Ethereum’s Disappointing Performance in 2021: A Detailed Analysis

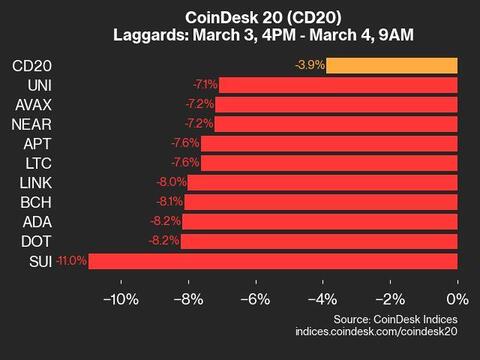

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has been underperforming this year, making it the worst-performing crypto among the top five. As of now, Ethereum has seen losses accelerating by 37.4%. Let’s delve deeper into the reasons behind Ethereum’s disappointing performance in 2021.

Factors Contributing to Ethereum’s Poor Performance

1. Rising Interest Rates: One of the primary reasons for Ethereum’s decline is the rising interest rates. The Federal Reserve’s decision to taper its bond-buying program and increase interest rates has led investors to shift their focus towards safer assets such as bonds, pushing the prices of riskier assets like cryptocurrencies down.

Impact on Individual Investors

Personal Implications: If you have invested in Ethereum, you might be feeling the pinch of its poor performance. It’s essential to keep a long-term perspective and not panic sell. Instead, consider averaging down your position by buying more Ethereum at lower prices. However, it’s crucial to remember that investing in cryptocurrencies always comes with risks, and you should only invest money that you can afford to lose.

- Consider diversifying your portfolio to minimize risk.

- Stay informed about market trends and news.

- Consult a financial advisor for personalized investment advice.

Impact on the World

Global Consequences: Ethereum’s poor performance could have ripple effects on the broader economy. The cryptocurrency market is interconnected, and the decline in Ethereum’s price could lead to a sell-off in other cryptocurrencies. Additionally, many decentralized finance (DeFi) projects are built on the Ethereum network, and their failure could lead to significant losses for investors and institutions.

Possible Solutions

1. Ethereum 2.0: Ethereum’s transition to Ethereum 2.0, also known as Serenity, could be a potential solution to its current woes. Ethereum 2.0 aims to improve the network’s scalability, security, and sustainability. Once completed, it could attract more users and investors to the platform, leading to a potential price increase.

2. Institutional Adoption: Institutional adoption of Ethereum could also help boost its price. Several large financial institutions, including JPMorgan and Goldman Sachs, have shown interest in Ethereum. Once they start investing in Ethereum, it could lead to a significant price increase.

Conclusion

Ethereum’s poor performance in 2021 has left many investors disheartened. However, it’s essential to remember that the cryptocurrency market is volatile, and prices can fluctuate significantly. Ethereum’s transition to Ethereum 2.0 and institutional adoption could be potential solutions to its current woes. As an individual investor, it’s crucial to stay informed, diversify your portfolio, and consult a financial advisor for personalized investment advice. The ripple effects of Ethereum’s poor performance could have significant consequences for the broader economy, making it essential to monitor the situation closely.

Investing in cryptocurrencies always comes with risks, and it’s crucial to remember that past performance is not indicative of future results. Stay informed, stay calm, and stay invested.