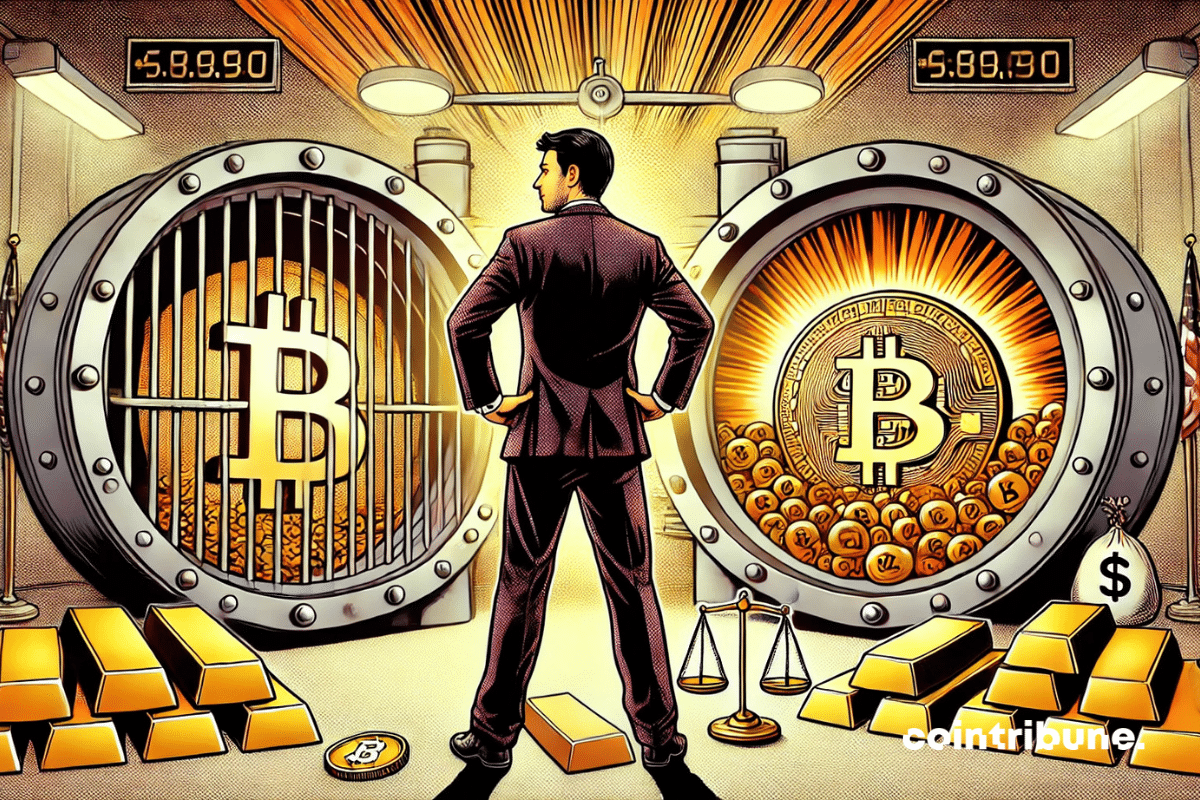

A Radical Proposal: Integrating Bitcoin into Central Bank Reserves

In the ever-evolving world of finance, central banks have long relied on the traditional tool of monetary printing to stimulate their economies and maintain control. However, as this practice loses steam and economic certainties become increasingly shaky, an intriguing idea has emerged from the unlikeliest of places. François Asselineau, the charismatic president of the Union Populaire Républicaine (UPR) in France, has proposed a radical shift: integrating 5 to 10% of Bitcoin into the reserves of the Bank of France.

Shaking Traditional Economic Certainties

This proposal, while seemingly far-fetched, has the potential to challenge the very foundations of traditional economic theories. For decades, central banks have held onto the belief that their primary role is to maintain price stability and control the money supply. By integrating Bitcoin, a decentralized digital currency, into their reserves, they would be acknowledging the emergence of a new form of currency and financial system.

A New Relationship with Sovereignty

Moreover, this move could have profound implications for the relationship between nations and their sovereignty. Bitcoin is not controlled by any single entity or government, making it a truly decentralized currency. By holding Bitcoin, central banks would be acknowledging the power of this new financial system and potentially reducing their reliance on their own governments for financial stability. This could lead to a shift in the balance of power, with nations having more control over their own financial destinies.

Impact on Individuals: Empowering Personal Finance

On a more personal level, the integration of Bitcoin into central bank reserves could have a significant impact on individuals. As central banks adopt this new financial instrument, it could lead to increased mainstream acceptance of Bitcoin and other cryptocurrencies. This could, in turn, make it easier for individuals to use Bitcoin for daily transactions and as a store of value, potentially providing greater financial freedom and empowerment.

- Greater financial inclusion: Bitcoin’s decentralized nature makes it accessible to anyone with an internet connection, regardless of their location or financial situation.

- Reduced reliance on traditional financial institutions: Bitcoin transactions do not require intermediaries like banks, potentially saving users time and money.

- Increased financial privacy: Bitcoin transactions are pseudonymous, providing users with greater privacy and control over their financial information.

Impact on the World: A New Financial Landscape

On a global scale, the integration of Bitcoin into central bank reserves could lead to a new financial landscape. This could result in increased competition among currencies, with Bitcoin potentially challenging the dominance of traditional fiat currencies. This competition could lead to greater innovation and efficiency in the financial sector, ultimately benefiting consumers.

- Reduced reliance on traditional financial institutions: As more central banks adopt Bitcoin, there could be a shift away from traditional financial institutions and towards decentralized financial systems.

- Increased financial stability: Bitcoin’s decentralized nature makes it less susceptible to manipulation and control by governments or financial institutions.

- Global financial inclusion: Bitcoin’s accessibility could make financial services more accessible to people in developing countries, helping to reduce financial inequality.

Conclusion: A New Era in Finance

The proposal to integrate Bitcoin into central bank reserves may seem like a radical idea, but it could mark the beginning of a new era in finance. This shift towards decentralized currencies and financial systems has the potential to challenge traditional economic theories, empower individuals, and reshape the global financial landscape. Only time will tell if this idea gains traction, but one thing is certain: the world of finance is changing, and we must be prepared to adapt.

As individuals, we can stay informed and prepare ourselves for this new financial reality by learning about Bitcoin and other cryptocurrencies. By embracing these new technologies and understanding their potential benefits and risks, we can take control of our own financial futures.

So, let us not shy away from the unknown, but instead, embrace the possibilities that this new era in finance presents. Who knows what wonders await us in this brave new world of decentralized currencies and financial systems?