Ethereum’s Lowest Valuation Relative to Bitcoin: A Detailed Analysis

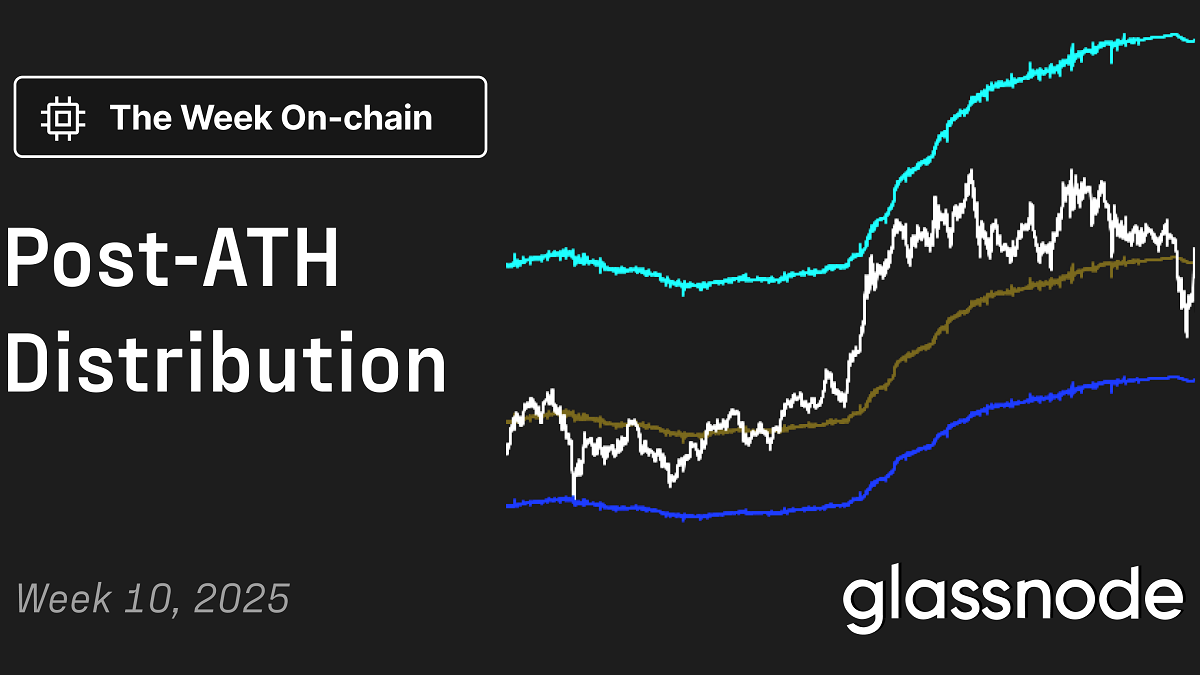

In recent market developments, on-chain data has revealed that Ethereum (ETH) had reached its lowest valuation relative to Bitcoin (BTC) since May 2020. The current trading rate stands at 0.023278, representing an 8.7% decline over the past 48 hours.

Understanding the Ethereum-Bitcoin Ratio

The Ethereum-to-Bitcoin (ETH/BTC) ratio is a popular metric used to measure the relative value of Ethereum against Bitcoin. This ratio is calculated by dividing the value of one Ethereum token by the value of one Bitcoin. A ratio below 1 indicates that Ethereum is undervalued relative to Bitcoin, while a ratio above 1 indicates the opposite.

Historical Perspective

The current ETH/BTC ratio of 0.023278 is the lowest since May 2020, when it stood at 0.019. This means that Ethereum is currently even more undervalued relative to Bitcoin than it was during that period.

Market Reactions and Implications

The declining ETH/BTC ratio has significant implications for investors and traders. For those holding a long-term view on Ethereum, this could be an opportunity to accumulate more ETH at a lower price relative to BTC.

- Impact on Investors: For long-term investors, the current ETH/BTC ratio could represent an attractive entry point for those looking to add more Ethereum to their portfolios. Given Ethereum’s growing role in the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems, some investors may view this as an opportunity to diversify their crypto holdings.

- Impact on Traders: For short-term traders, the declining ETH/BTC ratio could indicate a bearish trend for Ethereum. However, it’s important to note that short-term price movements do not always correlate with long-term value.

Global Implications

The declining ETH/BTC ratio could have broader implications for the crypto market and the digital economy as a whole. Here are some potential ways this could impact the world:

- Decentralized Finance: The DeFi sector, which is heavily reliant on Ethereum, could see increased competition from other platforms. However, Ethereum’s first-mover advantage and growing ecosystem could help it maintain its market leadership.

- Non-Fungible Tokens: The NFT market, which has seen explosive growth in recent months, could also be affected. Ethereum is currently the dominant platform for NFTs, and a lower ETH/BTC ratio could make it more attractive for creators and collectors.

- Regulatory Environment: Regulatory uncertainty and potential crackdowns in certain jurisdictions could impact the price of both Ethereum and Bitcoin. However, the underlying technology and use cases for both cryptocurrencies remain strong.

Conclusion

The declining ETH/BTC ratio is a significant development in the crypto market. For investors and traders, this could represent an attractive entry point for Ethereum. For the broader digital economy, it could have implications for the DeFi and NFT sectors, as well as the regulatory environment. As always, it’s important to do thorough research and consult with financial advisors before making any investment decisions.

Stay informed about the latest developments in the crypto market by following reputable news sources and engaging with the community. Remember, the world of cryptocurrencies is constantly evolving, and staying informed is key to making informed decisions.