MicroStrategy Founder Suggests US Should Consider Buying One Million Bitcoin for Strategic Reserves

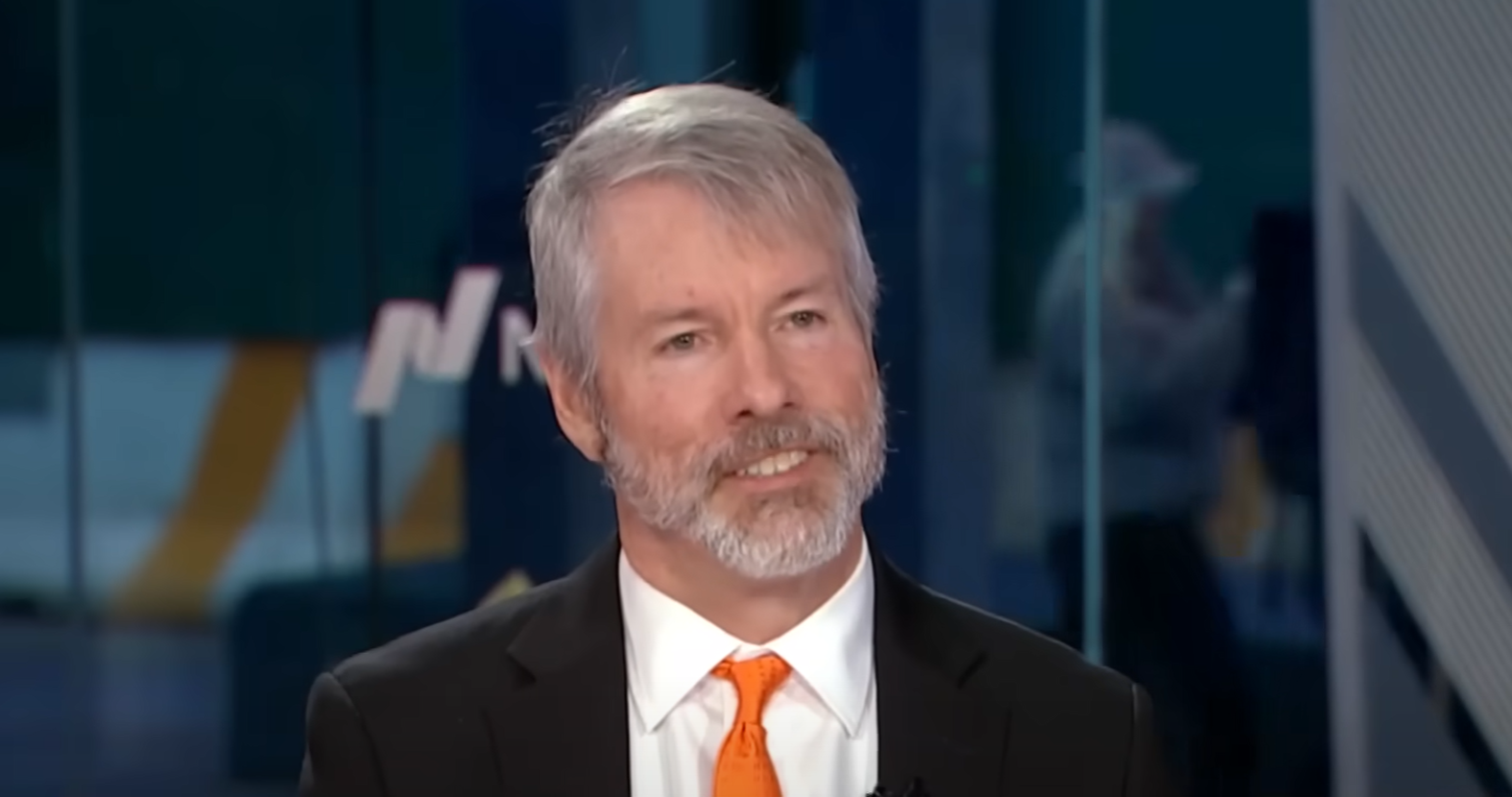

During an interview with FOX Business, MicroStrategy founder and executive chairman, Michael Saylor, shared his thoughts on the United States purchasing one million Bitcoin for its strategic reserves. This suggestion came ahead of the White House Crypto Summit, which was set to be hosted by US President Donald Trump.

Background on MicroStrategy and Michael Saylor

MicroStrategy is a business intelligence company that provides software platforms, as well as consulting and analytics services. Saylor, who founded the company in 1989, is a well-known figure in the business world and has been an advocate for Bitcoin for quite some time. In August 2020, MicroStrategy made headlines when it announced it had purchased $425 million worth of Bitcoin, becoming the first publicly-traded company to hold Bitcoin as a treasury reserve asset.

Saylor’s Suggestion

During the interview, Saylor expressed his belief that the US should consider following MicroStrategy’s lead and purchasing one million Bitcoin for its strategic reserves. He argued that Bitcoin is a “digital gold” that offers several advantages over traditional gold, such as being portable, divisible, and scarce. Saylor also pointed out that Bitcoin is a non-correlated asset, meaning it doesn’t move in lockstep with other assets like stocks or bonds.

Implications for Individuals

If the US were to purchase one million Bitcoin for its strategic reserves, it could have a ripple effect on the price of Bitcoin. Some investors might see this as a sign of institutional adoption and could be more likely to invest in Bitcoin themselves. This could lead to increased demand and potentially higher prices. However, it’s important to note that investing in Bitcoin comes with risks, and individuals should do their own research and consider their risk tolerance before making any investment decisions.

Implications for the World

The US purchasing one million Bitcoin for its strategic reserves could also have implications for the world at large. It could signal a broader shift towards digital currencies and away from traditional assets like gold. This could lead to increased adoption of Bitcoin and other cryptocurrencies as a store of value. Additionally, it could put pressure on other countries to consider similar moves, potentially leading to a global trend towards digital currencies.

Conclusion

Michael Saylor’s suggestion that the US consider purchasing one million Bitcoin for its strategic reserves is a bold one that could have significant implications for the price of Bitcoin and the wider world of finance. While the US has not yet made a decision on this matter, it’s clear that the idea of governments holding digital currencies as a reserve asset is gaining traction. As always, individuals should do their own research and consider their risk tolerance before making any investment decisions.

- MicroStrategy is a business intelligence company that advocates for Bitcoin as a treasury reserve asset

- Michael Saylor suggested the US should consider purchasing one million Bitcoin for its strategic reserves

- This could lead to increased demand for Bitcoin and potentially higher prices

- It could signal a broader shift towards digital currencies and away from traditional assets like gold

- Individuals should do their own research before making any investment decisions