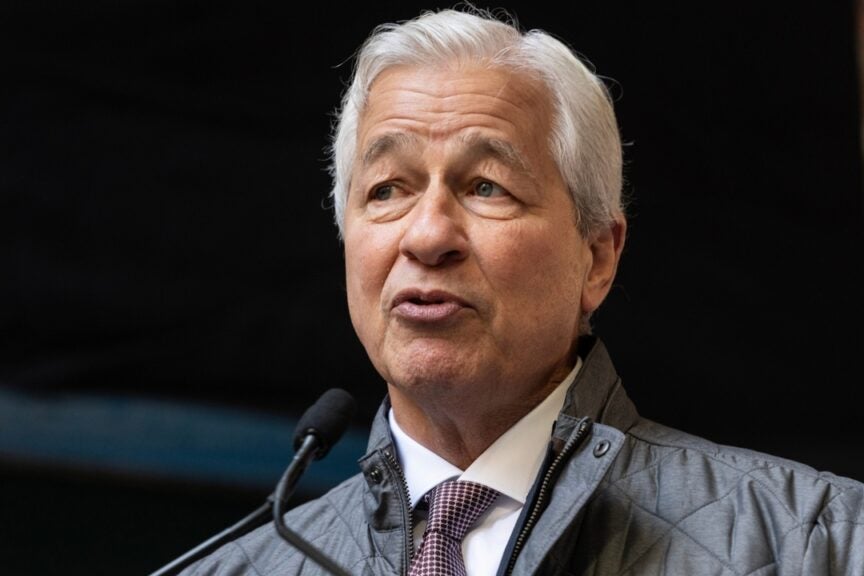

JPMorgan Chase CEO Jamie Dimon’s Unwavering Criticism of Bitcoin: A Persistent Skeptic

JPMorgan Chase CEO Jamie Dimon, a prominent figure in the financial industry, has long been vocal about his criticism towards Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization. His skepticism towards Bitcoin has been a consistent theme, with his views remaining unchanged despite the asset’s meteoric rise in value and growing acceptance within the financial sector.

A History of Criticism

In 2017, Dimon famously declared that he would “fire in a second” any JPMorgan trader caught trading Bitcoin. He went on to label the cryptocurrency a “fraud” and criticized its lack of underlying value. Fast forward to 2021, and Dimon’s stance on Bitcoin remains unchanged. He has continued to express his concerns about the asset’s volatility and lack of intrinsic value.

Questioning the Supply Limit

One of Dimon’s primary criticisms of Bitcoin revolves around its supply limit of 21 million. He has questioned whether such a limited supply can truly serve as a viable currency for global transactions. In contrast, traditional fiat currencies, which are issued and controlled by central banks, have an infinite supply.

Why Does This Matter?

For Individuals:

- Understanding Dimon’s perspective can help individual investors make informed decisions about their investments in Bitcoin and other cryptocurrencies.

- It’s important to consider the opinions of influential figures in the financial industry, as they can impact market sentiment and, ultimately, asset prices.

For the World:

- Dimon’s criticism of Bitcoin could discourage institutional investors from entering the cryptocurrency market, potentially limiting its growth and adoption.

- His views also highlight the ongoing debate within the financial industry about the role and value of cryptocurrencies in the global economy.

Implications for the Future

Despite Dimon’s criticism, the adoption and acceptance of Bitcoin and other cryptocurrencies continue to grow. Central banks around the world are exploring the use of digital currencies, and major companies like Tesla and Square have invested significant resources in Bitcoin. It remains to be seen how Dimon’s views will evolve as the cryptocurrency landscape continues to change.

Conclusion

JPMorgan Chase CEO Jamie Dimon’s criticism of Bitcoin has been a consistent theme throughout the asset’s history. His views, which include labeling Bitcoin a fraud and questioning its limited supply, have not evolved significantly. As an individual investor or a global citizen, it’s essential to understand Dimon’s perspective and consider its implications for the future of cryptocurrencies. Despite his skepticism, the adoption and acceptance of Bitcoin and other cryptocurrencies continue to grow, and it remains to be seen how this trend will unfold in the years to come.

As the financial industry and the wider world grapple with the implications of cryptocurrencies, it’s crucial to stay informed about the latest developments and the views of influential figures like Jamie Dimon. Only then can we make informed decisions and navigate the complex and ever-changing landscape of the digital currency market.