Recent Bitcoin ETF Outflows: A Detailed Analysis

The cryptocurrency market has experienced a significant downturn in the last few days, leading to substantial Bitcoin ETF outflows. According to various reports, these outflows have almost reached $750 million in the last two days.

BlackRock’s Role in the Bitcoin ETF Market

BlackRock, the world’s largest asset manager, has been a major player in the Bitcoin ETF market. In the previous 24 hours alone, the firm offloaded around 2,000 BTC from its Proshares Bitcoins Strategy ETF (BITO) and iShares Bitcoin Trust ETF (BIT). This move came as a response to the market downturn, which saw Bitcoin’s price drop below the $40,000 mark.

Impact on Individual Investors

The recent Bitcoin ETF outflows could have several implications for individual investors. For those who hold Bitcoin directly, the downturn in the market might present an opportunity to buy at a lower price. However, for those who have invested in Bitcoin ETFs, the outflows could mean a decrease in the value of their holdings. It is essential to keep an eye on market trends and adjust investment strategies accordingly.

Impact on the Wider Market

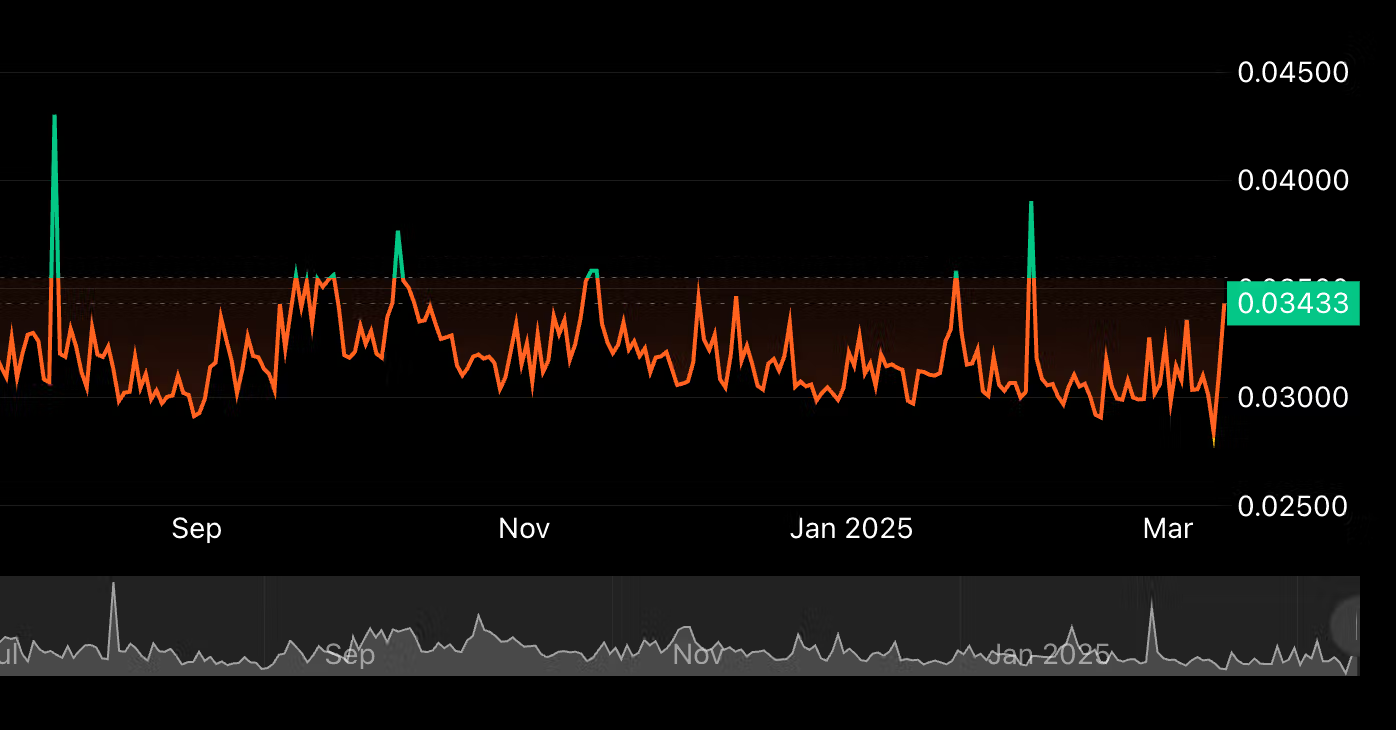

The Bitcoin ETF outflows could have a ripple effect on the wider market. Institutional investors, who have been major buyers of Bitcoin ETFs, might be selling off their holdings due to the market downturn. This could lead to further selling pressure, potentially pushing the Bitcoin price down even further. However, it is essential to note that the cryptocurrency market is highly volatile, and prices can change rapidly.

Possible Reasons for the Market Downturn

Several factors could be contributing to the recent market downturn. One possible reason is the regulatory uncertainty surrounding Bitcoin and other cryptocurrencies. For instance, China’s recent crackdown on cryptocurrency mining and trading has caused concern among investors. Additionally, the Federal Reserve’s plans to taper its asset purchases could lead to increased interest rates, which could negatively impact the value of Bitcoin and other risky assets.

Conclusion

The recent Bitcoin ETF outflows, amounting to nearly $750 million in the last two days, highlight the volatility of the cryptocurrency market. Individual investors should keep an eye on market trends and adjust their investment strategies accordingly. Meanwhile, the impact on the wider market could be significant, with institutional investors selling off their holdings due to the market downturn. However, it is essential to remember that the cryptocurrency market is highly volatile, and prices can change rapidly.

- Bitcoin ETF outflows have reached nearly $750 million in the last two days.

- BlackRock, the largest issuer, offloaded around 2,000 BTC in the previous 24 hours.

- Individual investors might see a decrease in the value of their Bitcoin ETF holdings.

- Institutional investors selling off their holdings could lead to further selling pressure.

- Regulatory uncertainty and the Federal Reserve’s plans to taper asset purchases could be contributing to the market downturn.