SOL’s Relative Futures Volume: A Hidden Gem in the Crypto Market

In the ever-evolving world of cryptocurrencies, keeping an eye on market trends and indicators is essential for investors and traders. One such indicator that has recently piqued the interest of analysts is the relative futures volume of Solana (SOL).

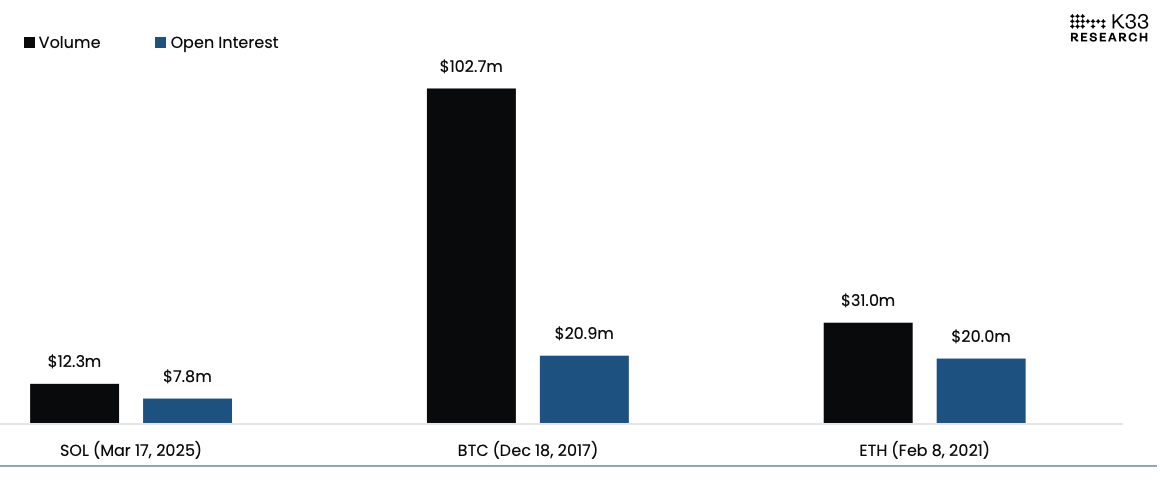

According to a recent report from K33 Research, when adjusted for asset market capitalization, SOL’s relative futures volume looks more impressive than some of its larger counterparts. But what does this mean, and why should we care?

Understanding Relative Futures Volume

Before diving into the specifics of SOL’s relative futures volume, let’s first define what we mean by “relative futures volume.” Futures contracts are financial instruments that allow investors to buy or sell an asset at a future date and price. The volume of futures contracts traded represents the number of contracts bought and sold during a given time period. “Relative” volume, in this context, refers to the volume of futures contracts traded relative to the size of the underlying asset.

Why SOL’s Relative Futures Volume Matters

High relative futures volume can be a sign of increased market interest and liquidity. It indicates that a significant number of investors are actively trading futures contracts for the underlying asset, which can lead to greater price stability and more efficient price discovery. In contrast, low relative futures volume can make it harder to execute large trades and may increase price volatility.

Comparing SOL to Other Cryptos

When compared to other large-cap cryptocurrencies, SOL’s relative futures volume stands out. According to K33 Research, SOL’s relative futures volume is higher than that of Ethereum and Ripple, despite having a smaller market capitalization. This suggests that there is a greater degree of interest and liquidity in SOL’s futures market relative to its size.

Implications for Individual Investors

For individual investors, high relative futures volume can be a positive sign. It indicates that there is a large and active market for the underlying asset, which can make it easier to enter and exit positions. Additionally, it may lead to more stable price movements, which can help reduce the risk of large price swings.

Implications for the Wider World

Beyond the individual investor, high relative futures volume can have broader implications for the wider crypto market. Increased liquidity and efficiency in the futures markets of large-cap cryptocurrencies can help attract more institutional investors and further legitimize the crypto asset class as a whole. This, in turn, can lead to greater price stability and more widespread adoption.

Conclusion

While the relative futures volume of Solana may not be the most widely discussed topic in the crypto world, it’s an important indicator that warrants attention. Its outperformance in this area relative to larger cryptocurrencies like Ethereum and Ripple suggests a high degree of interest and liquidity in SOL’s futures market, which can lead to greater price stability and more efficient price discovery. For individual investors, this can make SOL an attractive investment opportunity, while for the wider world, it could help attract more institutional investors and further legitimize the crypto asset class.

- High relative futures volume can indicate increased market interest and liquidity

- SOL’s relative futures volume is higher than that of Ethereum and Ripple

- Greater liquidity and efficiency in the futures markets of large-cap cryptocurrencies can help attract more institutional investors

- SOL’s high relative futures volume could make it an attractive investment opportunity for individual investors