Vaulta: EOS’s Rebranding and Pivot to Web3 Banking

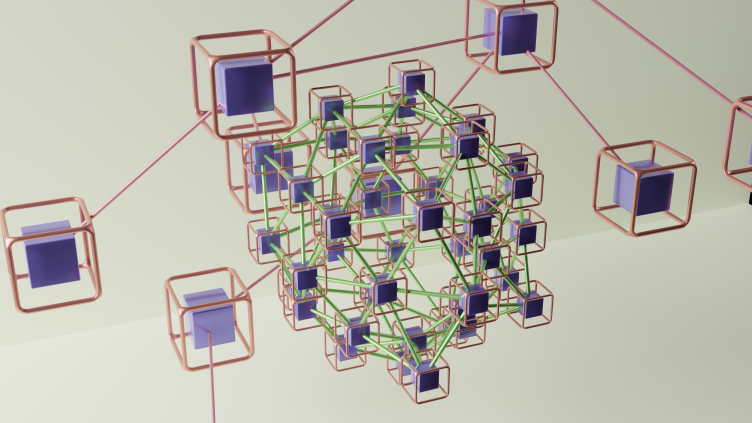

Recently, the blockchain network EOS made a significant announcement. The platform, which has been known for its decentralized applications (dApps) and high-performance infrastructure, is rebranding itself as “Vaulta.” Moreover, Vaulta is pivoting towards Web3 banking and establishing itself as a banking advisory group.

New Identity: Vaulta

EOS, which was launched in 2018, has been a notable player in the blockchain industry. It boasts a high transaction throughput and a delegated proof-of-stake (DPoS) consensus mechanism. However, the team behind EOS has decided to rebrand the network as Vaulta. The rebranding signifies a new era for the platform, focusing on its potential in the financial sector.

Web3 Banking and Financial Services

The shift towards Web3 banking is an ambitious move for Vaulta. Web3 banking refers to the use of decentralized technologies, such as blockchain, to provide financial services. This approach eliminates the need for intermediaries like traditional banks, offering more transparency, security, and control to users.

Vaulta’s pivot to banking advisory group is another intriguing aspect of the rebranding. As a banking advisory group, Vaulta aims to provide expertise and guidance to individuals and organizations looking to adopt and optimize Web3 banking solutions. This role could position Vaulta as a thought leader and trusted partner in the emerging decentralized finance (DeFi) sector.

Impact on Users

For users, the rebranding and pivot to Web3 banking may offer several benefits. These include:

- Increased security: Decentralized systems are generally more secure than traditional financial institutions due to their distributed nature.

- Faster transactions: Blockchain technology enables faster transactions compared to traditional banking methods.

- Greater control: Users have more control over their financial data and transactions with Web3 banking solutions.

- Potential for higher returns: DeFi applications on platforms like Vaulta could offer higher returns on investments due to their decentralized nature and lack of intermediaries.

Impact on the World

The rebranding and pivot to Web3 banking by Vaulta could have significant implications for the world:

- Disintermediation of traditional banking: Web3 banking solutions could disrupt the traditional banking sector by eliminating intermediaries and reducing costs.

- Increased financial inclusion: Decentralized financial systems could provide access to financial services for the unbanked and underbanked populations.

- Global financial system transformation: The widespread adoption of Web3 banking could lead to a more interconnected and transparent global financial system.

Conclusion

The rebranding of EOS to Vaulta and its pivot to Web3 banking signify an exciting new chapter for the blockchain platform. By focusing on decentralized financial services and acting as a banking advisory group, Vaulta aims to leverage the potential of blockchain technology to offer more secure, faster, and user-controlled financial solutions. This move could have significant implications for individual users and the world at large, including increased security, faster transactions, greater financial inclusion, and a more interconnected global financial system.

As the decentralized finance sector continues to evolve, platforms like Vaulta are poised to play a crucial role in shaping the future of finance. Stay tuned for more updates on this developing story.