Bitcoin Dips Below $100,000: A Buying Opportunity According to “Rich Dad”?

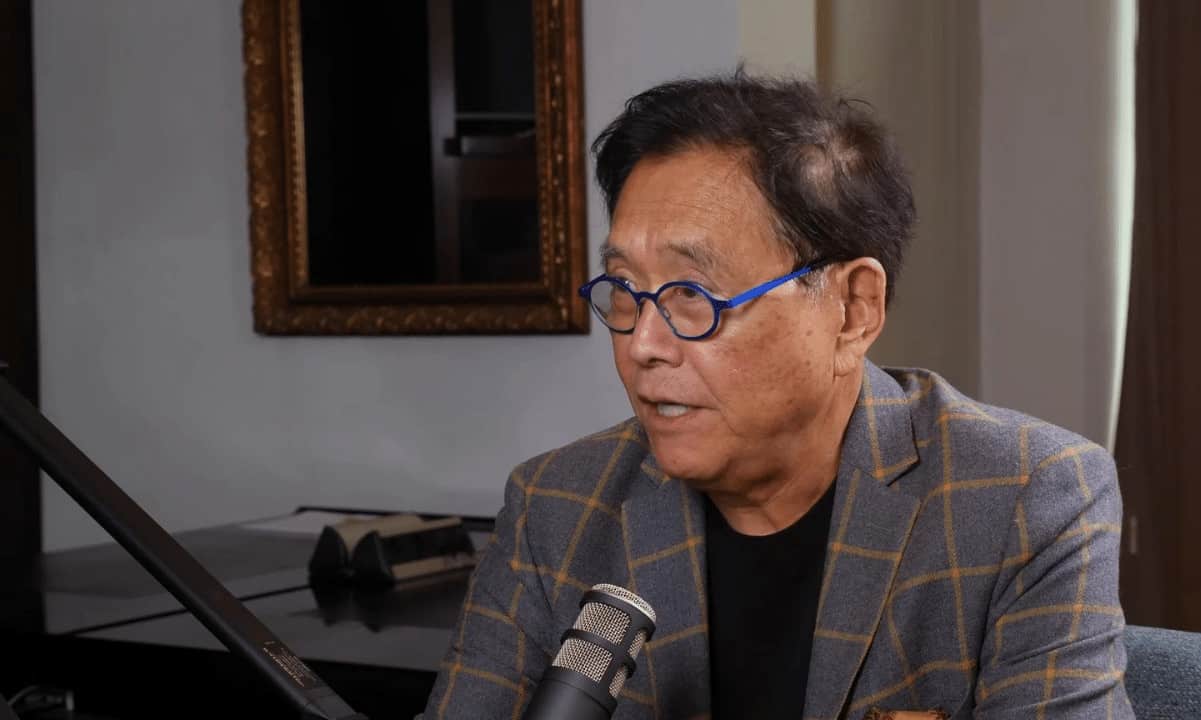

The cryptocurrency market experienced a significant downturn this week, with Bitcoin plunging below the $100,000 mark. This drop came as a surprise to many investors, given the cryptocurrency’s meteoric rise throughout 2021. Robert Kiyosaki, the author of “Rich Dad Poor Dad,” saw this as an opportunity rather than a cause for concern.

Why Robert Kiyosaki Believes Bitcoin Is on Sale

In a series of tweets, Kiyosaki expressed his optimism towards Bitcoin, stating that the cryptocurrency is on sale at these rates. He explained that he sees the current market conditions as a result of macroeconomic threats looming over the global economy. These threats include inflation, rising interest rates, and potential recession.

Inflation: The Hidden Tax

- Inflation is a significant concern for many investors, as it erodes purchasing power over time.

- Governments and central banks use inflation as a tool to reduce debt levels by devaluing their currencies.

- Historically, Bitcoin has been seen as a hedge against inflation due to its limited supply.

Rising Interest Rates

- Rising interest rates make borrowing more expensive, which can negatively impact economic growth.

- However, higher interest rates can also make holding cash less attractive, as the returns on savings accounts decrease.

- Bitcoin, on the other hand, offers potential returns that are not subject to the whims of central banks.

Potential Recession: A Buying Opportunity?

- Recessions can lead to significant market volatility, with many assets experiencing steep declines.

- However, they can also present opportunities for savvy investors to buy undervalued assets.

- Bitcoin, as a non-correlated asset, has the potential to outperform during economic downturns.

How This Affects You

If you are an investor, the current market conditions may be a cause for concern. However, if you share Kiyosaki’s optimism towards Bitcoin, then this dip could present an opportunity to buy at a discounted price. It is essential to do your own research and consider seeking advice from financial advisors before making any investment decisions.

How This Affects the World

The impact of Bitcoin’s price volatility extends beyond individual investors. Central banks and governments around the world are closely monitoring the cryptocurrency’s rise, as it challenges traditional financial systems. Some countries have banned Bitcoin outright, while others have taken a more cautious approach, regulating its use and trade.

Conclusion

The recent dip in Bitcoin’s price has left many investors feeling uneasy. However, Robert Kiyosaki sees this as an opportunity rather than a cause for concern. With macroeconomic threats looming over the global economy, Bitcoin’s limited supply and potential to outperform during economic downturns make it an attractive investment for some. It is essential to do your own research and consider seeking advice from financial advisors before making any investment decisions. Only invest what you can afford to lose, and remember that past performance is not indicative of future results.

As the world continues to grapple with inflation, rising interest rates, and potential recession, Bitcoin’s role in the global economy will only become more significant. Stay informed and stay cautious, but don’t let fear keep you from exploring the potential of this revolutionary technology.