A New Bill to Codify the US Strategic Bitcoin Reserve: An Overview

Recent developments in the world of cryptocurrencies have seen renewed interest in the US government’s approach to digital assets. Following in the footsteps of several other US lawmakers, a new bill is set to be introduced to the House of Representatives on March 14, 2023. This bill, which aims to codify US President Donald Trump’s executive order for a Strategic Bitcoin Reserve (SBR), represents a significant step towards formalizing and protecting the crypto plan initiated during his tenure.

Background: Trump’s Executive Order on the SBR

In August 2020, during the last days of his presidency, Trump signed an executive order directing the Secretary of the Treasury, in consultation with the Secretary of State and the Chairman of the Federal Reserve, to examine the potential use of digital assets for the country’s national security and financial stability. The order also instructed these officials to evaluate the potential risks and benefits of the US holding a Strategic Bitcoin Reserve.

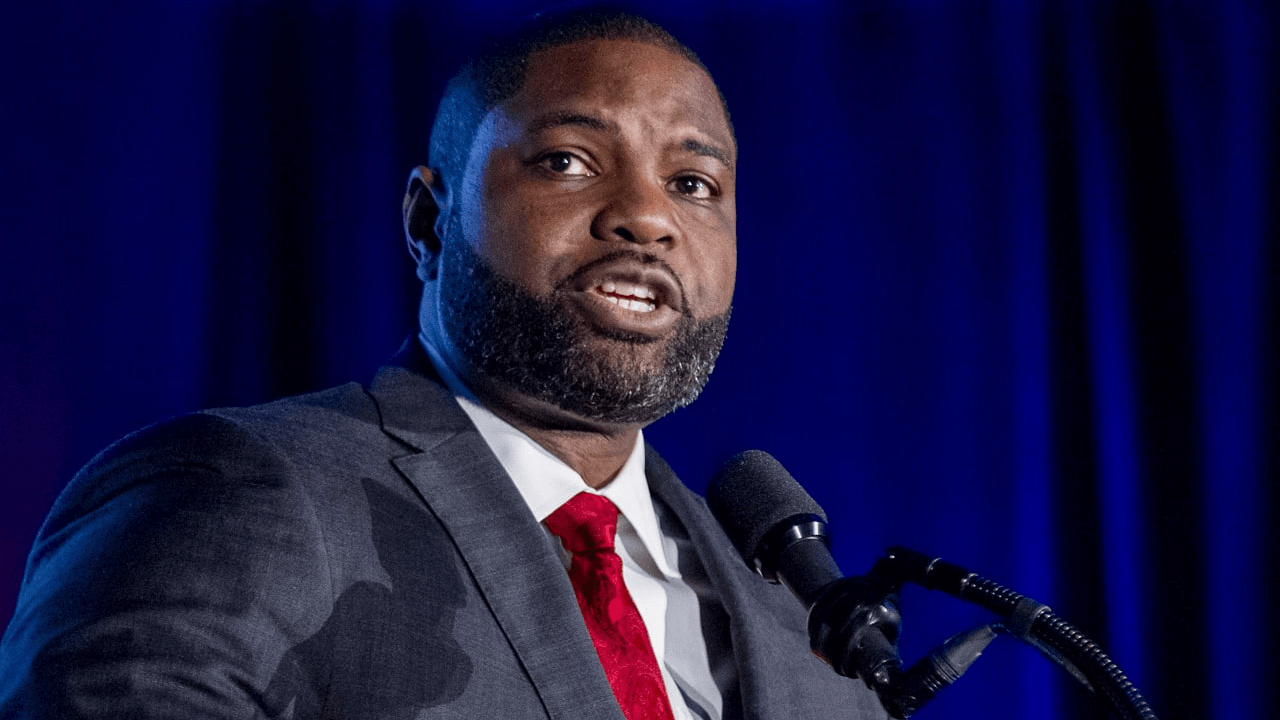

The New Bill: A Closer Look

The upcoming bill, sponsored by Representative Tom Emmer (R-MN), will reportedly build on Trump’s executive order by creating a legal framework for the SBR. The bill will outline the specifics of how the reserve should be managed, including the acquisition and disposition of Bitcoin, as well as the role of various government agencies in its oversight.

Impact on Individuals: A New Era for Crypto Adoption

The establishment of a Strategic Bitcoin Reserve by the US government could significantly boost the legitimacy and mainstream adoption of cryptocurrencies. This move could encourage more individuals and institutions to explore the potential of digital assets, leading to increased investment and innovation in the crypto space. Furthermore, the US government’s involvement in holding and managing Bitcoin could set a precedent for other countries to follow suit, further fueling the global adoption of cryptocurrencies.

Impact on the World: Geopolitical Ramifications

The creation of a Strategic Bitcoin Reserve by the US could also have significant geopolitical ramifications. As the world’s leading economy and a global leader in financial innovation, the US’s entry into the crypto space could shift the balance of power in the digital asset market. Additionally, the establishment of a national crypto reserve could potentially lead to increased cooperation between countries in the development and implementation of central bank digital currencies (CBDCs).

Conclusion: A New Chapter in the Crypto Narrative

The introduction of a new bill to codify the US Strategic Bitcoin Reserve marks an important milestone in the ongoing narrative of cryptocurrencies and their role in the global financial landscape. As the US government continues to explore the potential benefits and risks of digital assets, this move could pave the way for increased adoption and innovation in the crypto space. Whether you’re an individual investor or a global financial player, the potential implications of this development are vast and far-reaching. Stay tuned for updates on this developing story.

- The US House of Representatives will introduce a new bill on March 14, 2023, to codify the Strategic Bitcoin Reserve (SBR).

- This bill builds on US President Donald Trump’s executive order from August 2020.

- The SBR aims to manage the acquisition and disposition of Bitcoin, as well as the roles of various government agencies in its oversight.

- Individuals: The establishment of the SBR could lead to increased adoption and innovation in the crypto space.

- World: The creation of the SBR could have significant geopolitical ramifications, including increased cooperation between countries in the development and implementation of CBDCs.