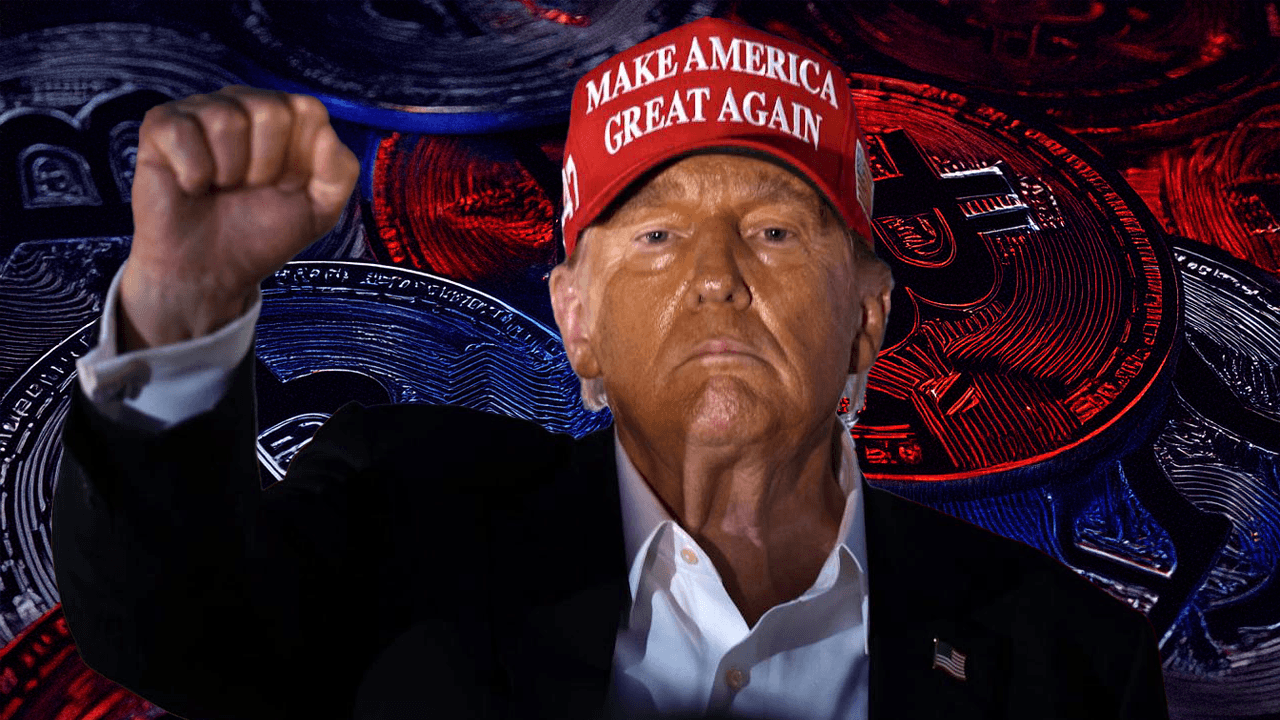

Bitcoin Surges after Trump’s Endorsement: A New Milestone in Digital Currency

On March 2, 2023, the value of Bitcoin (BTC) experienced a significant surge, reaching a new all-time high. This event was triggered by a tweet from the former U.S. President, Donald J. Trump, who announced his intention to establish a digital asset reserve. The announcement sent ripples through the financial world, leading to a 10.6% increase in Bitcoin’s value relative to the U.S. dollar.

The Trump Effect

Trump’s tweet read, “Excited to announce the creation of a new digital asset reserve. I believe in the potential of cryptocurrencies to revolutionize the financial industry. #Bitcoin #DigitalCurrency”

The market reacted almost instantly, with Bitcoin’s price jumping from around $85,000 to a high of $95,064 within hours. The former president’s endorsement added credibility to Bitcoin and fueled the curiosity of investors, both institutional and retail.

Impact on Individuals

For individuals, this sudden price increase presents both opportunities and risks. Those who have been holding Bitcoin for a while might be considering selling to capitalize on the gains. On the other hand, new investors could be enticed to enter the market, hoping to reap similar rewards. However, it is important to remember that investing in digital currencies comes with inherent risks, including market volatility and security concerns.

- Opportunity for profit: Holders of Bitcoin could sell at the current high prices, securing a profit.

- Risk of loss: New investors may experience a loss if the market reverses and the price drops.

- Diversification: Adding a small percentage of digital currencies to an investment portfolio can be a good diversification strategy, but it should not exceed more than 5% of the total portfolio.

Impact on the World

The sudden surge in Bitcoin’s value could have significant implications for the global financial system. Here are a few potential impacts:

- Increased adoption: Trump’s endorsement could lead to increased adoption of digital currencies by institutional investors, further legitimizing the asset class.

- Regulatory scrutiny: Governments and regulatory bodies might intensify their efforts to regulate digital currencies, potentially leading to more stringent regulations and compliance requirements.

- Infrastructure development: The surge in demand for digital currencies could lead to the development of more robust and secure infrastructure, making it easier for individuals and institutions to invest and transact in digital currencies.

Conclusion

The sudden surge in Bitcoin’s value following Trump’s endorsement is a testament to the growing influence of digital currencies in the financial world. While the short-term gains and risks are significant, the long-term implications for the global financial system could be even more profound. As always, it is essential to approach investments in digital currencies with caution and a solid understanding of the risks involved.

Stay informed and make informed decisions. Keep an eye on the news and market trends, and consult with financial advisors before making any significant investment decisions.

The digital currency landscape is constantly evolving, and it is crucial to stay updated to make the most of the opportunities and mitigate the risks.