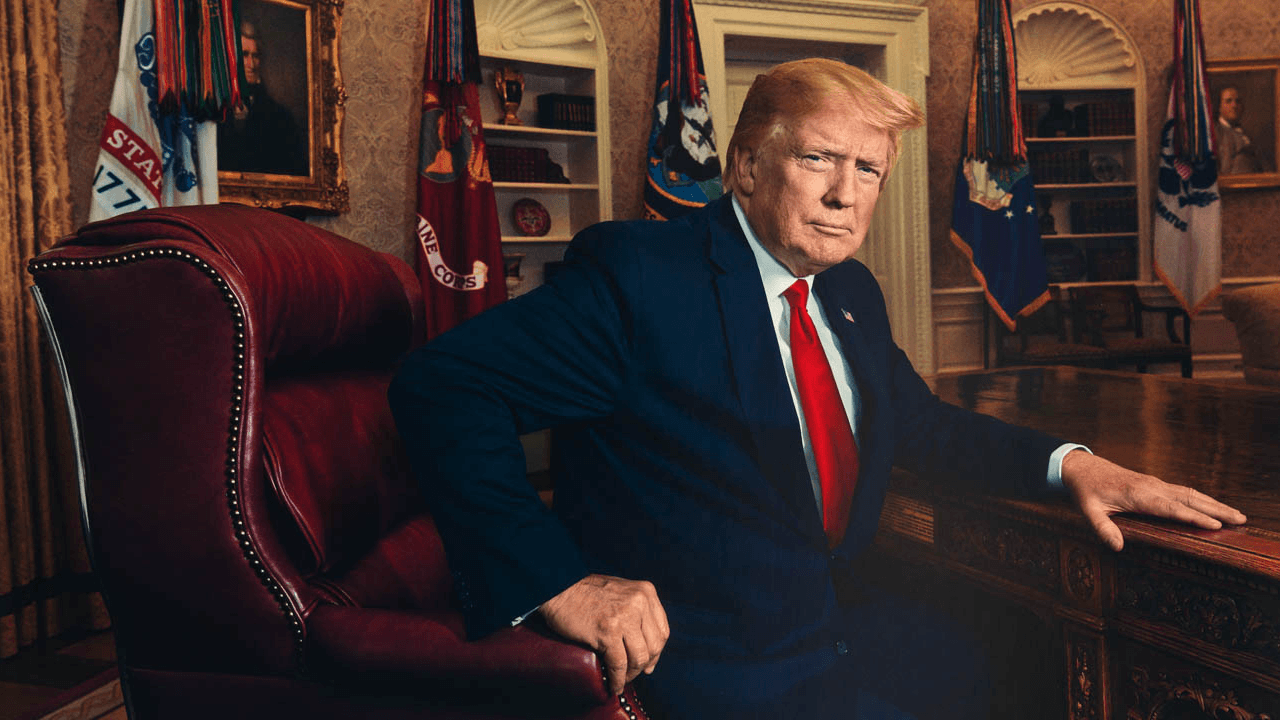

Trump’s Announcement: A Storm in the Financial Markets

The financial markets were sent into a frenzy on , as US President Donald Trump made an unexpected announcement during a press conference. The markets had been humming along fairly smoothly, with the Dow Jones Industrial Average and the S&P 500 reaching new all-time highs just days prior. But Trump’s words sent a chill down the spines of traders and investors around the world.

The Announcement

During the press conference, Trump announced that he was planning to re-introduce heavy tariffs on imports from China. This was not a new policy for Trump, who had been known for his “America First” stance during his presidency from 2017 to 2021. However, the markets had grown accustomed to a more conciliatory tone from the current administration, and the prospect of a trade war revival was not welcome news.

The Market Reaction

The markets reacted swiftly and negatively to the announcement. The Dow Jones Industrial Average dropped by over 500 points, or 1.6%, in intraday trading. The S&P 500 and the Nasdaq Composite also saw significant declines. European markets followed suit, with the Euro Stoxx 600 index dropping by 2.2%.

The Impact on Individual Investors

For individual investors, the announcement was a reminder of the volatility that comes with investing in the stock market. Those with heavy exposure to technology stocks, which had been leading the market’s recovery from the pandemic, were hit particularly hard. The tech-heavy Nasdaq Composite saw a decline of 2.3% on the day of the announcement.

- Diversification: Experts remind us that diversification is key to managing risk in a volatile market. Spreading investments across different sectors and asset classes can help mitigate the impact of any one announcement or event.

- Long-term perspective: History shows that the stock market tends to recover from downturns over the long term. Those with a long-term investment horizon may choose to ride out the volatility and stay the course.

The Impact on the World

The announcement also had implications beyond the financial markets. Relations between the US and China had already been strained, with ongoing disputes over issues such as intellectual property theft and human rights abuses in Xinjiang. The prospect of a renewed trade war could further escalate tensions between the two superpowers.

Furthermore, the announcement came at a time when the global economy was already facing significant challenges. The ongoing pandemic, rising inflation, and geopolitical tensions in Eastern Europe were all contributing to uncertainty and volatility in the markets. The announcement added another layer of complexity to an already complex situation.

Conclusion

Trump’s announcement of plans to re-introduce heavy tariffs on imports from China sent shockwaves through the financial markets on March 1, 2022. The markets reacted negatively, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all seeing significant declines. Individual investors were reminded of the importance of diversification and a long-term perspective in managing risk. The announcement also had implications beyond the financial markets, with potential consequences for US-China relations and the global economy as a whole.

As we move forward, it will be important to stay informed about developments in the financial markets and the global economy. By staying informed and taking a long-term perspective, investors can navigate the volatility and uncertainty that comes with investing in a complex and ever-changing world.

Stay tuned for more updates and insights from your friendly neighborhood AI!