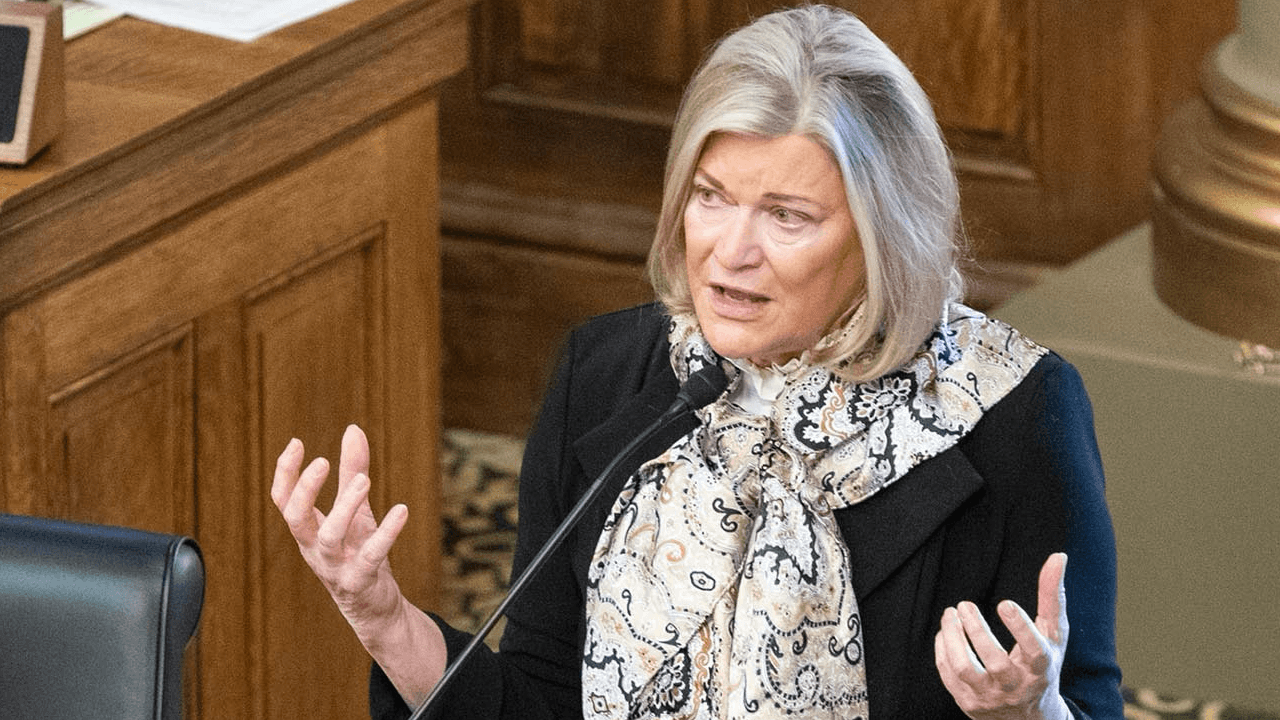

Sen. Cynthia Lummis’ Skepticism Towards Trump’s Proposed Crypto Strategic Reserve

Senator Cynthia Lummis, a prominent Republican from Wyoming and a known advocate for Bitcoin, has expressed her reservations about the feasibility of former President Donald Trump’s proposal for a US government-backed cryptocurrency strategic reserve. The proposal, which was announced during Trump’s presidency but never materialized, aimed to create a national digital currency to rival Bitcoin and other decentralized cryptocurrencies.

Insufficient Congressional Backing: A Major Barrier

In an interview with CoinDesk, Sen. Lummis shared her concerns about the lack of Congressional support for such a venture. She noted that the creation of a government-backed digital currency would require substantial legislative action and bipartisan cooperation. With the current political climate and the many competing priorities in Congress, she believes that the proposal is not likely to gain traction in the near term.

The Proposed Crypto Strategic Reserve: A Brief Overview

Trump’s proposed crypto strategic reserve was intended to serve as a store of value for the US government, much like how countries hold gold reserves. The digital currency would be issued and managed by the Federal Reserve and would be pegged to the US dollar. Proponents argued that a government-issued digital currency could offer several benefits, including greater control over the monetary supply and a potential reduction in transaction fees for Americans.

Impact on Individuals: Limited, but Potential for Increased Adoption

For individuals, the skepticism from Sen. Lummis regarding the proposed crypto strategic reserve may not have an immediate impact. However, her comments could potentially delay or even halt the progress of the initiative, which could have indirect consequences for the overall adoption of digital currencies in the US. If the proposal fails to materialize, it may send a signal to the market that the US government is not yet fully committed to creating a central bank digital currency (CBDC).

Impact on the World: Depends on US Leadership

On a global scale, the failure of the proposed US crypto strategic reserve could have significant implications. The US, being a major global economic power, has the ability to set trends and influence the direction of the financial world. If the US decides against creating a CBDC, it could potentially slow down the adoption of digital currencies in other countries. Conversely, if the US does decide to move forward with a CBDC, it could spur other nations to follow suit, leading to a new era of digital currencies and potential disruption to traditional financial systems.

Conclusion: A Long and Complex Road Ahead

Sen. Cynthia Lummis’ comments on the proposed US crypto strategic reserve cast doubt on the immediate feasibility of the initiative due to insufficient Congressional backing. While this news may not have a significant impact on individuals in the short term, it could potentially delay or halt the progress of digital currencies in the US and beyond. The road ahead for CBDCs is long and complex, and it will require careful consideration, bipartisan cooperation, and a deep understanding of the potential benefits and risks.

- Sen. Cynthia Lummis expresses skepticism about the feasibility of Trump’s proposed crypto strategic reserve

- Insufficient Congressional backing identified as a major barrier

- Individuals: Limited impact, but potential for delayed adoption

- World: Depends on US leadership and commitment to digital currencies