BitMEX Co-founder Arthur Hayes’ Take on Bitcoin’s Recent Correction: A Natural Cycle in a Bull Market

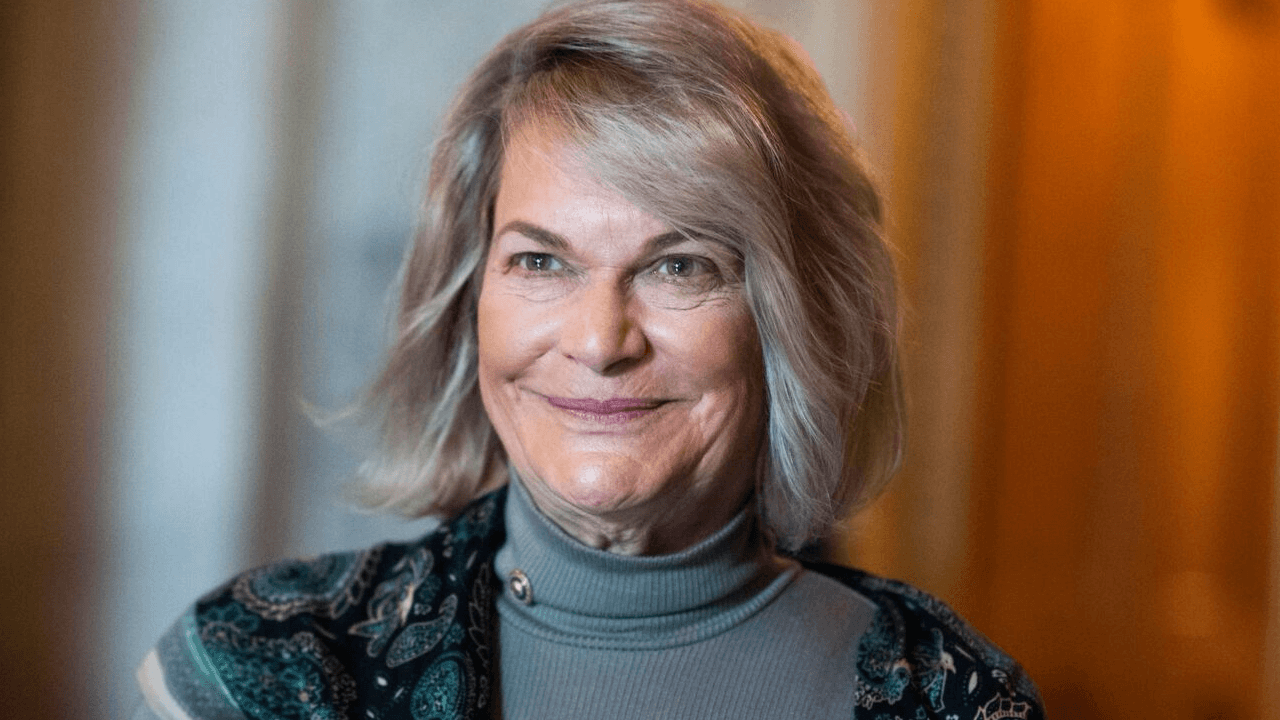

Arthur Hayes, the co-founder and CEO of BitMEX, the leading cryptocurrency derivatives trading platform, has displayed an unflinching demeanor in the face of Bitcoin’s (BTC) latest correction. In an interview with CoinDesk, he shared his perspective on the current market conditions and the factors influencing the next major move for the world’s largest cryptocurrency.

Natural Cycle in a Bull Market

According to Hayes, Bitcoin’s recent correction is just a natural part of the bull market. He explained, “Bitcoin is in a bull market, and bull markets are characterized by sharp corrections followed by even sharper rallies.” He further emphasized that these corrections serve to wash out weak hands and create a healthier market.

Macroeconomic Forces

When asked about the factors driving the next major move for Bitcoin, Hayes pointed towards macroeconomic forces. He stated, “The next major move for Bitcoin will be determined by macroeconomic factors, such as the global economy’s recovery from the COVID-19 pandemic, central banks’ monetary policies, and geopolitical developments.”

Implications for Individual Investors

For individual investors, Hayes advised maintaining a long-term perspective and not getting too emotional about short-term market volatility. He said, “The key for investors is to focus on the long term and not get too caught up in the day-to-day noise. Bitcoin has a proven track record of delivering outsized returns over the long term, and this trend is expected to continue.”

Global Impact

On a larger scale, the impact of Bitcoin’s price movements extends beyond the cryptocurrency community. As a decentralized digital asset, Bitcoin’s rise has the potential to disrupt traditional financial systems and institutions. Hayes noted, “Bitcoin’s growing popularity and increasing institutional adoption could lead to a paradigm shift in the global financial system. This could result in significant changes to how we store, transfer, and trade value.”

- Individual investors should maintain a long-term perspective and not get too emotional about short-term market volatility.

- Macroeconomic factors, such as the global economy’s recovery from the COVID-19 pandemic, central banks’ monetary policies, and geopolitical developments, will determine the next major move for Bitcoin.

- Bitcoin’s growing popularity and increasing institutional adoption could lead to a paradigm shift in the global financial system.

Conclusion

Arthur Hayes, the co-founder and CEO of BitMEX, believes that Bitcoin’s recent correction is a natural part of the bull market and that macroeconomic forces will determine the next major move. He advises individual investors to maintain a long-term perspective and not get too emotional about short-term market volatility. Furthermore, Bitcoin’s growing popularity and increasing institutional adoption could lead to significant changes in the global financial system.

As we continue to navigate this exciting and rapidly evolving space, it is essential for investors and enthusiasts to stay informed and adapt to the ever-changing landscape. By keeping a level head and focusing on the long term, we can ride the waves of market volatility and reap the rewards that come with investing in this groundbreaking technology.