Bitcoin Price Boom: Insights from Arthur Hayes’ Prediction

In the ever-volatile world of cryptocurrencies, the prediction of a closely-watched trader like Arthur Hayes carries significant weight. Known for his bold calls and deep market insights, Hayes, the CEO of BitMEX, has recently stirred the crypto community with his assertion that the Federal Reserve is on the brink of intervening in the markets to stabilize them. This potential intervention could trigger a bitcoin price boom.

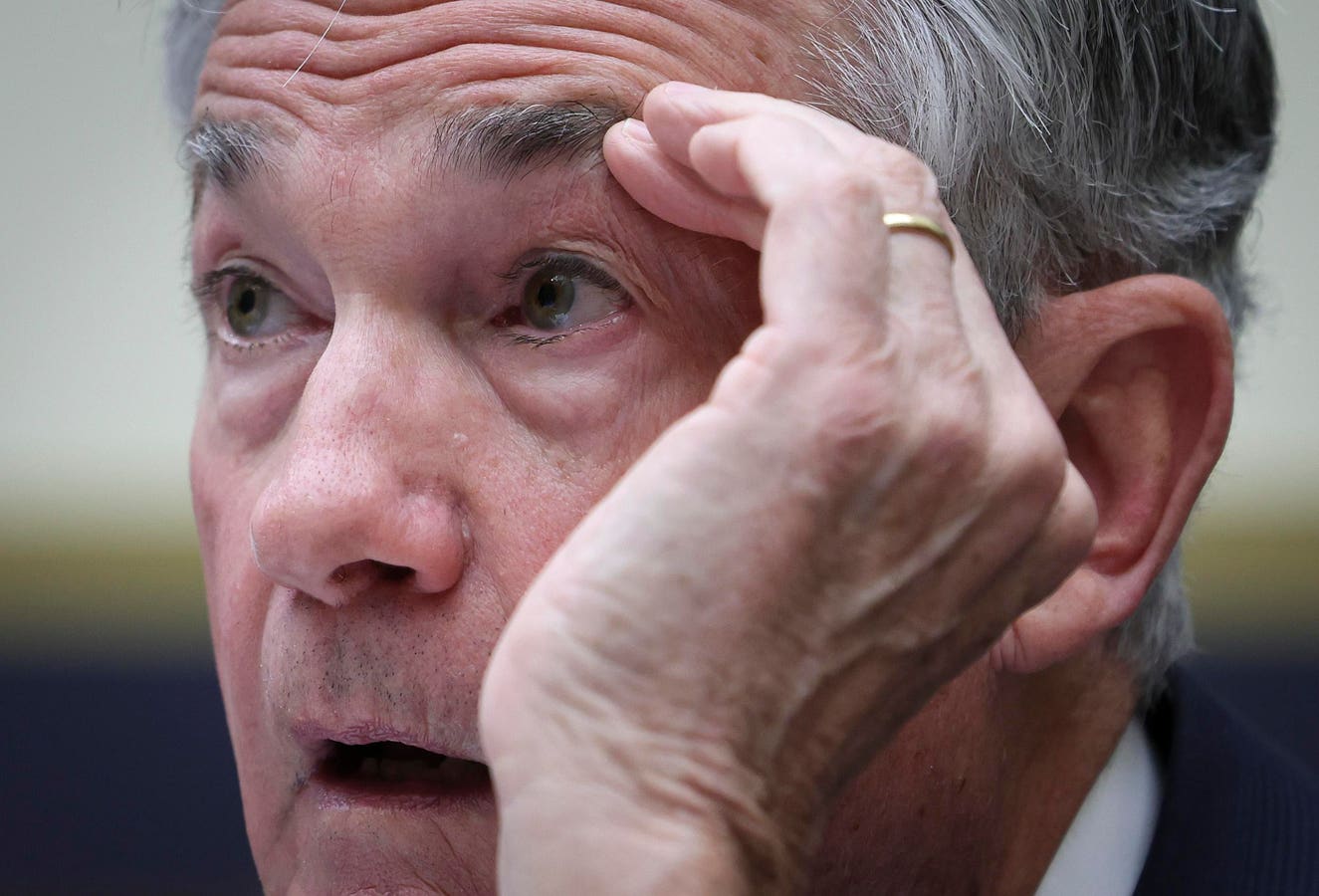

The Federal Reserve’s Role in the Financial Markets

The Federal Reserve, often referred to as the “Fed,” is the central banking system of the United States. Its primary role is to manage the nation’s monetary policy by controlling the supply of money in circulation, setting interest rates, and maintaining the stability of the financial system. It is not uncommon for the Fed to intervene in the markets during periods of extreme volatility or financial instability.

Hayes’ Prediction: A Bitcoin Price Boom

During an interview with CoinDesk TV, Hayes shared his belief that the Fed could step in to stabilize the markets, potentially leading to a significant increase in bitcoin’s price. He explained that the current market conditions, characterized by high inflation and uncertainty, are similar to those seen in the late 1960s and early 1970s. During that time, the Fed’s response to economic instability was to devalue the US dollar, which led to a surge in gold prices and, by extension, other commodities.

Impact on Individual Investors

For individual investors, a bitcoin price boom could mean substantial gains. Bitcoin’s value has historically been correlated with traditional safe-haven assets like gold, making it an attractive option during times of economic uncertainty. However, investing in cryptocurrencies carries inherent risks, including market volatility and the potential for fraudulent activities. It is essential to conduct thorough research, understand the risks involved, and consider seeking advice from financial professionals before making any investment decisions.

Impact on the World

The potential bitcoin price boom could have far-reaching implications for the global economy. Bitcoin’s decentralized nature and limited supply make it a unique asset in the world of finance. As more institutions and individuals turn to cryptocurrencies as a hedge against inflation and economic instability, the demand for bitcoin could increase significantly. This increased demand could lead to a ripple effect, with other cryptocurrencies and traditional assets potentially following suit. However, the full impact on the world remains to be seen, and it is crucial to consider the potential consequences, both positive and negative.

Conclusion

Arthur Hayes’ prediction of a potential Federal Reserve intervention and subsequent bitcoin price boom has sent ripples through the cryptocurrency community. While the exact outcome remains uncertain, the possibility of increased institutional adoption and investor interest could lead to significant gains for those who choose to invest in bitcoin. However, it is essential to approach this investment opportunity with caution, conducting thorough research and seeking professional advice before making any decisions. As we continue to navigate the complex world of finance and cryptocurrencies, staying informed and adaptable will be key.

- Federal Reserve: The central banking system of the United States, responsible for managing monetary policy.

- Arthur Hayes: CEO of BitMEX, known for his bold calls and deep market insights.

- Bitcoin price boom: Potential significant increase in bitcoin’s value due to increased demand and potential Federal Reserve intervention.

- Inflation: An economic condition characterized by a general increase in prices and decrease in the purchasing power of currency.

- Safe-haven assets: Assets, such as gold and cryptocurrencies, that investors turn to during periods of economic uncertainty.