President Trump’s Executive Directive: A New Era for Digital Currencies in the U.S.

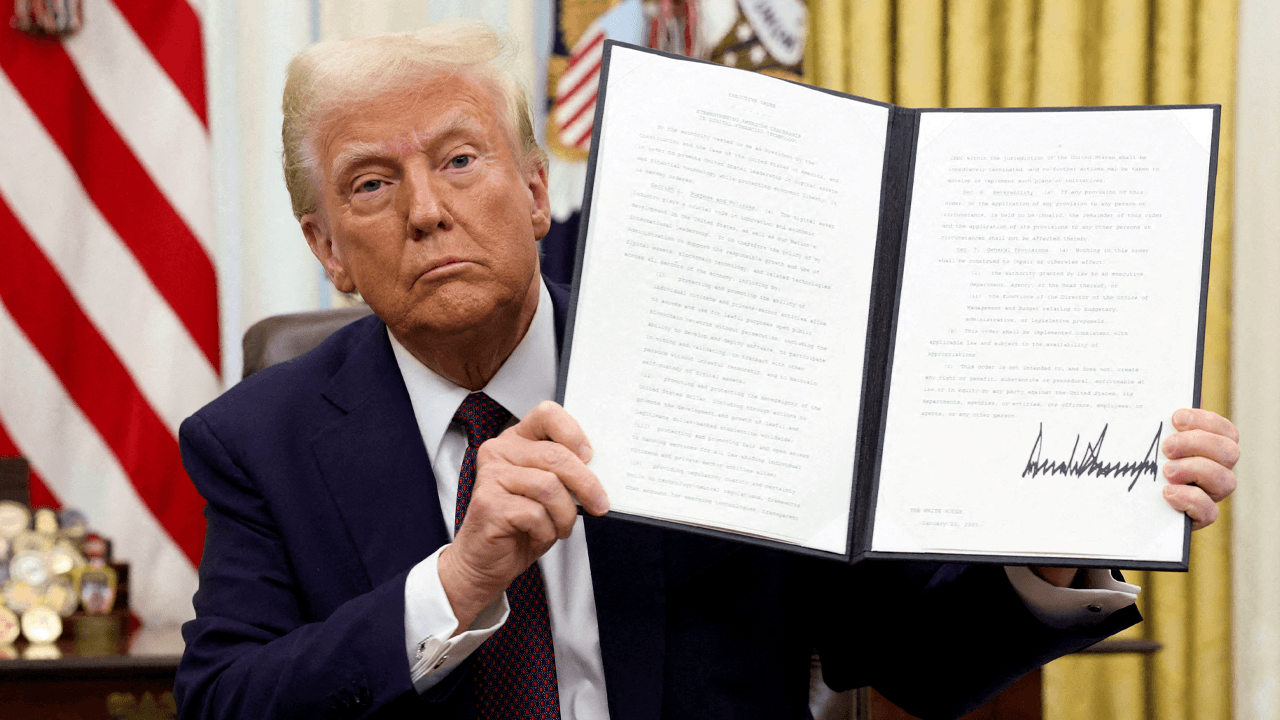

On a significant Thursday, President Donald Trump took a bold step towards acknowledging the growing importance of digital currencies in the financial world. He issued an executive directive instructing federal agencies to establish a U.S. strategic bitcoin repository and a complementary repository for other digital currencies.

Background

The executive order, which was signed behind closed doors, comes as a response to the increasing seizure of digital assets in civil or criminal cases. According to reports, the U.S. Marshals Service alone has seized over $1 billion in cryptocurrencies since 2014.

The creation of these repositories aims to enable the government to manage and sell the seized digital assets more effectively. Previously, the U.S. Marshals Service had to sell the assets through third-party exchanges or auction houses, which could result in substantial fees and price volatility.

Impact on Individuals

For individuals, the establishment of these repositories could lead to an increase in the legitimacy of digital currencies. As more governments and institutions embrace digital assets, it may pave the way for broader acceptance and integration into the mainstream financial system.

- Increased legitimacy: The U.S. government’s recognition of digital currencies as a legitimate asset class could encourage more businesses and individuals to explore their potential uses.

- Price stability: With the government managing the sale of seized digital assets, there may be less price volatility compared to third-party sales.

- Security: The creation of secure repositories for digital assets could help mitigate concerns regarding their security and protection.

Impact on the World

On a global scale, this move could have far-reaching implications for the digital currency market and the broader financial industry. Here’s how:

- Regulatory clarity: The U.S. government’s involvement in managing digital assets could lead to more regulatory clarity, which is essential for the growth and stability of the digital currency market.

- Increased adoption: The recognition of digital currencies by a major economy like the U.S. could encourage other countries to follow suit, leading to increased adoption and integration into the global financial system.

- Price stability: With more governments and institutions managing the sale of digital assets, there could be a reduction in price volatility, making them a more attractive investment option for institutions and individuals alike.

Conclusion

President Trump’s executive directive to establish a U.S. strategic bitcoin repository and a complementary repository for other digital currencies marks a significant milestone in the recognition of digital currencies as a legitimate asset class. The move could lead to increased legitimacy, regulatory clarity, and price stability, ultimately paving the way for broader adoption and integration into the financial system.

As individuals, we can expect to see more regulatory clarity, increased security, and price stability as digital currencies become more integrated into the mainstream financial system. On a global scale, this move could encourage other countries to follow suit, leading to a more interconnected and stable digital currency market. Only time will tell how this development unfolds, but one thing is certain – digital currencies are here to stay.