The Likelihood of Correction in Cryptocurrency Markets: Insights from CoinStats

The cryptocurrency market is known for its volatility, with prices fluctuating wildly on a daily, even hourly, basis. Amidst this uncertainty, the question of whether a correction is on the horizon for various coins is a common one. According to CoinStats, a popular cryptocurrency analytics platform, a correction remains the more likely scenario for most of the coins.

Understanding Correction in Cryptocurrency

Before delving into the specifics of CoinStats’ analysis, it’s important to first understand what a correction in cryptocurrency means. A correction is a price decline that occurs after a significant price increase. It’s a natural part of the market cycle and serves to bring the price back in line with its underlying value. In other words, a correction is a healthy adjustment that helps prevent bubbles and ensures that prices remain sustainable.

CoinStats’ Analysis: Likelihood of Correction

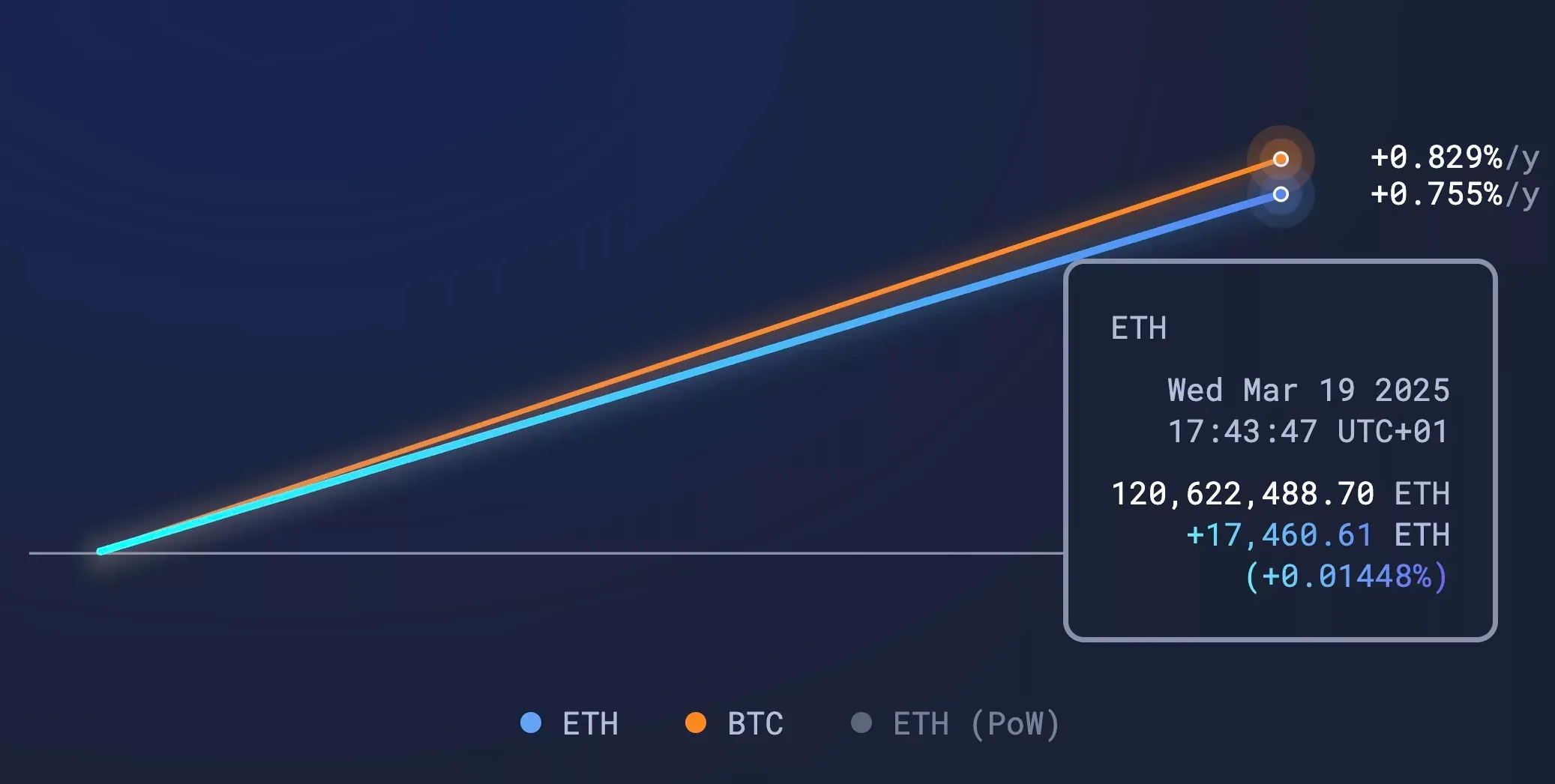

According to CoinStats, based on their analysis of historical data and current market trends, a correction is the most likely scenario for many popular cryptocurrencies. The platform uses a variety of metrics, including moving averages, relative strength index (RSI), and other technical indicators, to identify potential price corrections.

For instance, CoinStats notes that Bitcoin, the largest cryptocurrency by market capitalization, has seen a significant price increase in recent months. While this is a positive sign, it also puts the coin at risk for a correction. The platform predicts that a correction could occur in the range of $40,000 to $50,000, bringing the price back in line with its underlying value.

Impact on Individual Investors

For individual investors, a correction can be a double-edged sword. On the one hand, it presents an opportunity to buy coins at a lower price, potentially leading to higher returns in the long run. On the other hand, it can also result in losses if an investor is not prepared for the correction and sells at a loss.

- Preparing for a correction: It’s important for investors to keep an eye on market trends and be prepared for potential corrections. This could involve setting stop-loss orders, diversifying their portfolio, or having a long-term investment strategy.

- Emotional resilience: Cryptocurrency investments can be emotionally taxing, especially during market corrections. It’s important for investors to stay calm and not make hasty decisions based on fear or greed.

Impact on the World

The impact of a correction on the world at large can be significant, particularly in countries where cryptocurrency is a major part of the economy. For instance, in countries like El Salvador, where Bitcoin is legal tender, a correction could lead to economic instability.

Additionally, a correction could also impact the broader financial markets, potentially leading to a ripple effect as investors move their funds between different asset classes. However, it’s important to note that corrections are a natural part of the market cycle and serve to bring the market back into balance.

Conclusion

In conclusion, a correction remains the most likely scenario for many popular cryptocurrencies, according to CoinStats. While this can be a cause for concern for individual investors and the wider financial markets, it’s important to remember that corrections are a natural part of the market cycle. By staying informed, preparing for potential corrections, and maintaining a long-term investment strategy, investors can mitigate the risks and potentially even benefit from the correction.

As always, it’s important to do your own research and consult with financial advisors before making any investment decisions. The cryptocurrency market is volatile and unpredictable, but with the right mindset and preparation, you can navigate the market and potentially reap significant rewards.