Ethereum-to-Bitcoin Ratio Hits New Low: What Does It Mean for You and the World?

The cryptocurrency market has been experiencing significant fluctuations in recent times. One of the notable developments is the Ethereum-to-Bitcoin (ETH/BTC) ratio hitting its lowest level since 2020. This ratio represents the number of Bitcoins required to purchase one Ethereum. A lower ratio implies that Ethereum is outperforming Bitcoin in terms of price.

Historical Perspective

Since the inception of Ethereum in 2015, its price has generally followed a different trend compared to Bitcoin. While Bitcoin’s price has been more volatile, Ethereum has shown steady growth. However, the ETH/BTC ratio has seen its fair share of ups and downs. For instance, in late 2017, the ratio reached an all-time high of 0.08, indicating that it took 0.08 Bitcoins to buy one Ethereum. Fast forward to 2023, and the ratio has fallen to around 0.03, meaning that you now need fewer Bitcoins to acquire an Ethereum.

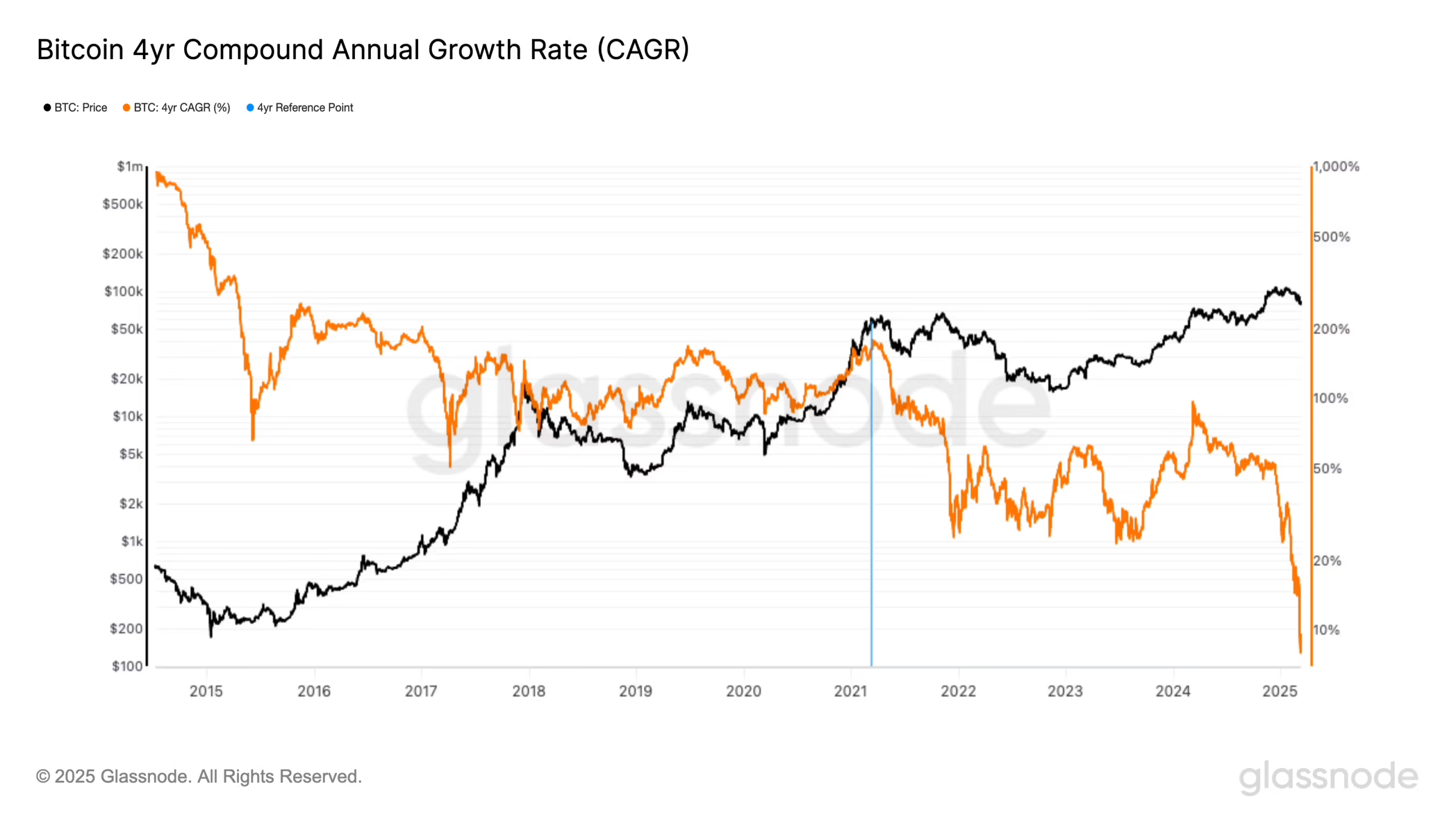

Negative Four-Year CAGR for Ethereum

The latest dip in the ETH/BTC ratio comes as Ethereum’s four-year compound annual growth rate (CAGR) has turned negative. This figure represents the average annual growth rate over a four-year period. While the exact figure varies depending on the source, most estimates put Ethereum’s four-year CAGR at around -3% to -5%. This is a significant change from the double-digit growth rates that Ethereum had enjoyed in previous years.

Impact on Individual Investors

For individual investors, a lower ETH/BTC ratio and negative Ethereum CAGR might raise concerns. Those who have been holding Ethereum for some time may be wondering if they should consider selling and moving their funds into Bitcoin or other altcoins. On the other hand, investors who have been considering buying Ethereum may be hesitant due to its recent underperformance.

- Monitor the market closely: Keep a close eye on the ETH/BTC ratio and Ethereum’s price movements. This will help you make informed decisions based on current market conditions.

- Diversify your portfolio: Don’t put all your eggs in one basket. Consider diversifying your portfolio by investing in a mix of cryptocurrencies and other asset classes.

- Long-term perspective: Remember that the cryptocurrency market is highly volatile. A negative CAGR does not necessarily mean that Ethereum is a bad investment. Consider your investment horizon and risk tolerance.

Impact on the World

The Ethereum-to-Bitcoin ratio and Ethereum’s negative CAGR have broader implications for the world. Ethereum is not just a cryptocurrency; it is a decentralized computing platform that powers numerous decentralized applications (dApps) and non-fungible tokens (NFTs). A lower ETH/BTC ratio could impact the adoption and development of these applications and tokens.

- Development and adoption: A lower Ethereum price relative to Bitcoin could slow down the development and adoption of Ethereum-based applications and tokens.

- Inflation and store of value: Ethereum’s negative CAGR could impact its status as a store of value and hedge against inflation. Bitcoin, on the other hand, continues to be the leading cryptocurrency in this regard.

- Regulatory environment: The regulatory environment for cryptocurrencies continues to evolve. A negative CAGR for Ethereum could impact its perception among regulators and investors.

Conclusion

The Ethereum-to-Bitcoin ratio hitting a new low and Ethereum’s negative four-year CAGR are significant developments in the cryptocurrency market. While these trends might raise concerns for individual investors and have broader implications for the world, it’s essential to maintain a long-term perspective. Keep monitoring the market closely, diversify your portfolio, and stay informed about the latest developments in the cryptocurrency space.

As always, it’s crucial to remember that investing in cryptocurrencies involves risks, and past performance is not indicative of future results. Always consult with a financial advisor before making investment decisions.