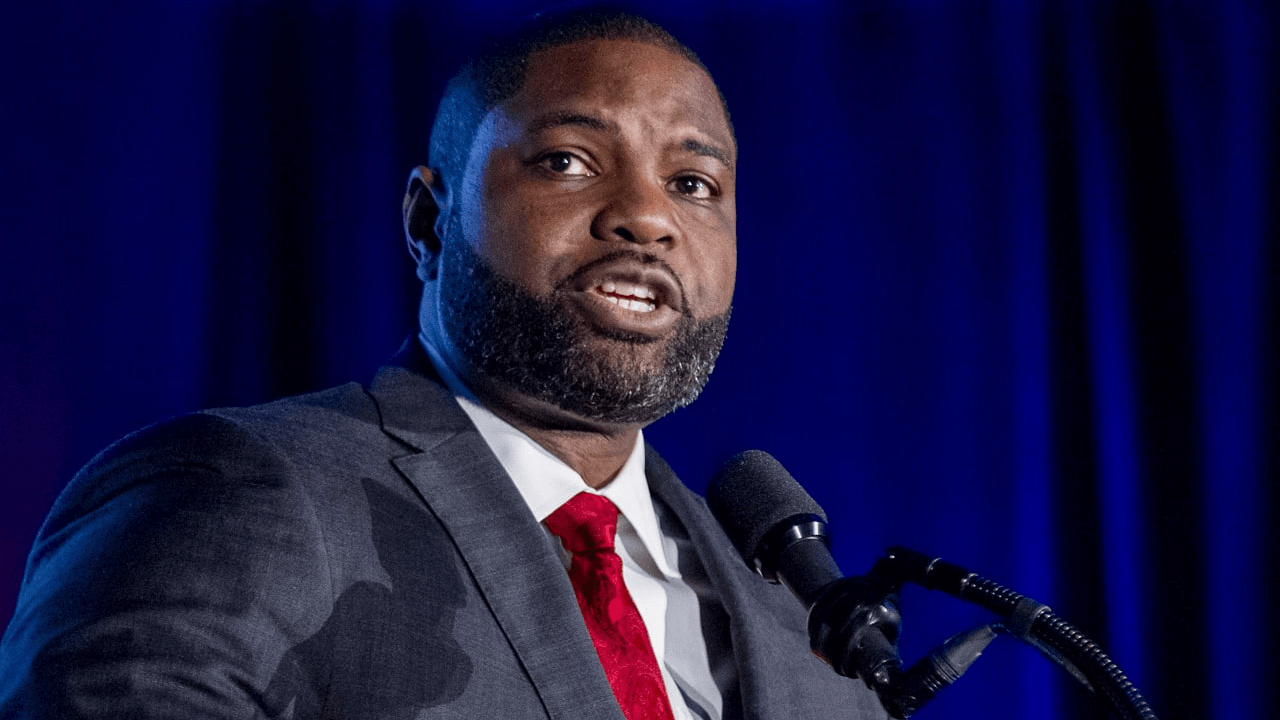

Representative Byron Donalds’ Proposed Legislation: Permanently Establishing the Strategic Bitcoin Reserve and Digital Asset Stockpile

U.S. Representative Byron Donalds (R-FL) has recently announced plans to introduce legislation on March 14, 2025, with the aim of permanently establishing the Strategic Bitcoin Reserve and Digital Asset Stockpile. This initiative, which was first introduced during the Trump administration, was designed to safeguard a portion of the country’s wealth in digital assets. The proposed bill is intended to shield the reserve from potential reversal by future administrations.

Background and Context

The Strategic Bitcoin Reserve and Digital Asset Stockpile was first proposed in 2021 by then-President Donald Trump’s administration. The idea was to allocate a portion of the U.S. Treasury’s funds to purchase and hold Bitcoin and other digital assets. The rationale behind this move was to diversify the country’s financial reserves and to position the U.S. as a leader in the emerging digital asset market.

Details of the Proposed Legislation

The legislation, if passed, would establish a legal framework for the Strategic Bitcoin Reserve and Digital Asset Stockpile. It would provide the U.S. government with the authority to purchase, hold, and manage digital assets as part of the national reserves. The bill would also outline the specifics of how the assets would be acquired, stored, and managed.

Impact on Individuals

The establishment of a permanent Strategic Bitcoin Reserve and Digital Asset Stockpile could have a significant impact on individuals, particularly those who are invested in digital assets. The move could lead to increased institutional investment in digital assets, potentially driving up their prices. Additionally, it could help legitimize digital assets as a viable store of value, further increasing their appeal to investors.

- Increased institutional investment: With the U.S. government as a major player in the digital asset market, institutions may feel more comfortable investing in digital assets.

- Legitimization of digital assets: The government’s involvement could help further legitimize digital assets as a viable store of value.

- Potential price increases: The increased demand from institutional investors could drive up prices.

Impact on the World

The establishment of a permanent Strategic Bitcoin Reserve and Digital Asset Stockpile could also have far-reaching implications for the global economy. It could help solidify the U.S.’s position as a leader in the digital asset market and could potentially lead to other countries following suit.

- Global competition: Other countries may feel pressure to establish their own digital asset reserves in response.

- Stabilization of the digital asset market: The U.S. government’s involvement could help stabilize the digital asset market, making it a more attractive investment option for institutions.

- Increased adoption: The U.S.’s involvement could help increase the adoption of digital assets as a mainstream investment option.

Conclusion

Representative Byron Donalds’ proposed legislation to permanently establish the Strategic Bitcoin Reserve and Digital Asset Stockpile is an ambitious move that could have significant implications for both individuals and the global economy. By positioning the U.S. as a major player in the digital asset market, the legislation could help legitimize digital assets as a viable store of value and could lead to increased institutional investment. However, it remains to be seen how the legislation will be received and whether it will ultimately be passed. Only time will tell if this move will mark a turning point in the acceptance and adoption of digital assets as a mainstream investment option.

Regardless of the outcome, it is clear that the digital asset market is here to stay, and individuals and governments alike would be wise to stay informed and adapt to this emerging trend.