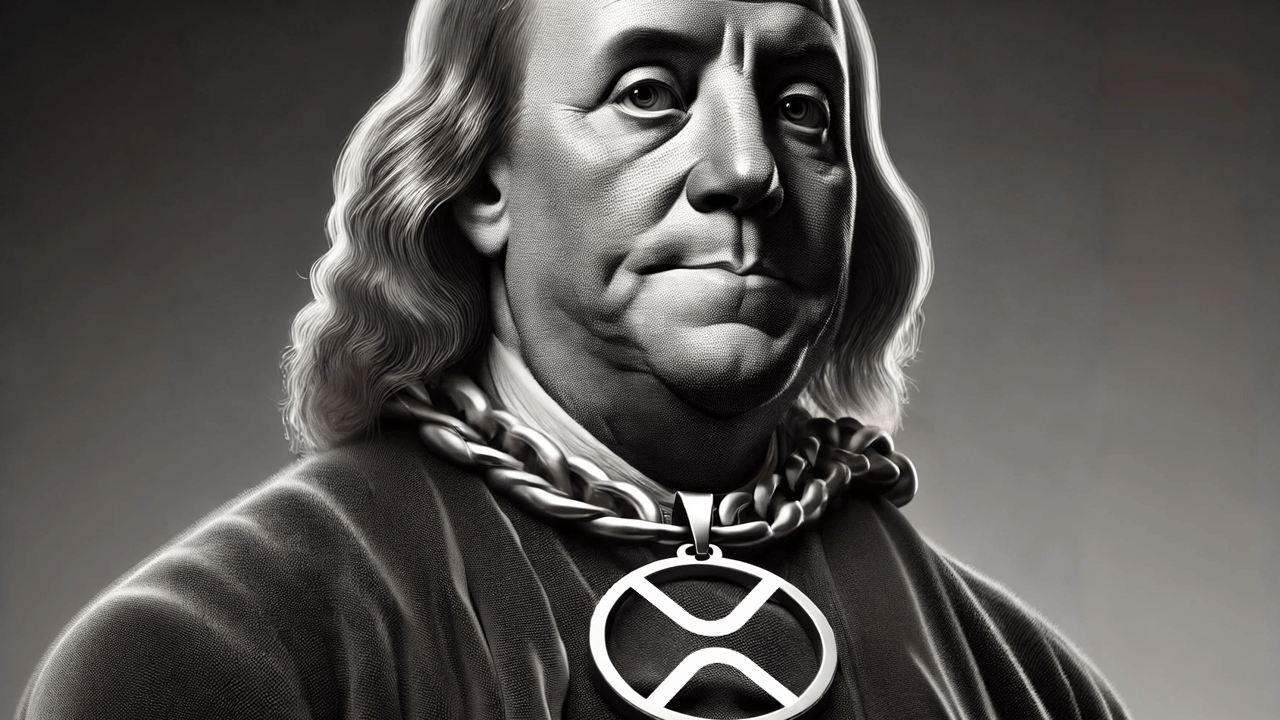

Franklin Templeton’s New Entry into the Crypto ETF Market: The Franklin XRP ETF

On March 11, 2025, Franklin Templeton, a leading global investment management firm, filed a Form S-1 with the U.S. Securities and Exchange Commission (SEC) to launch the Franklin XRP ETF. This exchange-traded fund (ETF) is designed to track the price of the cryptocurrency XRP, making it the latest addition to the growing list of crypto-focused investment vehicles. Let’s delve deeper into this development.

What is the Franklin XRP ETF?

The Franklin XRP ETF is a spot exchange-traded fund, which means it will buy and hold XRP directly, aiming to provide investors with the price performance of XRP, less the fund’s expenses. The fund will be listed and traded on a national securities exchange, offering investors an opportunity to gain exposure to XRP through a regulated investment vehicle.

Impact on Individual Investors

The introduction of the Franklin XRP ETF presents an opportunity for individual investors to gain easier access to XRP, as they can now add it to their portfolios through a more familiar investment vehicle. This could potentially increase demand for XRP and lead to broader market participation. Moreover, investing in an ETF provides diversification benefits, as investors can allocate a portion of their portfolio to cryptocurrencies while maintaining exposure to other asset classes.

Impact on the Crypto Market and the World

The launch of the Franklin XRP ETF could have far-reaching implications for the crypto market and the world at large. For one, it underscores the growing acceptance of cryptocurrencies as a legitimate investment asset class. As more institutional investors enter the market, we may see increased price stability and reduced volatility. Furthermore, the availability of regulated investment vehicles could attract a broader investor base, including those who may have been hesitant to invest in crypto due to regulatory uncertainty or lack of familiarity with the asset class.

Regulatory Implications

The filing of the Form S-1 with the SEC is a significant step towards regulatory approval. However, it is important to note that the SEC’s stance on crypto ETFs has been evolving. The regulator has previously denied applications for Bitcoin ETFs citing concerns over market manipulation and lack of sufficient regulation. The approval of the Franklin XRP ETF would be a positive sign for the crypto industry, potentially paving the way for more crypto ETFs to come to market.

Conclusion

The Franklin XRP ETF marks an important milestone in the evolution of the cryptocurrency market. It provides investors with a regulated investment vehicle to gain exposure to XRP, while also signaling the growing acceptance of cryptocurrencies as a legitimate investment asset class. As the regulatory landscape continues to evolve, we can expect to see more developments in this space. Stay tuned for updates on this exciting development.

- Franklin Templeton files Form S-1 for Franklin XRP ETF with the SEC

- ETF aims to track the price of XRP, providing easy access to investors

- Potential for increased demand and market participation

- Regulatory implications: a positive sign for the crypto industry