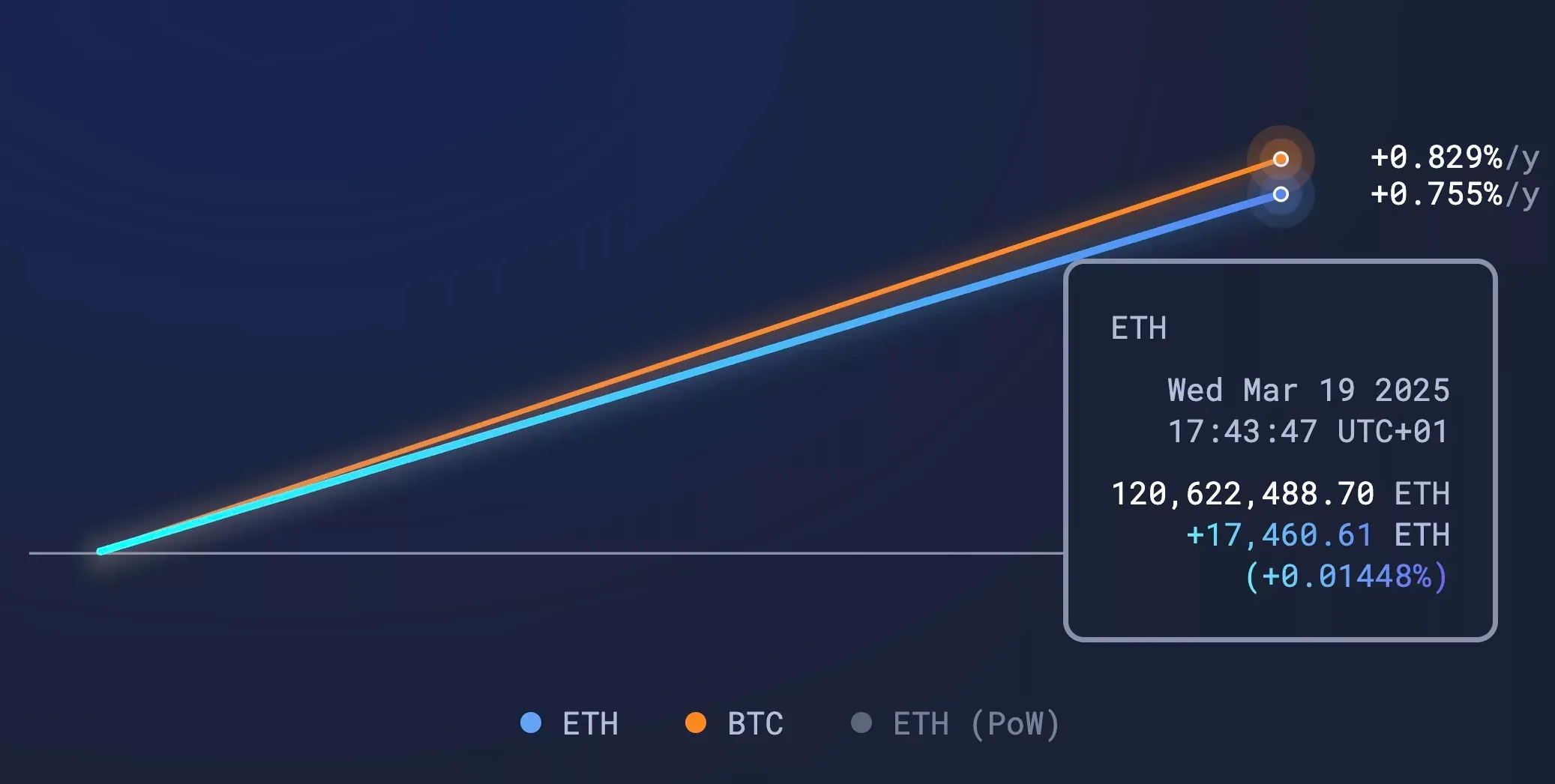

However, the Merge – Ethereum’s transition from a proof-of-work to a proof-of-stake consensus mechanism – marked a turning point for Ethereum’s monetary policy. With the Merge, Ethereum’s issuance rate, which had been at 4.33 Ethereum per minute, dropped to approximately 1.3 Ethereum per minute. This reduction was a result of the Ethereum network no longer requiring miners to validate transactions, thus eliminating the need for new Ether creation.

The New Inflationary Ethereum

But the Ethereum community did not rest on its laurels. In response to the concerns about the potential negative consequences of the reduced issuance rate, Ethereum introduced a new mechanism called “The London Upgrade.” This update, which includes EIP-1559 and EIP-3198, has led to a new, inflationary Ethereum.

Under the London Upgrade, Ethereum’s issuance rate has increased to approximately 1.7 Ethereum per minute. This increase is due to the introduction of a dynamic base fee that adjusts based on network demand. Additionally, EIP-3198 introduced a new fee burning mechanism, which incentivizes users to include transactions in blocks at a higher gas price, thus leading to more Ether being issued.

Impact on Individuals

For individual Ethereum holders, this shift from deflationary to inflationary dynamics might seem concerning. However, it is essential to remember that Ethereum’s monetary policy was never designed to be a fixed, one-size-fits-all solution. The community continuously adapts to the changing needs of the network and its users. As such, the current inflationary model could lead to increased network activity, which could, in turn, benefit Ethereum holders.

- Increased network activity could lead to higher transaction fees, which could result in higher revenue for miners and validators.

- A more active network could attract more developers to build decentralized applications (dApps) on Ethereum, potentially leading to increased demand for Ether.

Impact on the World

The shift to an inflationary Ethereum could have far-reaching implications for the world at large. Below are a few potential consequences:

- Increased competition for Bitcoin: Ethereum’s shift to inflationary dynamics could make it a more attractive alternative to Bitcoin for investors looking for a more active, developing blockchain ecosystem.

- More opportunities for decentralized finance (DeFi) and non-fungible tokens (NFTs): Ethereum’s growing issuance rate could lead to more liquidity in the DeFi and NFT markets, potentially driving innovation and growth in these sectors.

Conclusion

Ethereum’s journey from a deflationary digital asset to an inflationary one is a testament to the adaptive and evolving nature of the cryptocurrency space. While the shift may seem concerning to some, it is essential to remember that such changes are a natural part of the development process for any technological innovation. Ethereum’s new inflationary dynamics could lead to increased network activity, competition for Bitcoin, and more opportunities for growth in the DeFi and NFT markets. As always, it is essential to stay informed and adapt to these changes as they unfold.

In the ever-evolving world of cryptocurrencies, it is crucial to remain open-minded and embrace the dynamism that comes with innovation. Ethereum’s transition from deflationary to inflationary dynamics is just one example of the adaptive nature of the blockchain ecosystem. As we continue to explore the potential of decentralized technologies, it is essential to remain informed and prepared for the changes that lie ahead.