Understanding the CESR: Ethereum’s Staking Rewards

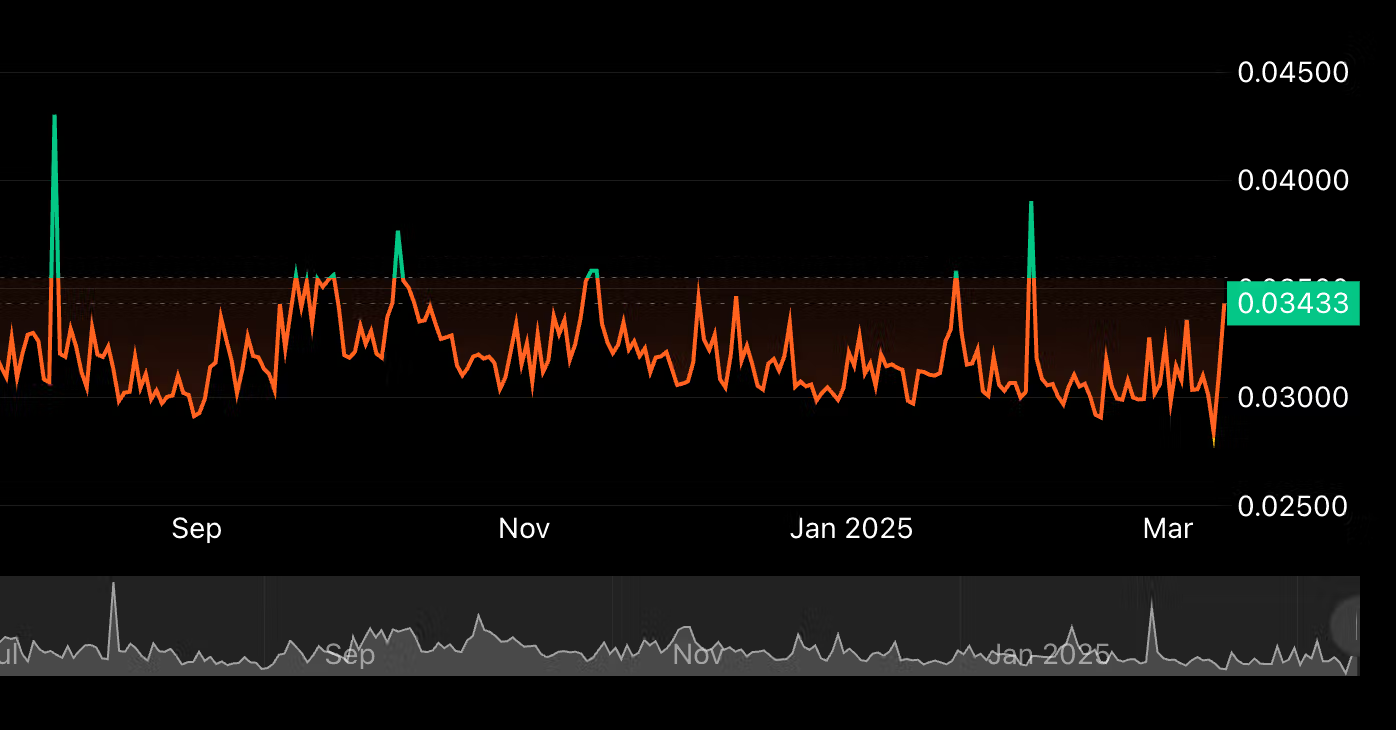

The Crypto Economic Security Reward (CESR) is a significant metric in the Ethereum blockchain ecosystem. This metric represents the mean annualized staking rate earned by Ethereum validators. In simpler terms, it is the average return on investment (ROI) for those who lock their Ethereum (ETH) tokens as collateral to validate transactions and secure the network.

How Does Staking Work in Ethereum?

Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus mechanism has brought about this new concept of staking. In PoS, validators are chosen to create new blocks based on the amount of ETH they have staked. The more ETH a validator stakes, the higher the chances of being chosen to create a new block and earn rewards.

Validators are also responsible for maintaining the security of the network by validating transactions and ensuring that the Ethereum rules are being followed. In return, they receive CESR as a reward. It’s important to note that validators can lose their staked ETH if they act maliciously or make errors, which further incentivizes them to act honestly.

Impact on Ethereum Validators

For Ethereum validators, the CESR is a crucial factor in their decision to participate in the network’s security. A higher CESR means a more attractive return on investment. Conversely, a lower CESR might discourage validators from participating. This could potentially compromise the network’s security.

Additionally, the CESR can influence the ETH price. If validators anticipate a higher CESR, they might be more inclined to stake their ETH, increasing demand and potentially driving up the price. Conversely, a lower CESR might lead to less demand for ETH, which could put downward pressure on its price.

Impact on the World

Beyond the Ethereum network, the CESR can have broader implications. PoS consensus mechanisms are gaining popularity in the blockchain world, and other projects, such as Cosmos and Polkadot, also use staking mechanisms. Understanding the CESR can help us gauge the health and security of these networks.

Moreover, the CESR can influence the broader financial markets. As more institutional investors enter the crypto space, they might view staking as a passive income opportunity. A higher CESR could attract more capital to these networks, potentially leading to increased adoption and mainstream recognition.

Conclusion

The CESR is a vital metric for Ethereum validators and the Ethereum ecosystem as a whole. It represents the average return on investment for those securing the network and can influence the behavior of validators and the ETH price. Furthermore, understanding the CESR can help us evaluate the health and potential growth of other PoS blockchain networks. As the crypto landscape continues to evolve, keeping a close eye on metrics like the CESR will be essential for investors and enthusiasts alike.

- The CESR is the mean annualized staking rate earned by Ethereum validators.

- It represents the average return on investment for validators securing the network.

- A higher CESR can attract more validators and capital to the network.

- Understanding the CESR can help evaluate the health and potential growth of PoS blockchain networks.